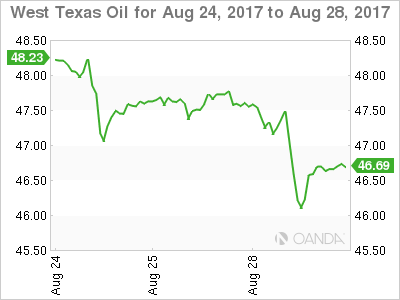

Contrasting fortunes for oil with Brent supported by OPEC, while Hurricane Harvey is washing WTI away.

WTI Spot

WTI fell by some 2.60% overnight while gasoline futures rose by 3.50% in a somewhat counter-intuitive price action. What the street is clearly pricing in as the effects of Hurricane Harvey’s flooding become apparent, is that the United States has plenty of crude oil, the difficulty will be refining it into usable products and then moving it to where it is needed.

This may well prove a boon to Asian refiners, who have the immediately available refining capacity, should capacity in Texas and Louisiana be taken offline for a long time. The result could mean refiners in Asia suddenly needing to fulfill orders for gasoline and jet fuel for shipment to the U.S.

At this stage, it is still unclear what the final disruption will be, but there is no denying that WTI crude has suffered a very bearish technical development overnight, breaking out of the lower boundary of its recent triangle pattern. WTI spot touched 46.00 overnight becoming initial support, before recovering to 46.70 in early Asia trading. The next support is seen at the 45.00 regions with initial resistance the base of the triangle, today at 47.20.

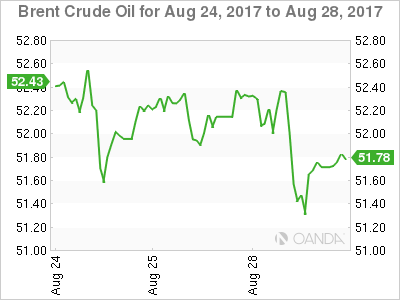

Brent Spot

The story is very different with Brent spot, which continues to trade constructively, dropping only 0.50% overnight. The near month futures are in backwardation, and the premium over WTI widened to multi-year highs. It has also been bolstered by news that Saudi Arabia and Russia are apparently lobbying the OPEC/Non-OPEC grouping to extend the production cut deal by three months to June 2018.

Brent spot trades midrange at 51.75 this morning with support at 51.20 followed by 50.00. Resistance appears at 52.50 initially and then 52.70 as it continues to consolidate its recent gains supported by more sound fundamentals.