The big question for the oil market next week is what will happen with Saudi oil tankers that are en route to the US laden with 40m bbl of oil?

Those tankers are sailing into a hostile situation where the lack of local oil storage has already created a phenomenal drop in WTI prices this week, where there is no visible uptick in demand on the horizon, and where the US President has already threatened to block those imports. The message from Senator Ted Cruz was less veiled: “Turn the tankers the hell around,” he tweeted.

The spectacular drop in the WTI oil price this past week was only partially caused by fundamentals; the bigger short-term issue was that no trader wanted to take delivery of thousands of barrels of oil at a time when it is phenomenally difficult to get hold of any oil storage. Nearly 60% of the 653 million barrels of US oil storage capacity is currently taken up. Under normal circumstances that wouldn’t create any problems but with the demand likely to be corroded by the coronavirus for weeks if not months ahead and with production and imports still going strong, estimates of how quickly the storage will fill up range from late May to August. No wonder the 20 Saudi boats heading for the US are causing a mixture of frustration, anger, and panic!

Ultimately the options for Saudi shippers are limited; the Saudis have limited time to find a home for their crude cargoes. They could consider rerouting the cargo either into Asian or European markets which would create additional pressure in those regions and potentially crush Brent crude prices. The biggest oil storage facility in the US – at Cushing in Oklahoma – is likely to run out of space within the next three weeks. The bigger issue is that storage around the globe is also filling up. There is no reliable data on China’s free oil storage capacity, but there is some correlation between the speed at which US storage is filling up and storage on other continents.

Earlier this month the International Energy Agency reported that worldwide crude stocks could rise by as much as 11.9 million barrels per day in the second quarter of this year leading to the highest stock build in history. The agency assumes that only about 80% of the global nameplate capacity is on an operational level meaning that at the current rate of buildup, stock levels could approach their operational capacity limit by mid-year.

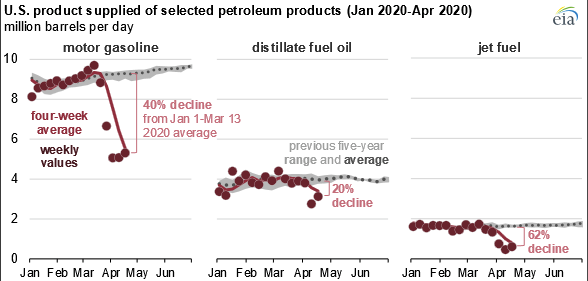

At the same time, US consumption has fallen to its lowest level in decades. Lockdowns across the country, lack of travel and the enormous erosion of the job market has reduced demand to an average of 14.1m b/d, the lowest level in EIA’s weekly data series, which dates back to the early 1990s.

BP and Shell Results

BP (NYSE:BP) and Royal Dutch Shell (NYSE:RDSa) will report their earnings on Tuesday, April 28 and Thursday, April 30 and though the results will not yet show the full damage caused by COVID-19, it will undoubtedly reflect a difficult quarter. Asian demand had started being affected in January, soon after the first cases of coronavirus were made public, followed later by Europe and then the US.

In a comparable set of figures from Italian oil producer ENI (MI:ENI), one of the biggest losses came from the company revaluing its inventory book value to reflect new market prices. This is a process that other oil majors like BP and Shell will have to go through next week.

|

When |

What |

Why is it important |

|

Tue 28 April 07.00 |

BP results |

Likely writedowns due to drop in oil prices |

|

Tue 28 April 21.00 |

API crude oil stocks |

Look for further build up of stocks but possibly less than last week as some states reopen for business |

|

Wed 29 April 13.30 |

US Q1 GDP |

Reporting period will catch only the beginning of the corona spread and lockdowns in the US |

|

Wed 29 April 15.30 |

EIA crude oil stocks |

Look for further build of stocks |

|

Thu 30 April 02.00 |

China April manufacturing PMI |

The number should be back almost back to pre-corona levels |

|

Thu 30 April 07.00 |

Royal Dutch Shell |

Similar issues as BP |

|

Thu 30 April 10.00 |

EU Q1 GDP |

Expect erosion from previous quarter, possibly down to -2.5% |

|

Thu 30 April 13.30 |

US initial jobless claim |

Should show a reduction on previous week’s decline as some states reopen |

|

Fri 1 May |

Labour Day |

Chinese and some EU markets close |