Oil fell nearly 25% on Monday and is poised for another decline on Tuesday.

Speculators keep betting on an oil industry bailout or a revival in demand. Neither is in sight.

Crude is down again after hours following a 25% plunge on Monday.

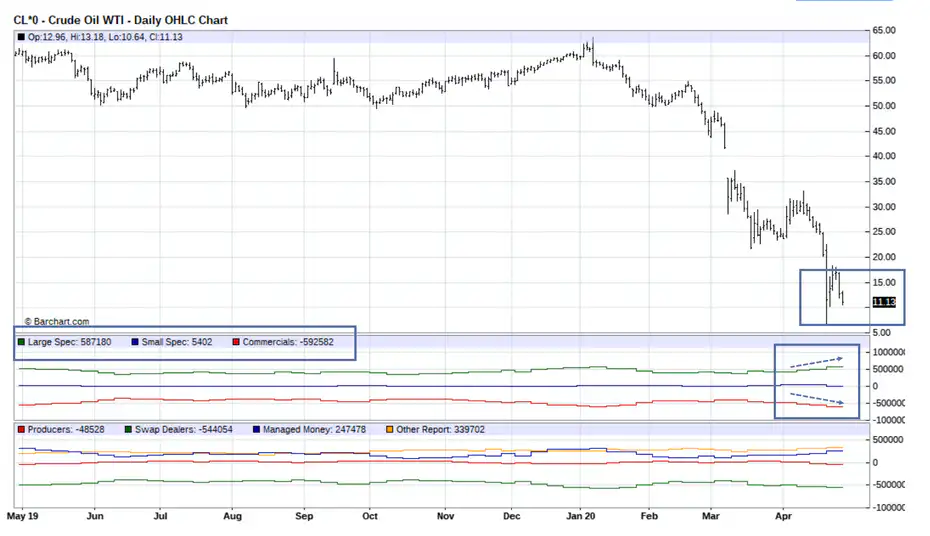

The large speculators are long 587,180 contracts and have been increasing their bet since April as the arrow show.

They appear to be betting on one of two things.

- A Bailout

- A Return in Demand

Bailout: OK, suppose Trump and Congress work out a deal to hold reserves in the ground. There is still excess supply with nowhere to put the oil. At best, this maneuver stabilizes the price at some price below the price to produce the oil.

Demand: As people go back to work demand will pick up. But demand return will be slow, not instantaneous.

On the corporate side, expect more work-at-home, more teleconferencing, and fewer flights.

On the personal side, consumers need to rebuild savings. Many will be scarred for life.

Gains or Losses

The large speculators increased their bet from 435,108 contracts on April 1 to 587,180 contracts as of last Tuesday, April 21.

There will be a time for a long energy play, but this does not seem like the time.

Note that 40% of Oil Producers Will Go Bankrupt if $30 Persists

Paper Oil

Oil is another example of leveraged trades. Even more so than gold, speculators will not take delivery.

It's time for personal responsibility, not bailouts of favored industries.

That's the only plan we need.

Fed Bailout Not Possible

Some readers suggested the Fed would bail out the sector. It cannot. There is no place to store the oil if the Fed bought futures and I do not believe the Fed would even if it could.

Those expecting hyperinflation out of forced debt writeoffs and plunging prices understand neither hyperinflation nor inflation.

Moreover, hyperinflation and strong inflation proponents do not even understand what is most important in general: credit and the balance sheets of lenders.