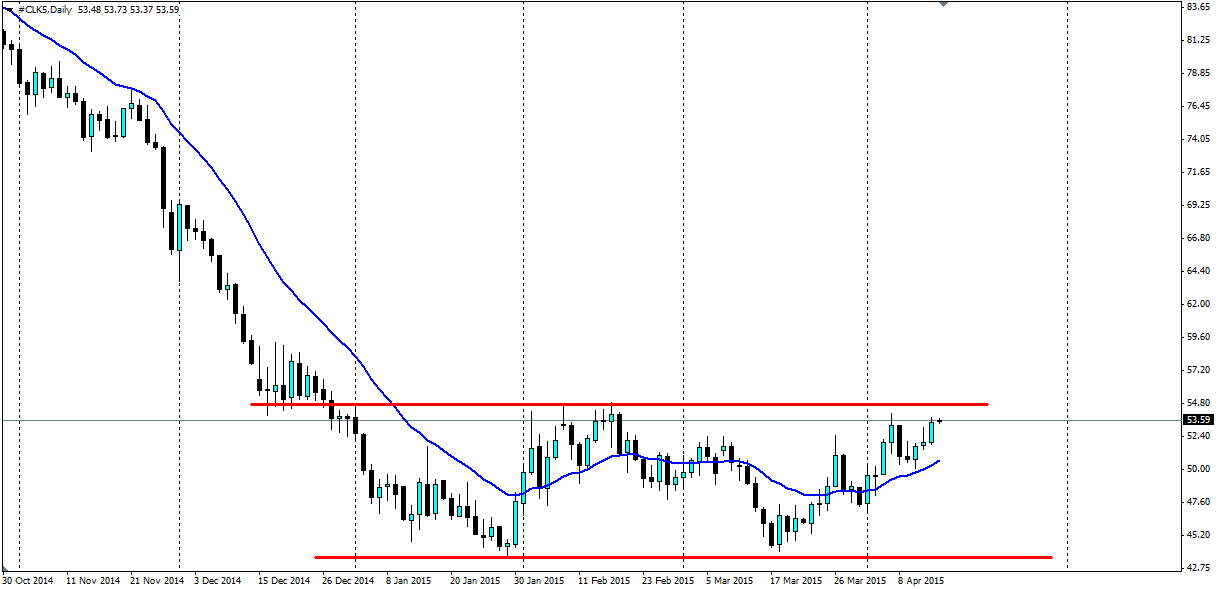

The oil market is on a bit of a bull run at present, but it looks to have run head first into the resistance at the top of the current range. Are we going to see the range hold or will oil see highs not seen since the end of 2014?

Source: Blackwell Trader

Oil has seen a rather solid leg up towards the top of the current range, thanks to some figures that point to a slowdown in US production capacity. New statistics released by the EIA have forecasted shale oil production to fall by 45,000 barrels to 4.98 million barrels per day throughout the May period. Tensions in Yemen have not shown any sign of cooling off and the market fears this could spread.

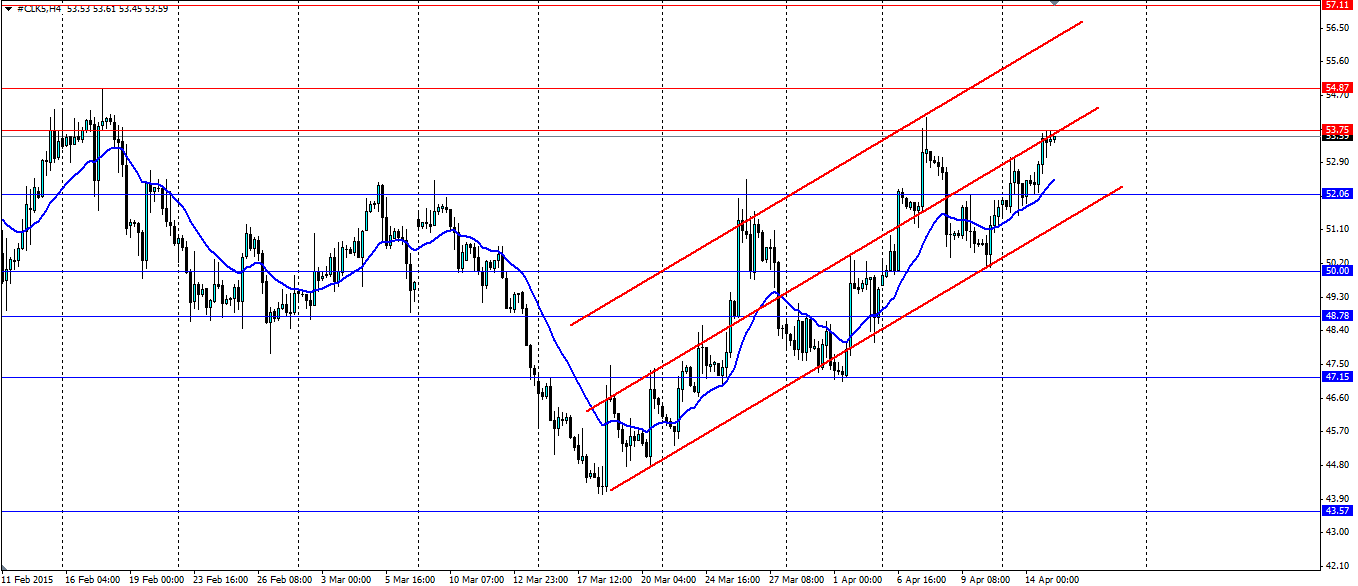

The official Department of Energy oil inventories figure, which is due for release later today, will be closely watched by the market. The market is predicting a surplus of 3.83m which is down considerably on the 10.95m we saw last week. Another big surplus will likely see a strong rejection off the resistance at the top of the range, likewise a small surplus will put pressure on it.

The range is likely to hold for now thanks to the fact that the fundamental oversupply persists and production will take some time to adjust. We may have found a bottom; that is to say we are unlikely to see the price of oil fall out of the bottom of the range, but for now the top of the range is likely to remain firm until we see a structural change in the oil market.

In the short term, look for resistance at 53.75 and the top of the range at 54.87. If we see a breakout, the immediate target will be 57.11. If the range holds, price will look for support at 52.06, 50.00 and 48.78 in the immediate term. Watch for dynamic support along the bottom of the current bullish channel as shown on the H4 chart below. Pay attention to the center line of the channel as this has acted as a point of interest for the price, finding both dynamic support and resistance along it.

The oil market is nearing the top of the range. The fundamental oversupply persists which should aid the resistance in holding steady in the near term.