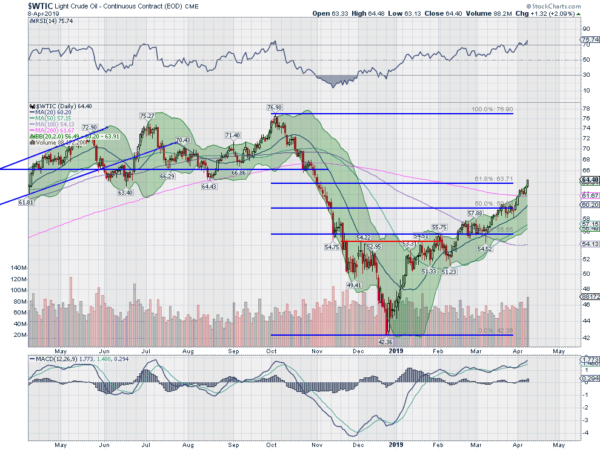

After a week of consolidation Crude Oil prices are moving higher again. The basing took place as the price crossed the 200 day SMA. It had not been above that level since late October. It has now retraced 61.8% of the drop from October to the December low. With a move like that what does the future hold for Crude Oil?

The chart above, of Crude oil prices over the last year, gives some clues. The move from $54 to $64 retraced an area where there was little price history. Not many prior buyers looking to unload or sellers needing to cover. But now Crude Oil is entering an area where there was long battle over price.

Looking left on the chart the area between $64 and $70 was the scene of a long price battle, with occasional pops up to $75-$76. It could take a while to burn through that supply. In addition, momentum is venturing into overbought territory. The RSI is technically overbought, over 70, but looking strong, with the MACD rising and near the tops from July and October.

Crude Oil has had a great run to the upside since Christmas. And it may continue for some time still. But the prior price action and momentum suggest that it could run into a slow down soon. It may be time to tighten stops or flip from stock to options in Oil stocks

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.