Citigroup says oil could collapse to $65 a barrel by the end of this year and slump to $45 by end-2023 if a demand-crippling recession hits.

Let’s not go that far. Will we get to $85 before the end of July?

Crude prices tumbled more than $11 a barrel during Tuesday’s lows as deepening fears of a US recession pushed oil markets to one of their worst trading days since the Ukraine conflict triggered highs in March.

The dollar's surge to two-decade highs also incentivized selling in oil, which tends to attract less buying from non-US entities when the value of the greenback surges.

However, no sooner had the price of a barrel broken below the $100 mark—the key to the conviction of oil bulls—some of the voices cheering Tuesday’s collapse from the sidelines posited that perhaps crude had been oversold.

The misgivings are understandable. The 'higher and higher' mantra has become institutionalized for oil prices, the same way as 'lower and lower' was two years ago.

Back in 2020, it was demand destruction from COVID that ultimately canceled tens of billions of dollars of investments in oil exploration projects and refining projects we are paying for in cost today.

Since 2022 began, the narrative in oil has either been 'Russia, Russia, Russia' (sounding like the rant of a one-time president), the folly of clean-energy policies unfriendly to fossil fuels or OPEC+’s virtually impossible task in meeting the production targets set by its Saudi masters.

Amid such mindsets, enters the R-word. The last time a recession was in our midst, it was at the height of the COVID outbreak. But it was brief, so brief that officially, it was estimated to have lasted just about two months—March through April—before demand came surging back for most goods and, eventually, oil.

There was good reason for such a lightning recovery in sentiment. The Federal Reserve was hosing down the fires of the pandemic then with a river of easy money, on top of interest rates almost at zero—setting up the catalyst for today’s inflation headache.

This time, there just can’t seem to be any agreement on how long and deep the recession would be and whether there’d even be one.

Under Close Watch: Fed Meeting Minutes, US Jobs Data

The drone of recession talk is, nevertheless, expected to get louder across the US after the Atlanta Federal Reserve’s forecast on June 30 of a second straight quarter of economic decline for the year. Some say the Atlanta Fed is prone to rewriting its forecasts all the time—indeed, its projection is called GDPNow, meaning it’s a call that can change by the day—and that the final reading for Q2 GDP could actually be positive.

Others say the US may be witnessing the beginnings of a real economic shakedown, only that it’s been too numb to notice because of the miraculous resilience of its consumers insulated by two years of pandemic aid money; a housing market still running on old stimulus energy and stock markets often coming back after a few days of sell-offs.

Deepening worries about a recession could weigh on the demand outlook for oil this week despite tight supply concerns and prospects of US job gains in June.

June's nonfarm payrolls are expected to have slowed from May, but remaining in solid, positive territory. Economists tracked by Investing.com say some 268,000 payrolls were probably added last month—versus the 390,000 in May—holding unemployment at 3.6% for a third straight month. A jobless rate of 4% or below is seen by the Fed as full employment.

There is a very close nexus between oil prices and US jobs data. The relationship is quite simple: people need to commute to work (at least those who don’t work remotely) and they need to either drive or rely on public transport. Whatever the mode, oil is needed for that. Also, when jobs—and wages—numbers are good (as they have been for a long time), Americans literally go the extra mile in discretionary travel, i.e. with road trips and flights to far-away holiday destinations. Gas prices stubbornly at north of $4.50 per gallon could chip away at some of that road travel, although the evidence of that has so far been thin.

Wednesday’s minutes from the US central bank’s June meeting will give investors some insight into how policymakers see the future path of interest rates as markets remain focused on the prospect of a recession. The Fed is expected to push ahead with another 75 basis point rate hike at its upcoming July meeting, but the path for September is less clear.

“I think the market is caught between two narratives,” Scott Redler, partner with T3Live.com, said in comments carried over the weekend by CNBC.

“I don’t know if it wants good news or bad news. At first, the hot economic news was bad because the Fed could go another 75 basis points and keep going, but now the market wants softer news. But is the landing going to be soft or hard? It’s like threading the needle right now.”

Charts Suggest Overshoot To Downside, Break Towards $85

In oil markets especially, the prospect of a recession has created more two-way price action in recent weeks, preventing any unsustainable surges in the price of crude even as China reopened from COVID shutdowns and an oil workers’ strike in Norway loomed.

“The price action overnight … hints more at panic and forced liquidation, than a structural change in the tight supply/demand situation globally,” said Jeffrey Halley, who oversees Asia-Pacific research for OANDA. “That says that in the physical market, supplies remained as constrained as ever, and despite the noise seen overnight, oil prices may be in danger of overshooting to the downside.”

This brings us to the earlier question: Will we get to $85 a barrel or lower before the end of July?

Interestingly, Citigroup does not fit a recession picture into the extreme price collapse it has forecast.

“For oil, the historical evidence suggests that oil demand goes negative only in the worst global recessions,” Citigroup analysts said in their July 5 projection.

“But oil prices fall in all recessions to roughly the marginal cost.”

Citigroup said its call was based “on an absence of any intervention by OPEC+ producers” and “a decline in oil investments”. Both sound quite ludicrous. The notion of a non-intervening OPEC+ is as believable as the notion of a vegetarian tiger. Also, a further decline in oil investments would only lead to the supply situation worsening—hardly the sort of thing that would support a price collapse.

In a more plausible scenario, investment manager BlackRock said commodity prices will likely remain "structurally higher" for decades to come as supply fails to keep pace with rising global demand.

Energy Aspects Director of Research, Amrita Sen also said crude oil prices will remain above historic levels despite the impact of a looming global slowdown.

"Even in a pretty deep recession I just don't see oil prices going below $80, maybe even not even $90 because of years of underinvestment," Sen, one of oil’s biggest cheerleaders this year, said on Bloomberg TV.

But crude has fallen its most since April and after the March run to $130 a barrel by US benchmark West Texas Intermediate and the rally to almost $140 by global benchmark Brent.

Ahead of its US open on Wednesday, WTI was up $1.84, or 1.9%, to $101.34 per barrel in Asian trading by 01:30 PM in Singapore (01:30 AM New York). It settled Tuesday’s session—July’s first—down by 8.2% after finishing June lower by more than 7%.

Brent was up $2.35, or 2.3%, to $105.12 in Singapore’s afternoon trade. Brent rose 1.7% in the previous session but lost nearly 6% in June. Prior to Tuesday’s collapse, it had held steadily near $120 for weeks.

The crux of the matter though is that WTI’s $97 low has been tested. The bears have tasted blood that they haven’t in three prior months and a further assault on the lower $90s is likely before the next attempt on the mid-$80s, according to charts drawn up for Investing.com by skcharting.com.

“The whole saga of a drop to $85 and even $79 will depend on how the market reacts to the next bear approach of $92,” said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“But the odds are in favor of a breakdown below $90 and it’s very likely that it could happen before the end of July.”

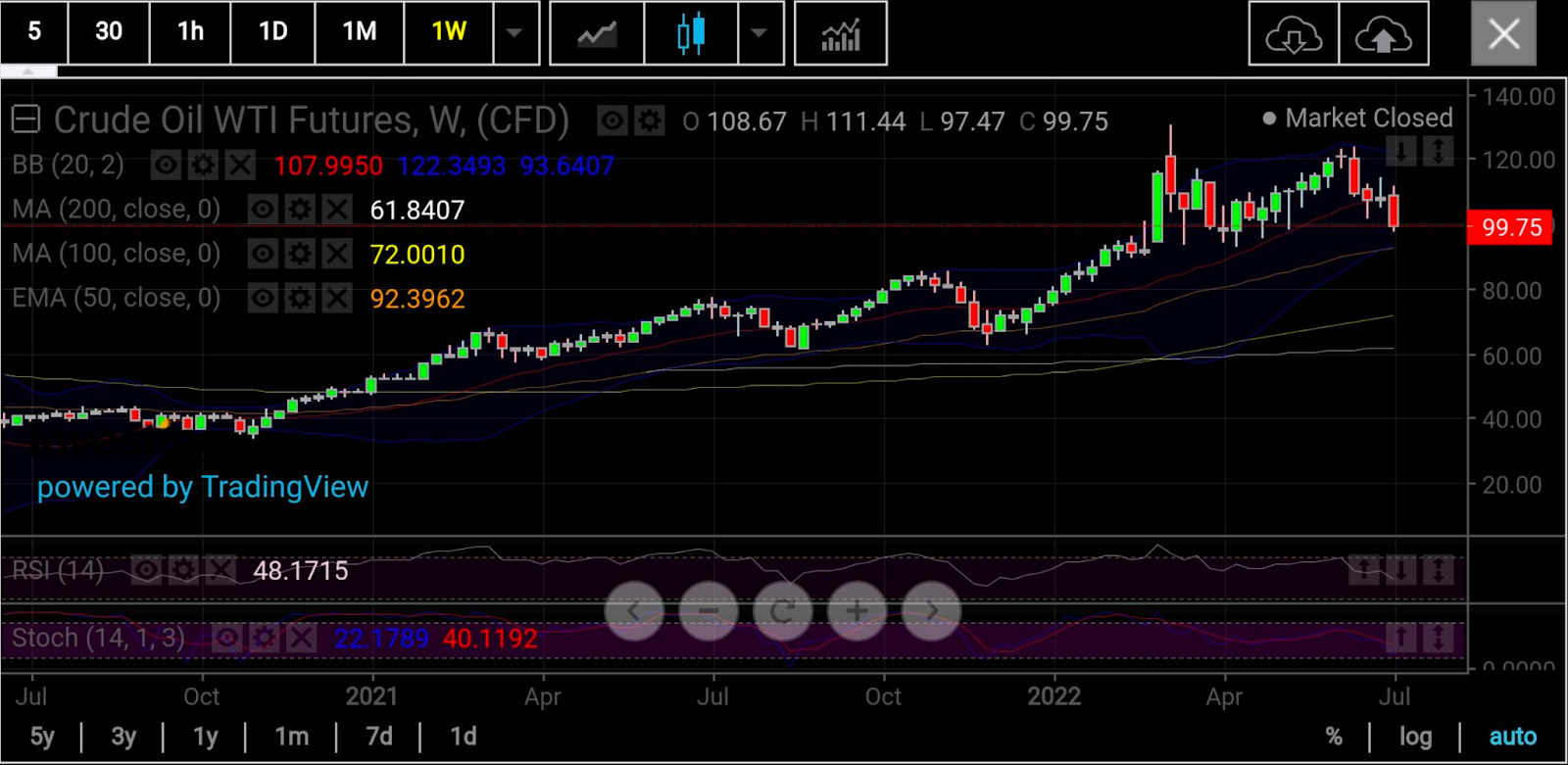

Source: skcharting.com with proprietary data from Investing.com

WTI’s weekly chart exhibits a second upcoming bearish wave aimed at the 50-week Exponential Moving Average of $92.40, which is possible with sustained pressure on Tuesday’s low of $97.47.

Stochastic indicators for WTI all show weakness, with the 12/23 reading for daily, 23/40 for weekly, and 55/66 for monthly all positioned for a bearish setup.

Any bounce back upwards is likely to be capped at the 100-Day Simple Moving Average of $107 and the 50-Day Exponential Moving Average of $109.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.