Oil has been jumping up and down on the charts, but has had a slightly bullish bias to it lately. The reason for that has been somewhat confusing for investors at present as there has been a surplus in the market, but not as much as some people had originally feared when it comes to the American market.

Last weeks 8.43M surplus for crude oil inventories was an increase on the previous month, but oil quickly bounced back within its range. The reason for this is the market is looking for larger surpluses at present to justify further drops. What we have seen regarding oil is that the surplus is stable and unlikely to increase, which in turn has led the market to rally back up to the 50 dollar mark in the short term.

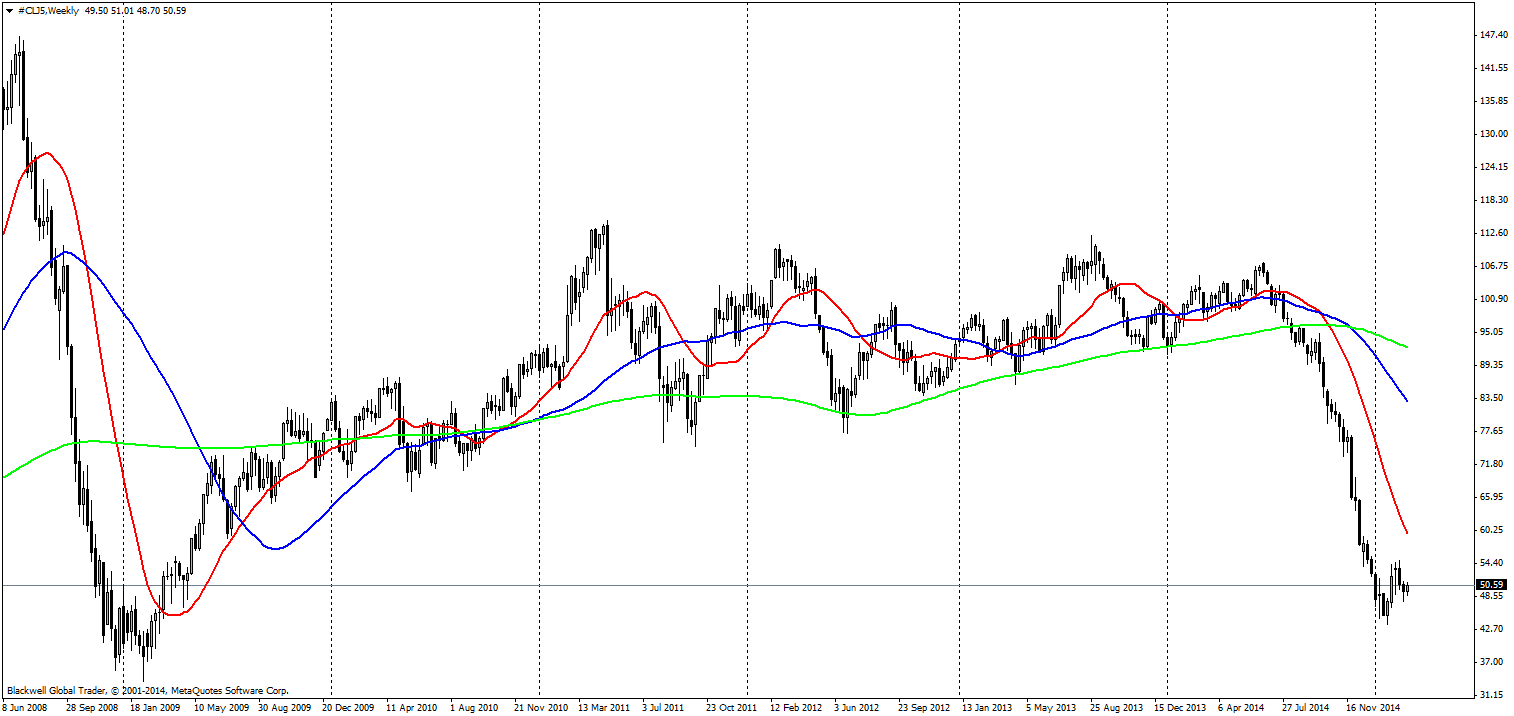

The market has thus far been looking for some sort of correction and it’s unlikely to get exactly that. What is more realistic after a sudden supply shock/demand drop is not a rush back to the norm, but a slow persistent grind back up the chart for oil prices in the long run.

As can be seen here we saw a sharp sell off in 2008 followed by strong buying over the course of the following year. This is what I feel is the most realistic scenario given the drop in capital expenditure in the oil market, which will reign in future supply in the medium to long term.

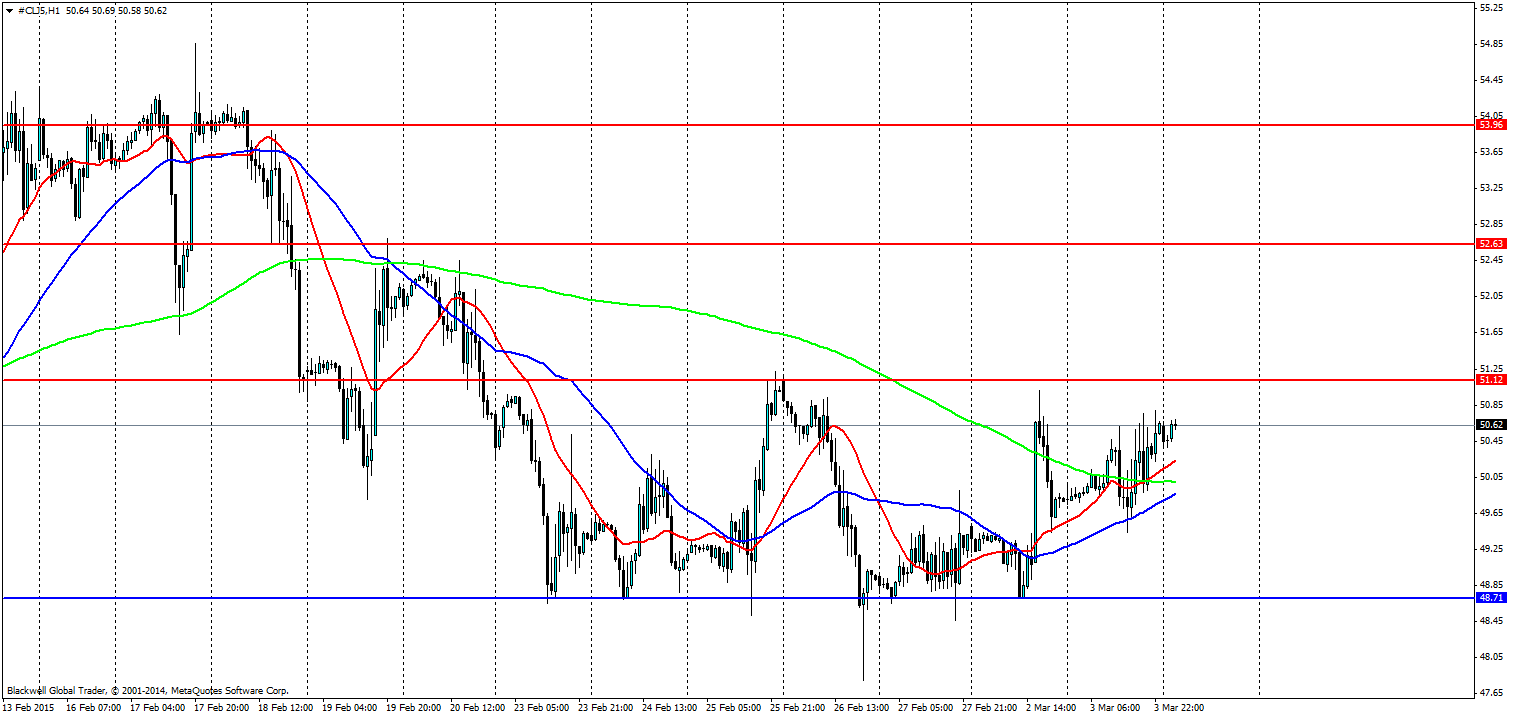

But the short term presents golden opportunities for swing trades and the many playing of key levels. Support is strong at 48.71 and it would take a large drop to change that suddenly, it’s likely that this level will remain for some time unless we see oil pushing over 12 million barrels in reports. Plays upwards are likely to find key resistance at certain levels 51.12, 52.63 and 53.96 are where oil will look to push to. A breakout of 51.12 should be seen as a strong bullish signal up to 52.63 where it will be a struggle between the markets and we could see a bounce off this level.

If we fail to see a push through 51.12 then a short here taking a few points is an applicable option and likely what most market players will be looking for.

Overall, oil has so far struggled to find direction and the American trading session has some very volatile candles which shows there is a battle going on out there. But the bulls are looking to take charge and the 51.12 level is the one to watch.