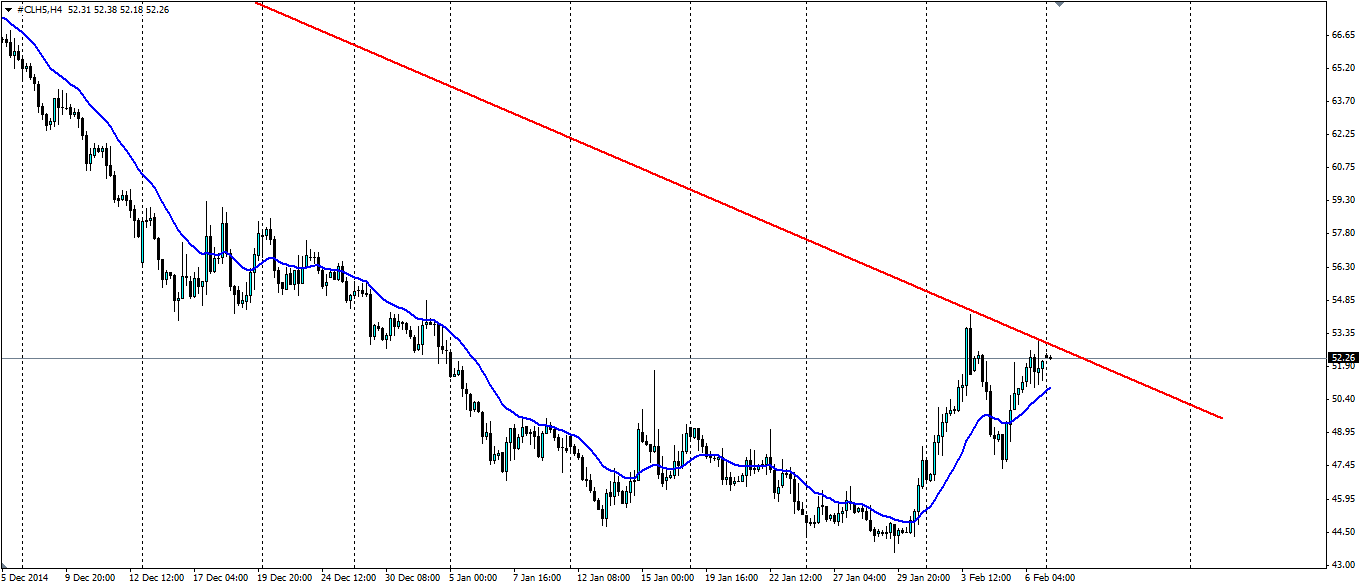

Crude Oil has seen a strong movement in the last week as the supply side of the market begins to react to the lower oil price. The result is that price has found the trend line and rejected off it. A double top also points to a rejection and a reversal of the short term trend.

(Source: Blackwell Trader)

A report last week showed that rigs in the US fell to their lowest level in three years which suggests the fall in the price of oil is having an effect on the supply side. This was inevitable really as some rigs will become unprofitable at such low prices and it’s better to leave the oil in the ground for when the price is higher.

This has only led the price of crude oil up towards the trend line and we have already seen two strong rejections off it. The week ended out with a strong rejection off the trend line that formed a pin bar on the H4 charts, which could suggest a turning point as the bears start to take back control from the bulls.

The fundamental oversupply is still plaguing the market and this is evident in the US Crude Oil Inventories. Last week we saw another big jump, this time by 6.33m to go with the previous week’s 8.87m jump. Another jump this week and oil is likely to feel further pain.

The double top that has also formed on the H4 chart is another indication that the short term bullish trend is likely to fail. The second high of the structure has formed a lower high, indicating the bulls ran out of steam and failed to break the previous high. This should encourage the bears further.

If we see the trend line hold, look for oil to find support at 50.00, 47.69 and the low at 43.58. Given that the double top structure is so large, we could even see the price target much lower than the low at 43.58, possibly as low as 40.53. If we see the trend line breached and the price breakout, look for resistance to be found at 54.20, 56.30 and 58.26.

(Source: Blackwell Trader)

The market has reacted slightly to a restriction in the number of oil rigs in operation, but the fundamental oversupply still persists. A technical double top has formed as the price rejects off the trend line and this is likely to lead the price back down.