The stock and currency markets have been weak since the beginning of the week, with little major reason to move in any direction. Active players on stock and FX markets pause to assess the situation, but oil continues climbing.

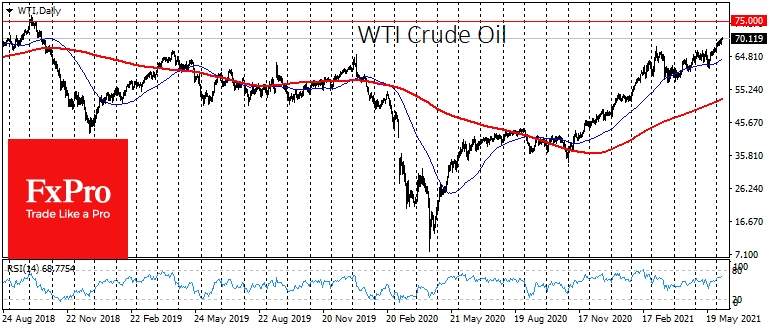

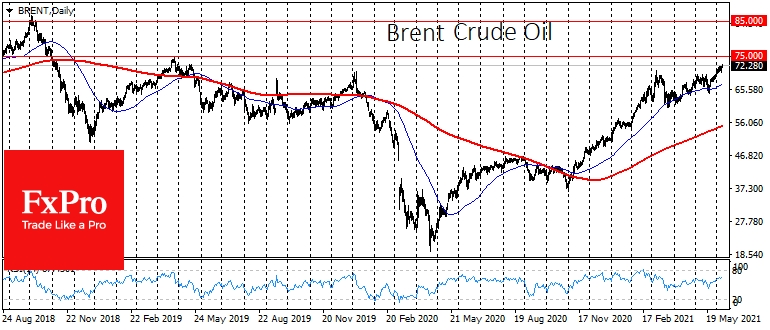

Over the last two weeks, oil prices have been rising gently, which is a very interesting dynamic. The price of a barrel of Brent and WTI has surpassed $70, an important psychological and technical milestone.

Current levels, near $70.30, were last traded in October 2018 for US WTI. Brent has peaked higher as its price jumped briefly to $75 in 2019 after a drone attack on the Saudi Arabian oil refinery.

However, over the last days, we did not see any signs of the bears' submission, i.e., short-squeeze, or, vice versa, a loosening of the bulls' grip with new highs. Instead, gentle buying on intraday declines is pushing oil higher day by day as if the bulls are trying to find the pain threshold level that a bull surrender would follow, with bears then betting on a fall in crude prices.

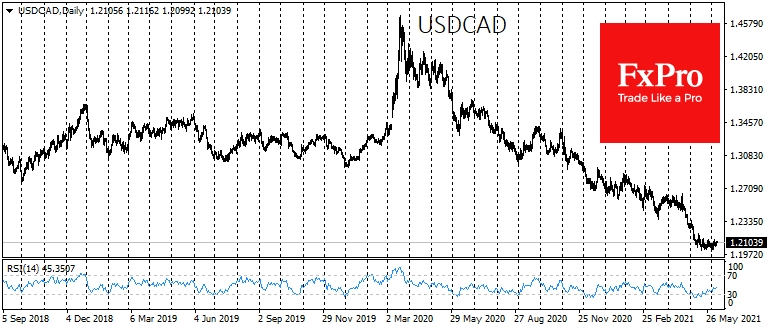

What is even more surprising is the sluggishness of related instruments. For example, the USD/CAD found itself locked in a tight range, running into solid support near 1.2000. And the Canadian dollar cheered the latest oil momentum with a step-down, trading above 1.2100 at the time of writing.

The currency market is deeper and more liquid, so we perceive a halt in the USD/CAD decline with caution: it is quite possible that in oil, we will see a loss of growth momentum near $75 per barrel Brent as well.

The big players want to find the short-squeeze area. However, thanks to the corrective pullback in March, the overbought zone and pain threshold has shifted higher.

The currency market dynamics make one wary of the potential for a rally in oil and a retreat in the dollar.

Patient traders might want to wait for a spike in oil volatility before taking short-term selling positions.

Besides the Crude Oil move, traders with USD/CAD should note that the Bank of Canada's monetary policy rate decision at 14:00 GMT may impact pairs with the Canadian Dollar today.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil In Search Of A Bears' Pain Threshold

Published 06/09/2021, 04:01 AM

Updated 03/21/2024, 07:45 AM

Oil In Search Of A Bears' Pain Threshold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.