It is now all a matter of time, time that it will take for two opposing trends to find a new balance.

Officially many US states can start lifting their stay-at-home orders from May 1. Unofficially, reopening already began more than a week ago. From next week the US jobs market, retail spending and transport will start picking up but they will not revert from 0% to 100% capacity any time soon. A smaller trickle of around 25%-30% is more likely because of the phenomenal amount of lost jobs and the subsequent retail spending power decline.

Despite an easing of restrictions, a large slice of the population does not feel safe enough to go back to life as it was before the pandemic; according to the Wall Street Journal that number is close to 60%. Nevertheless, demand should gradually start getting better over the coming weeks as some of the jobs that were lost are reinstated.

On the supply side, OPEC countries and Russia will start producing less oil to the tune of 9.7mbd from the beginning of this month, and US producers will also cut output, as seen in ConocoPhillips's (NYSE:COP) 1.3mbd reduction that will start in June.

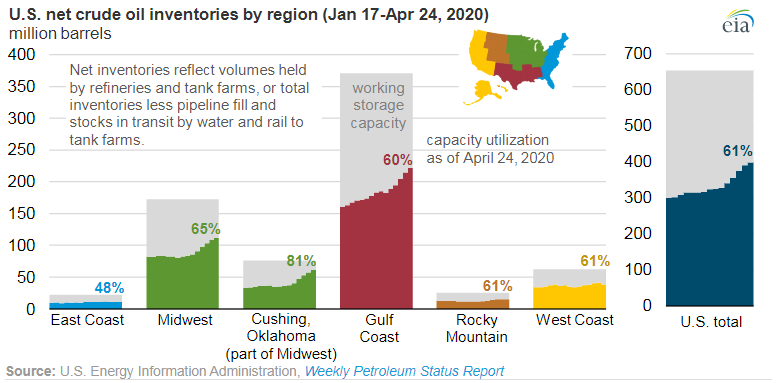

But the slow reopening of US states will only be a mouse-sized nibble at the problem. Footage of dozens of full oil tankers sitting off the coast of southern California is a very clear reminder of how much surplus oil there is. In addition, Saudi Arabia and other OPEC countries ramped up their oil output to the max in April to balance out the lower income they will see from May onwards and a large portion of that oil—28 tankers, according to Rystad Energy—is still making its way to the US.

So timing here is crucial. Although the supply/ demand will start to slightly shift in the weeks ahead, it is possible that the oversupply will initially become worse before it starts improving. API weekly crude oil stocks on Tuesday, EIA’s petroleum reserve numbers on Wednesday, US jobless data on Thursday and the Baker Hughes rig count on Friday should all be looked at together to form a clearer picture.

New tariff war on the horizon?

Ever since the Washington Post published an article in mid-April about how US Embassy officials in China warned the State Department about inadequate safety at a Chinese research facility in Wuhan, the epicenter of the COVID 19 outbreak, it has been a question how this particular sword will be used in the months ahead. It seems that it has now become a spark to ignite the flames of a new tariff war between the US and China.

President Trump has this week escalated his attacks on China over the spread of the coronavirus by threatening new tariffs. There is nothing positive in this for the oil market. For the moment Chinese demand is the only engine still driving global demand, eroded by the lockdowns and stay-at-home orders in Europe and the US. Chinese April trade data on Thursday will show where China’s oil imports are and if they have returned to pre-corona levels in April, when most of the country had already reopened and the spread of the virus was brought under control.

|

When |

What |

Why is it important |

|

Mon 4 May 8.55 |

German April manufacturing PMI |

Covers the period of the worst lockdown in Germany. Last at 34.4 |

|

Mon 4 May 9.00 |

Eurozone April manufacturing PMI |

As in Germany. March reading was at 33.6 |

|

Tue 5 May n/a |

Eurozone economic growth forecast |

A look at Europe’s expected life-after-corona economic growth |

|

Tue 5 May 21.30 |

API weekly crude oil stocks |

Likely to jump over 10m bbl |

|

Wed 6 May |

General Motors (NYSE:GM) earnings |

A look at the company’s expectations for car sales this year |

|

Wed 6 May 15.30 |

EIA crude oil stocks |

Last at 8.991m, lower than API numbers |

|

Thu 7 May n/a |

China April imports and exports |

The numbers will indicate if the Chinese economy has got back on track after the pandemic was brought under control |

|

Thu 7 May 13.30 |

US initial jobless claims |

Numbers should show improvement as the job markets starts reviving again |

|

Fri 8 May |

UK Bank Holiday |

Markets closed |

|

Fri 8 May 18.00 |

Baker Hughes US oil rig count |

Expect further decline in rig count |

|

Fri 8 May 20.30 |

CFTC oil net positions |

Money managers’ net positions in oil |