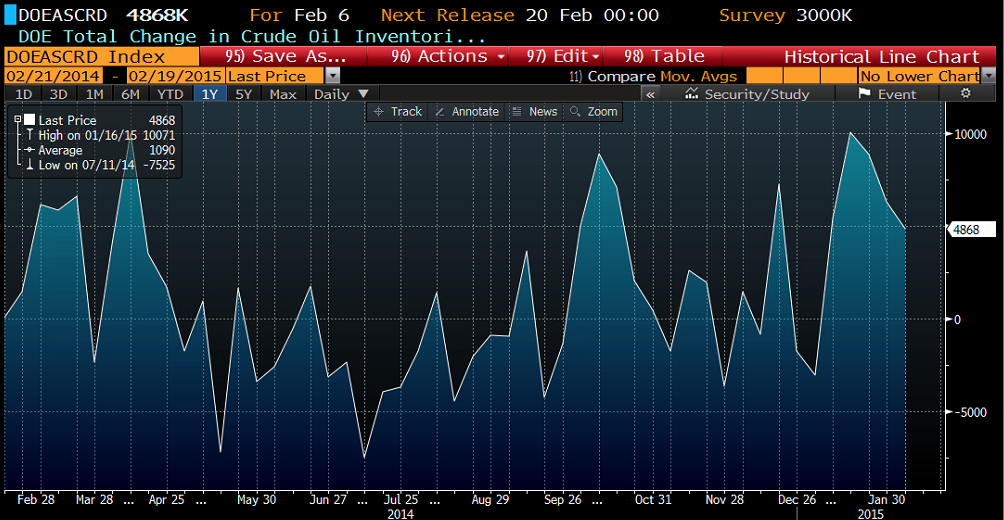

Oil markets were in free fall in late trading as API data showed a massive surplus of 14.3 million barrels. The API release is basically the predictor before the official DoE report due out tomorrow where markets are expecting 3.12 million barrels. The question is the API report accurate and will the DoE report reflects the massive surplus they are currently experiencing, markets are certainly thinking so.

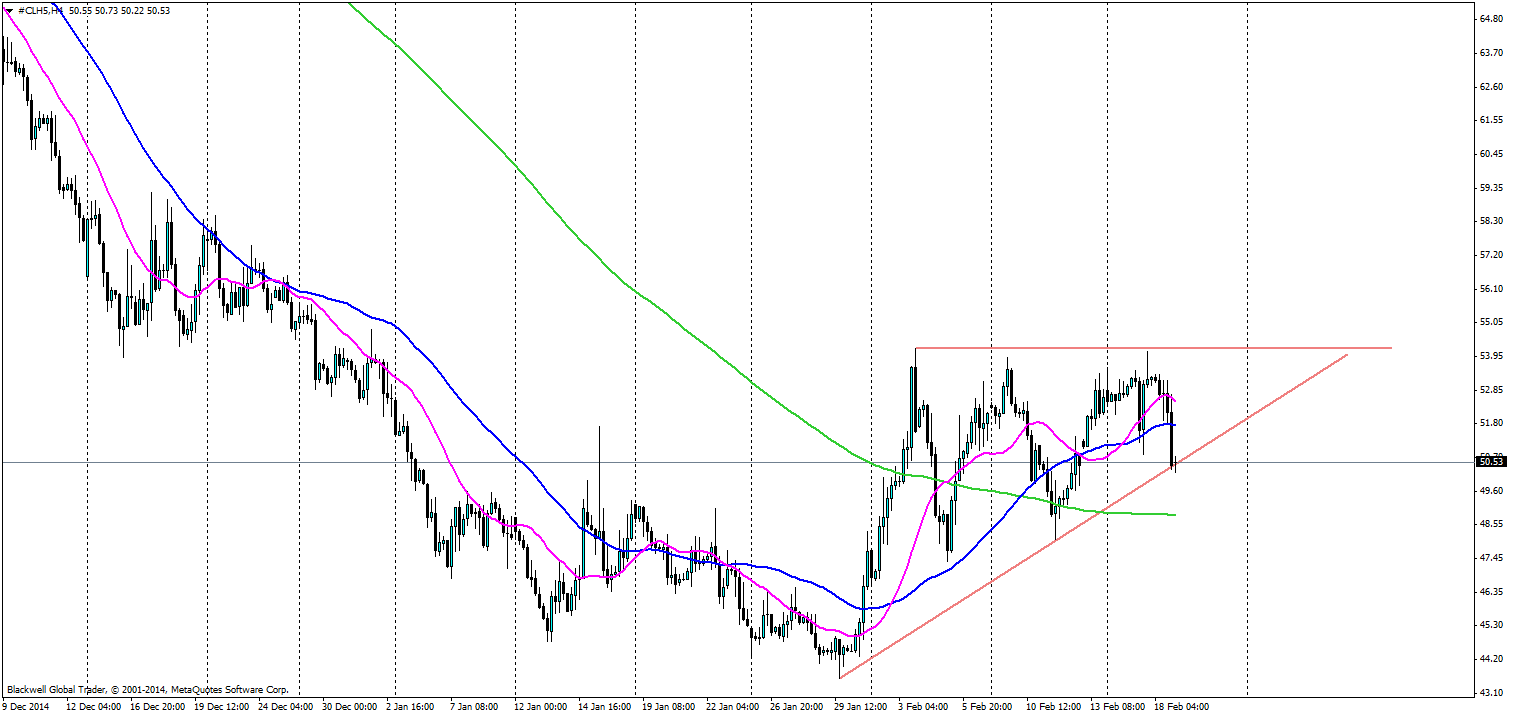

(Source: Blackwell Trader Oil, H4)

So the market has taken a breather now and is looking for the next move, but many in the market will be looking at this morning’s movement, which struck the trend line and has looked to slow down in the short term – giving support to the ascending triangle.

With the top of the triangle finding massive resistance at 54.21 the market will be looking at this point as a breakout area and a push through here could lead to massive buying. A reason why I feel the market might be prone to further buying is the bullish attitude we have as of late, and also that the market expects the surplus to dry up in Q2-Q3. People forget that oil markets are pricing in future prices and if the market believes supply will dry up then it will price in higher prices.

Despite the upturn in the market as of late, there is still potential for drops on the downside. As the market will be ready to digest the recent DoE report on crude oil inventories. The market is pricing in 3 million barrels, but API data suggests that there could be a much bigger surplus than what we are seeing.

(Source: Bloomberg DOE Total change in Oil Inventories)

Either way we can see that the market is quite cyclical when it comes to inventory data as of late, however, we can see also that there is a big build up of oil in the recent month as demand slackens amid a boost in surplus.

However you want to play oil, there are a few things to consider, but the ascending triangle on the H4 should not be ignored by anyone. As the market is looking to respect these levels and a breakthrough will likely lead to pressure on either side and good opportunities for those that are aware.