In financial social media circles, Bitcoin is all anyone can talk about. It has had a spectacular run and so few understand it, how can you blame the crowd for focusing there. But elsewhere Equity markets are at all-time highs. The US economy just printed GDP growth of over 3% for the 3rd Quarter. Inflation is still not rising. And some kind of corporate tax cut seems to be coming. It is a pretty rosy picture.

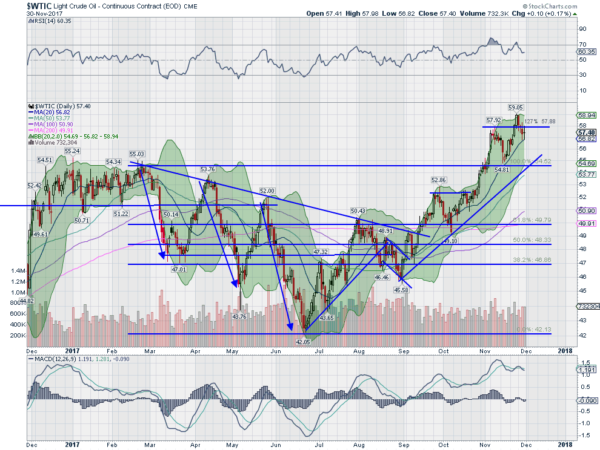

Within this backdrop there has been one major sector that has had a hard going though, Energy companies. They all took a beating as crude oil cratered from over $100 per barrel in 2014 to a low at the beginning of 2016 under $30. Since that low, crude oil had a short quick burst higher in the first half of 2016 and then settled into a channel. In June of this year it hit the bottom of that channel and has been rising ever since. Not quite as fast and strong as Bitcoin, but a strong move. Now crude is up over 37% from that June low. Can it continue?

The chart above gives some clues. Crude oil confirmed a reversal to an uptrend when it broke above the falling trend resistance and made a higher high in September. Since then it has continued to move higher, with a series of higher highs and higher lows. The lows have found support at the rising 20-day SMA and price has reversed. Currently the price is sitting at that 20-day SMA after a mild pullback to the 127% extension of the retracement of the down leg.

If the price movement higher is going to continue this is the place for it to reverse. Momentum has receded slightly, but remains strong. And as I write in the pre-market hours Friday, the price is pushing back higher. A Measured Move to the upside gives a target to 62.50. That would put Crude Oil prices at the plateau level of 2015 and with very little price history above. A move back under the early 2017 top, at about 54.50 would be a first indication that the run higher is over.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.