OPEC and the API Crude Inventories torpedo oil overnight, but the move could have more to do with positioning than a structural change.

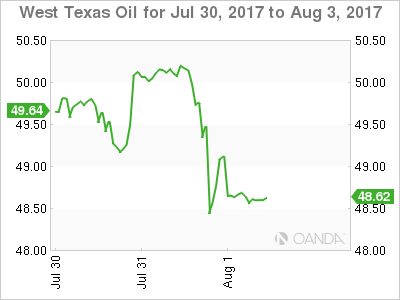

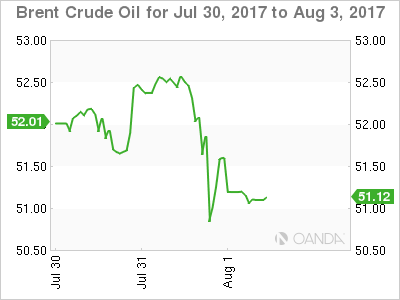

Crude oil’s storage tank burst last night, with both Brent and WTI spot contracts falling 2.80% as the spectacular run higher came to an unceremonious end. The rot had already started earlier in New York as a Reuters’ survey suggested OPEC production had risen in July. With extended long short term positioning, traders stampeded for the door to lock in profits from the last eight days bull run.

The coup de grace came from the American Petroleum Institute’s (API) Crude Inventory release late in the New York session. Inventories rose 1.80 million barrels against an expected drawdown of 2.8 million barrels, bringing to an end to the last few weeks' trend of falling supplies in storage.

As the dust settles, we feel that the move is more to do with nervous positioning rather than a structural change in the market. Traders will now look anxiously to tonight’s official Department of Energy inventory numbers for more guidance, with the Street looking for a 3.1 million barrel drawdown.

Brent spot trades at 51.25 in early Asia just below its 200-day moving average at 51.40 which will be an intra-day pivot. Brent has traced out a triple top at 52.65 overnight, and this presents formidable resistance now. Support is at the overnight low of 52.60. Also, the 100-day moving average and perhaps the only real positive traders can take from the overnight price action.

WTI spot trades at 48.70 with its 200-day average at 49.10 above the intra-day pivot followed by a double top at 50.30 that formed overnight. Support lies at 48.25, the overnight low, and then the 100-day moving average at 47.75. A daily close below which may signal the bull run is over for now.