Oil Futures prices jumped to a four-month high on Tuesday, rallying on hopes of economic stimulus. However, the uncontrolled spread of the coronavirus in the U.S. puts something of a ceiling on prices for the time being.

After several days of tough negotiations, the European Union agreed to a 750-billion-euro stimulus package, in a historic vote of confidence in the European project. For the first time, European countries will sell bonds collectively rather than on an individual basis, and funnel the proceeds to hard-hit countries, particularly in Southern Europe.

Meanwhile, in the U.S., Congress is set to begin negotiations on another massive stimulus package. The details remain subject to intense negotiations, but there is a broad consensus that both political parties want to pass another trillion-dollar package.

The oil markets welcomed the news, pushing up crude prices to the highest levels since March. Adding to the optimism was positive news on the vaccine front. A potential coronavirus vaccine developed by Oxford University and AstraZeneca (NYSE:AZN) demonstrated an immune response. Markets continue to price in optimism on vaccine progress.

Prices would be even higher if not the for the worsening spread of the of the coronavirus. The oil market fundamentals are increasingly bullish. “The global crude market is in deficit to the tune of 3.2 million bpd in July, and even with a tapering of OPEC+ cuts in August, will remain in deficit in August and September too of around 2.5 million bpd,” Bjornar Tonhaugen, head of oil markets at Rystad Energy, said in a statement.

“So the threat of a second wave of lockdowns is holding oil price gains back. An outright second wave of lockdowns will send oil prices lower,” Tonhaugen added.

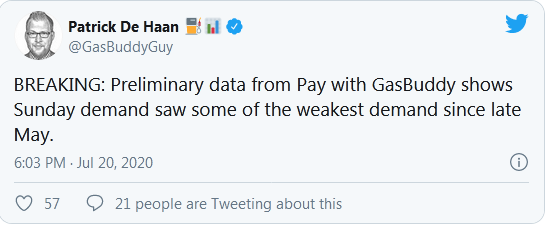

U.S. gasoline demand is showing signs of weakening. In the week ending on July 10, demand dipped from the week before. Other data suggests the downward trend is more than a one-off:

Florida, Texas and California, among a long list of other states, continue to suffer from a huge number of infections. The U.S. is not alone. India now ranks third globally in cumulative infections. The latest data from India shows an 18 percent decline in diesel demand in the first half of July compared to the same period in June, according to JBC Energy. Roughly 30 percent of the country is in lockdown, affecting more than 400 million people.

“The key question now is how much longer governments will wait before implementing new lockdown measures, and just how strict these will be,” JBC Energy said in another note. “The US is also approaching the turning point where individual states will have to decide how much economic pain they are willing to take in order to slow the spread of the virus.”

But there are other reasons why even Covid-19 related concerns may not lead to a horrific downward spiral for oil prices. The U.S. shale industry is showing no signs of bouncing back, despite the fact that prices have firmed up at $40. The rig count meltdown has slowed to a trickle, but drillers have no appetite to throw more rigs back into the field. Even in the EIA’s assessment, which typically tends to be optimistic on production, U.S. output will continue to erode until the second quarter of 2021.

At the same time, OPEC+ has hung together, improving compliance with the production cuts even as they move to add supply back onto the market. The cohesion bodes well for the group sticking with the plan in the months ahead, rather then returning to some sort of a price war.

Related: Weak Demand Forces Buyers To Cancel U.S. LNG Cargoes