The oil market continues to swing lower as the pressure on it continues to add up, but the pressure is not coming from the supply and demand side as many had expected. Instead, it’s being driven by the aggressive nature of USD buying as of late, which has pushed up the prices sharply.

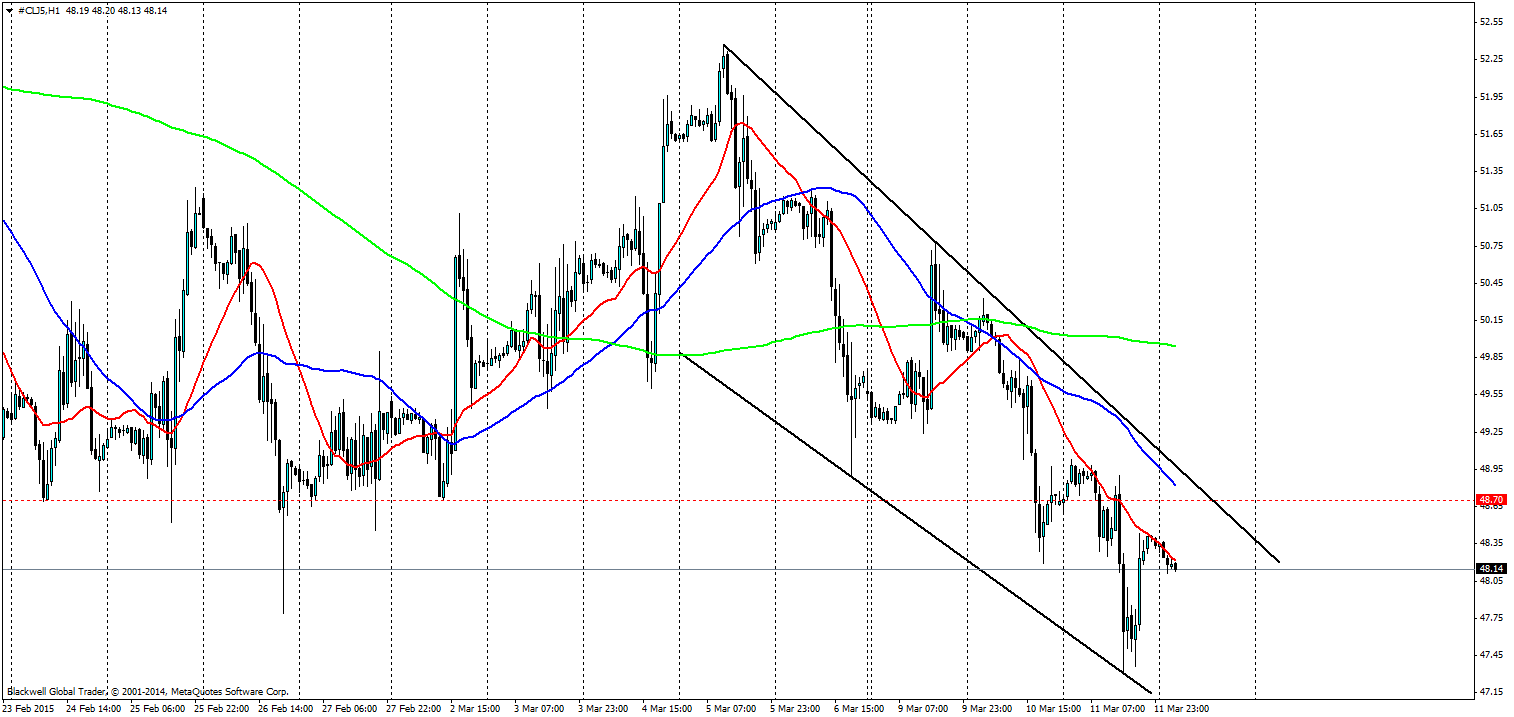

So with oil currently being pushed down by the 20 MA, the market is looking for points to bounce off as it looks to make a deep run on the charts and there is plenty of room to extend further, with the bottom around 43 dollars we could see the market run its course before a pull back up, which is inevitable. But in the short term the market is looking bearish with a strong USD.

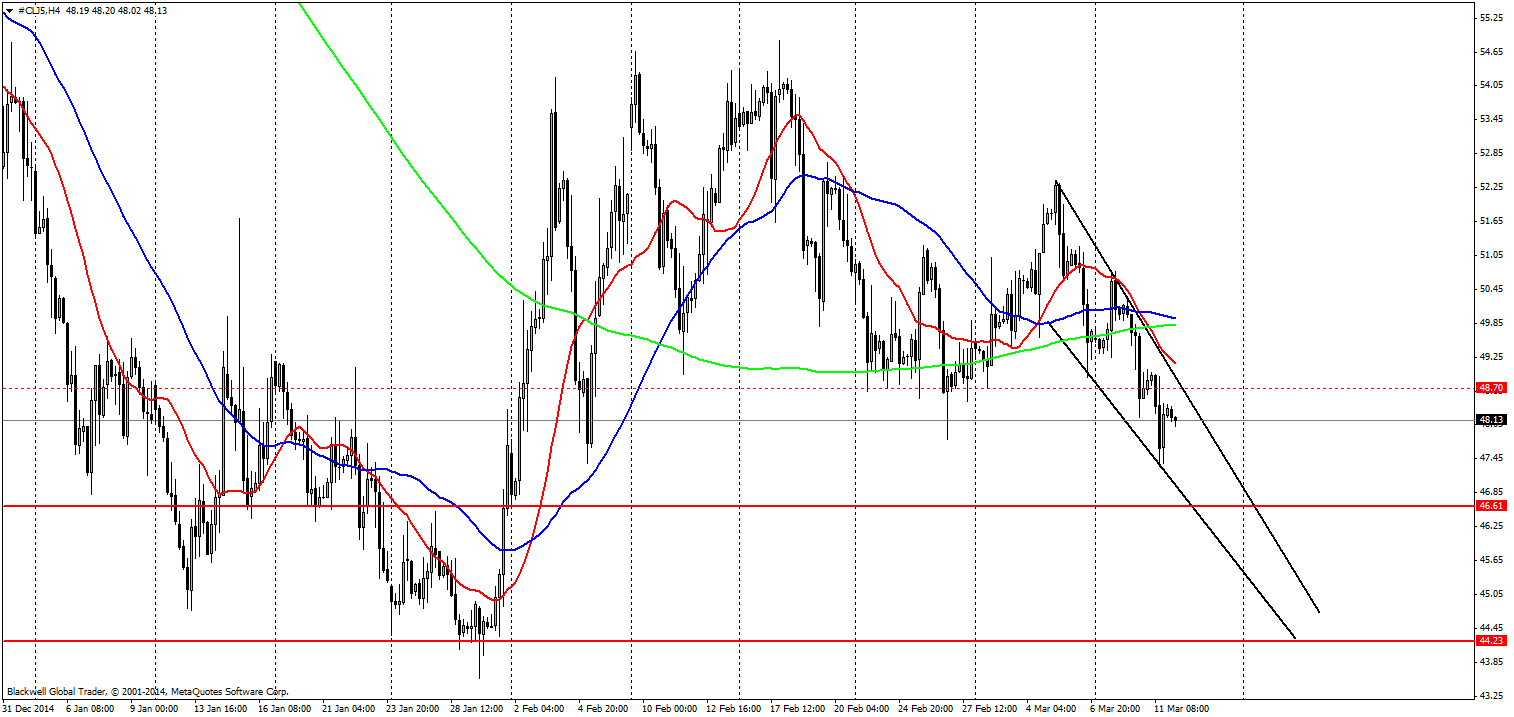

Strong support levels are likely to be major targets for the market as it dips down, with 46.61 and 44.23 likely to be the main focus. Any touch here should provoke a pullback up the charts, and it’s likely the market will look to trend for as long as possible down so pullbacks may be brief.

One thing to be careful of though, is the USD and if it starts to lose strength. This would cause the oil longs to jump back in and we could see oil start to push its way slowly back upwards as it has been over the last few weeks, but in the short term it’s time to shine for oil.