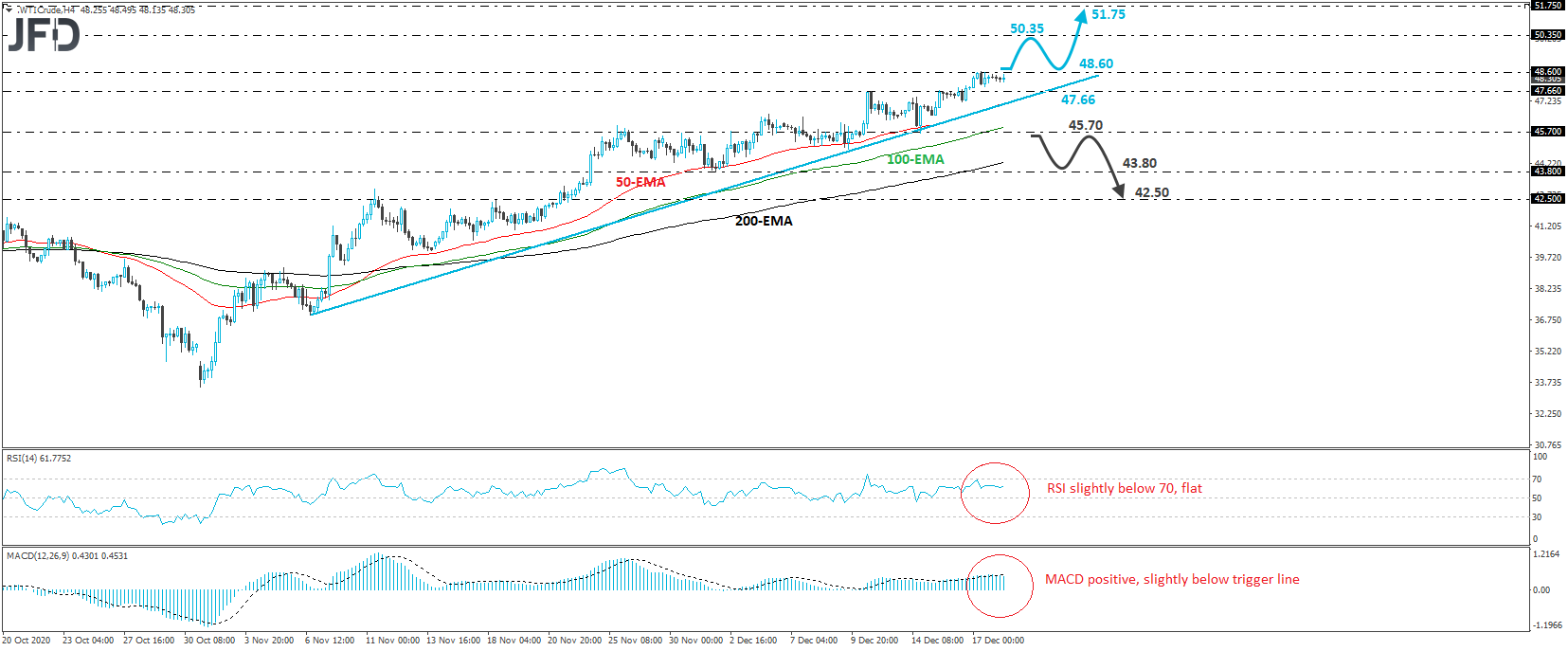

WTI traded in a consolidative manner today, staying slightly below yesterday’s high, at 48.60. Overall, the black liquid continues to print higher highs and higher lows above the upside support line drawn from the low of Nov. 6, and thus, we will consider the near-term outlook to be positive for now.

If the bulls are willing to stay in the driver’s seat, we may see them overcoming the 48.60 hurdle soon and targeting the 50.35 area, defined as a resistance by the high of Feb. 26. If that zone is not able to halt the trend, a break higher may see scope for extensions towards the high of the day before, at around 51.75.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50, but is currently flat, while the MACD, although positive, runs fractionally below its trigger line. Both indicators detect bullish momentum, but the fact that the RSI is flat and the MACD is below its trigger line, confirms our choice to wait for a move above 48.60.

Now, in order to start examining whether the bears have stolen the bulls’ swords, we would like to see a decisive dip below 45.70, marked by the low of Dec. 14. The price would already be below the aforementioned upside support line, and the bears may set the stage for declines towards the 43.80 area, marked by the low of Dec. 2. Another break, below 43.80, may extend the fall towards the 42.50 territory, defined as a support by the inside swing high of Nov. 18.