Let’s recall our Friday’s observations:

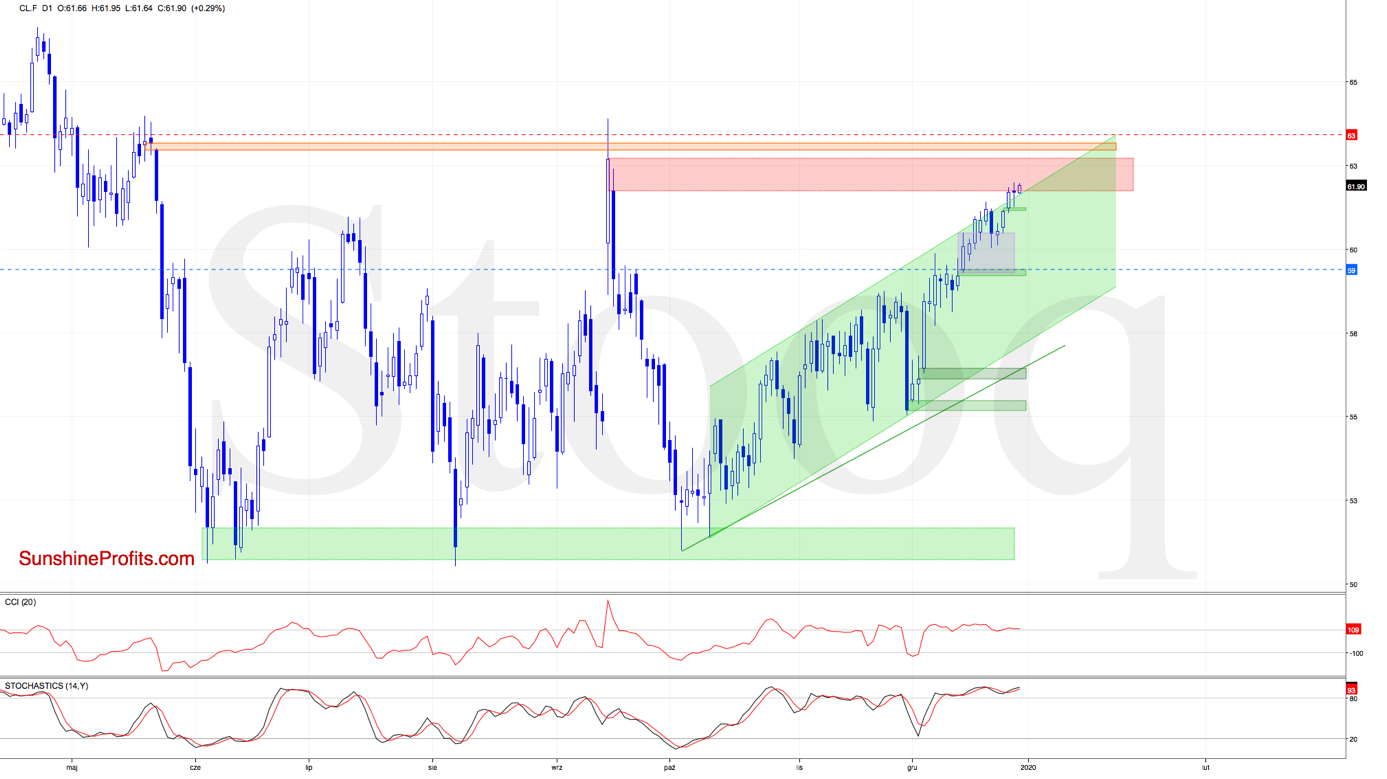

(…) Crude oil futures extended gains, breaking above the upper border of the rising green trend channel during yesterday’s session. This upswing took the futures right to the red gap. Let’s see how this has reflected upon the daily indicators.

They look quite extended, suggesting that the space for additional gains may be limited and that a reversal is probably just around the corner.

Should it be the case, and the futures move lower from here, the first downside target for the sellers will be yesterday’s green gap. If the bears close it, the next target will be the lower border of the purple consolidation and the next green gap, which is where our initial downside target currently is.

The situation has developed in tune with the above, and crude oil futures have indeed pulled back to our first downside target. However, the bears just couldn’t close the green gap, and the bulls took advantage, forcing a daily close above the upper border of the rising green trend channel.

This is certainly a bullish development, and the buyers followed through with more upside action. While crude oil futures moved above $61.90, the sizable red gap remain in play. It keeps supporting the bears and lower values of the futures in the coming week(s)