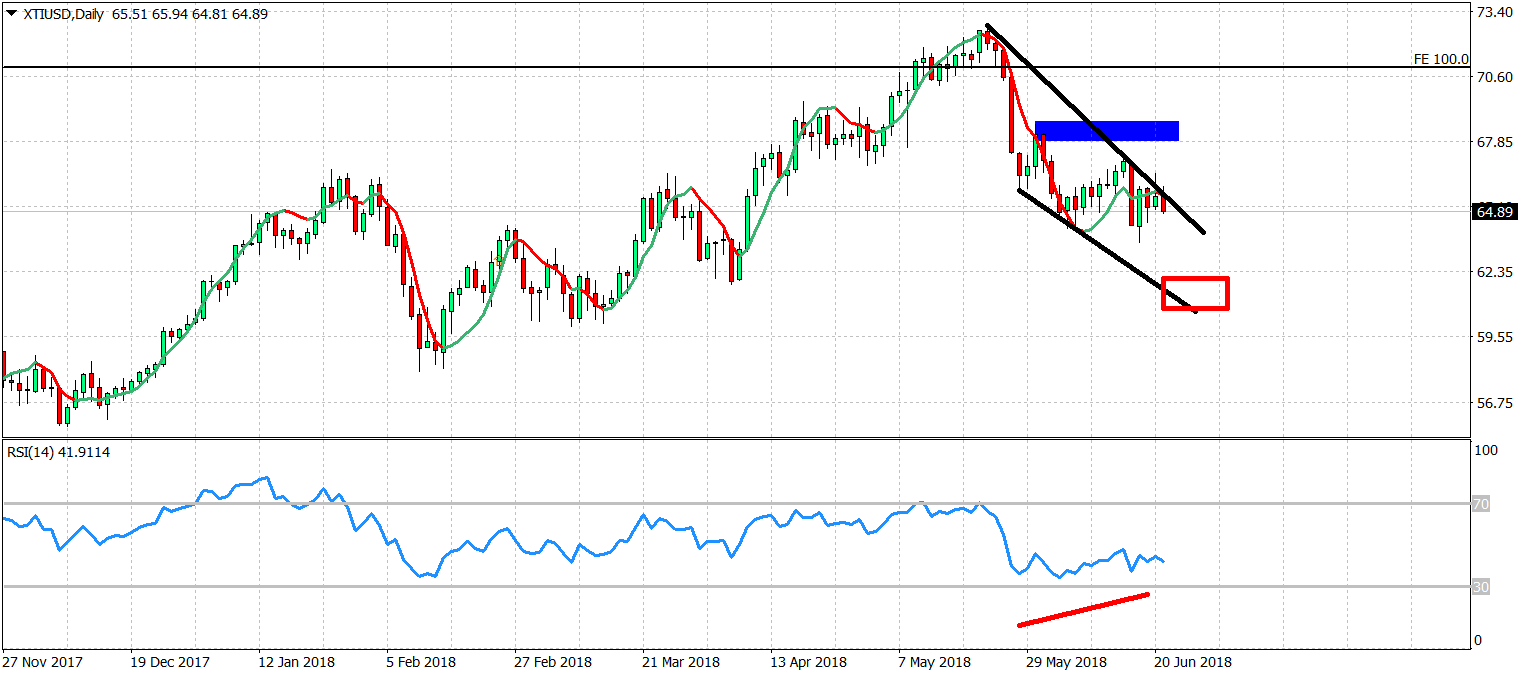

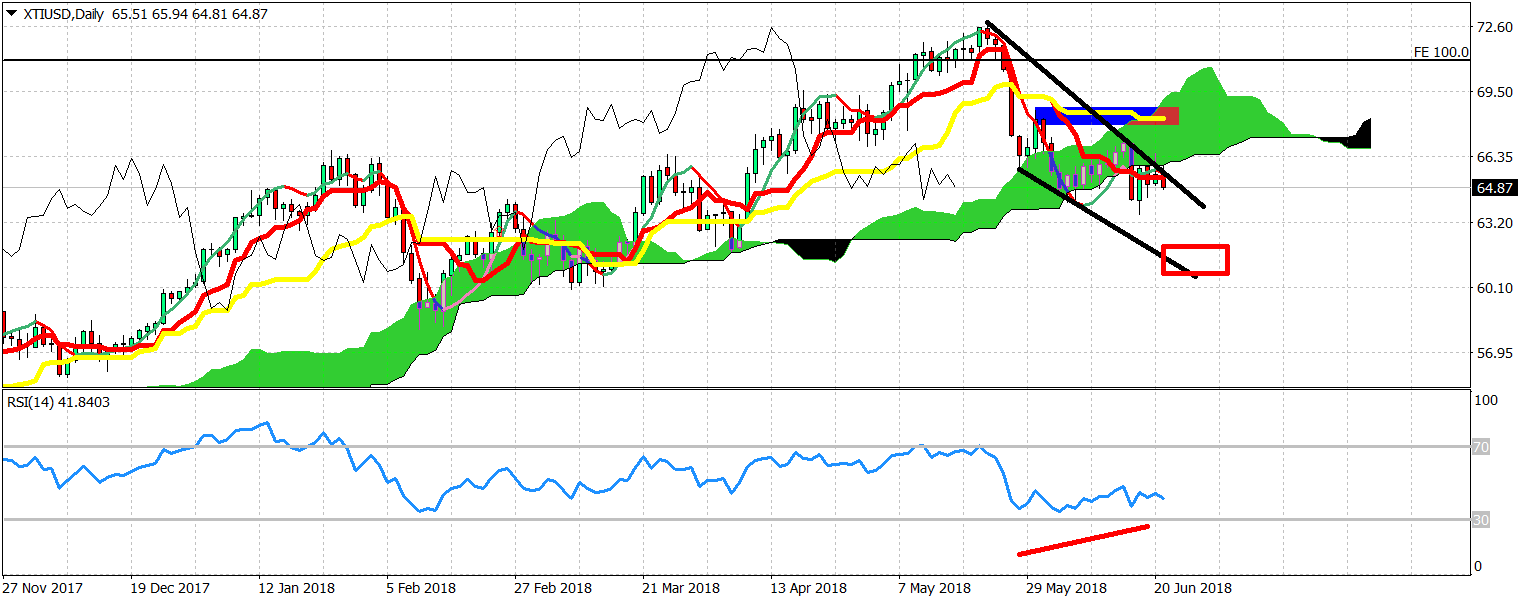

Oil price bounced towards 66.50$ yesterday and as I was saying on twitter, above 66$ Oil was testing major resistance levels for the short-term. Unfortunately for bulls Oil price got rejected and could not hold above 66$. There were several attempts to capture the 66$ price level and for price to stay above the trend line resistance levels, but each time sellers pushed price lower.

Oil price has broken below the 65$ level now and is ready for an acceleration lower. Our target area is at 62-60$.

Resistance is at 66-66.50$. As long as price is below that level trend is bearish. Price has also broken below the Daily Ichimoku cloud support level. This is another bearish sign supporting our bearish view for a move lower towards 62-60$.

Concluding, we believe that Oil prices have more downside and with a great risk reward ratio.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.