Crude oil's series of rallies appears to face stiff headwinds. Is this it, or can the oil bulls pull a rabbit out of their hats? After all, they've reversed Monday's downswing already. Or does the prospect of all the U.S.–China uncertainties have the upper hand? It's making itself heard across the board and crude oil is no exception. Let's assess the technical picture below.

chart courtesy of stockcharts.com

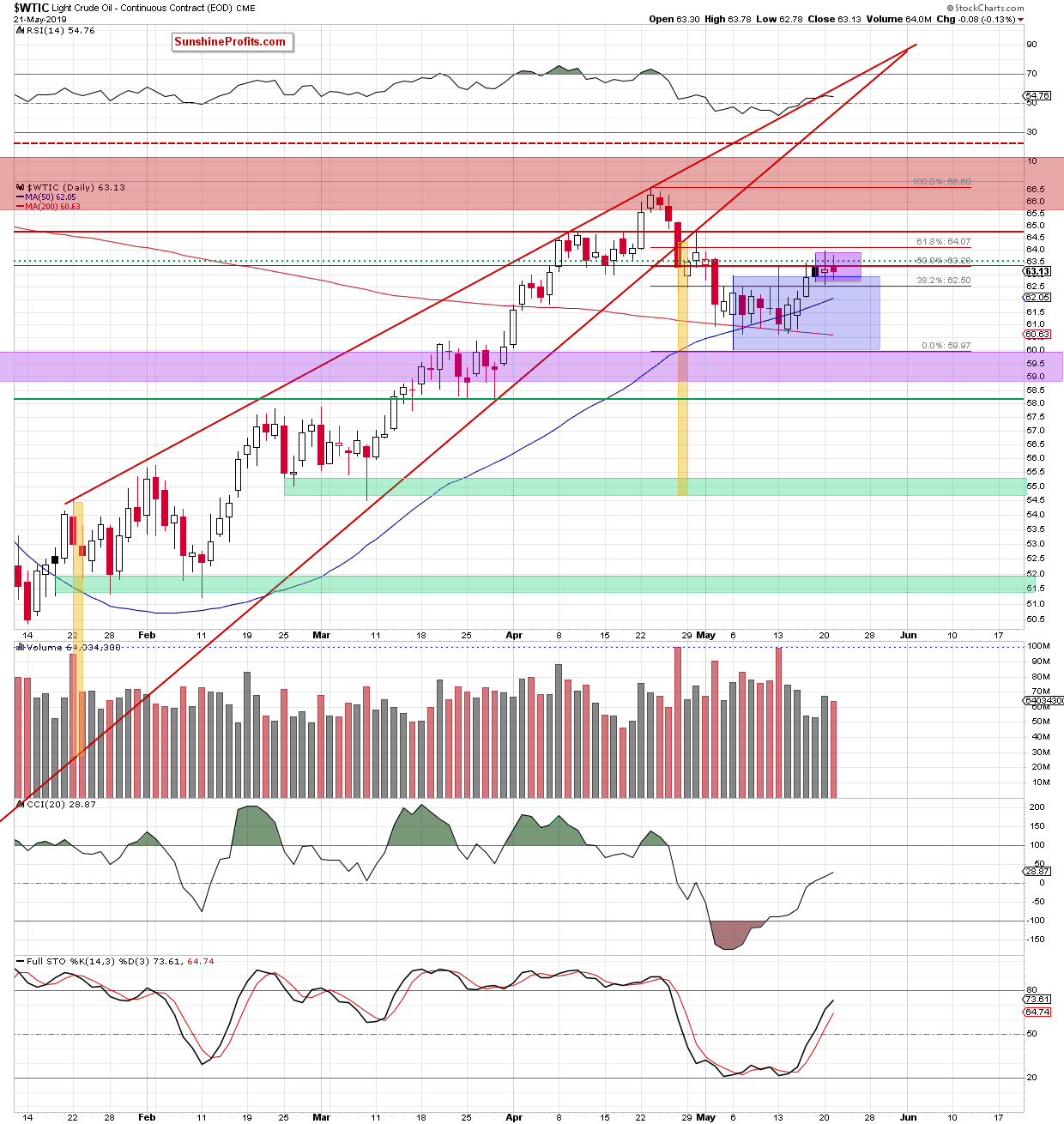

Tuesday's crude oil trading was almost a mirror image of Monday's session. While the bulls eked out minor gains on Monday, it was the bears who prevailed as the price closed down below the 50% Fibonacci retracement yet again. That was the fourth unsuccessful attempt to overcome it in a row.

As we recently pointed out, this suggests a bearish reversal of fortunes ahead. Indeed at the moment, black gold changes hands at around $62.20, which is back inside the blue consolidation.

Should the commodity keep moving lower from current levels, we're likely to see at least a test of the lower border of the blue consolidation. Such a move lower is supported by the unconvincingly low volume of the preceding upswing days.

Summing Up

Oil's outlook remains bearish as it continues to trade below the previously broken red horizontal line and has had trouble overcoming the 50% Fibonacci retracement. On Wednesday it looked to be rolling over and heading south. The weekly indicators still support a downside move.

A short position continues to be justified.

Thank you