Oil bulls are a battle-hardened species. Not only did they rebuff the bears' attack to close higher Monday, they built additional gains yesterday too. Right now, they're in the vicinity of an important resistance level. Will they manage to break above it? We're not too far from opening a new trading position...

Let's take a closer look at the charts below.

Charts courtesy StockCharts and Stooq.com

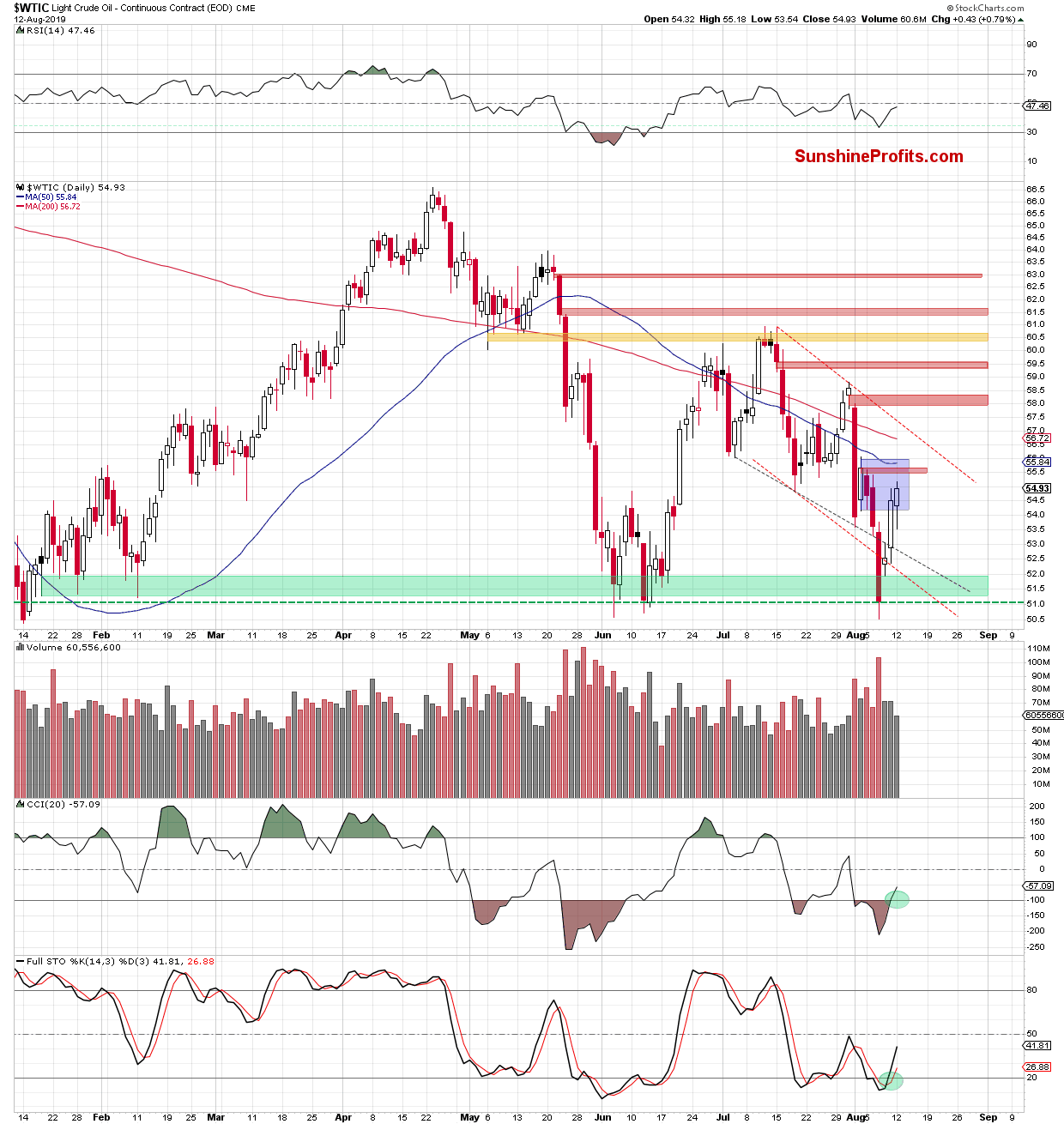

Monday's session opened with the bears taking oil lower, only to see the bulls take initiative and close the day above the previously-broken lower border of the blue consolidation.

The buy signals continue to support the buyers but there's a fly in the ointment - the decreasing volume of the upswing. Let's take a look at the action in the futures for more clues.

Yesterday, oil futures opened with a bearish gap, but the bulls haven't given up—they managed to close that gap before long. At the moment of writing these words, black gold is trading at around $56.50.

Crude oil futures have invalidated their earlier breakdown below the consolidation that took shape after the waterfall slide of Aug 1st. Coupled with the buy signals of the daily indicators, this suggests further price improvement. Such a bullish outcome would be more likely and reliable though only if the futures break above the 38.2% Fibonacci retracement first.

Should we see that, the next upside target would be the red gap. But this gap has stopped the bulls earlier this month—as long as it remains open, another move to the downside can't be ruled out.

Summing up, black gold has invalidated its breakdown below the recent consolidation, and the daily indicators suggest further improvement. The only cautionary sign is the comparatively lower volume of Monday's session. Should we see oil bulls appear in strength, we'll consider opening long positions.