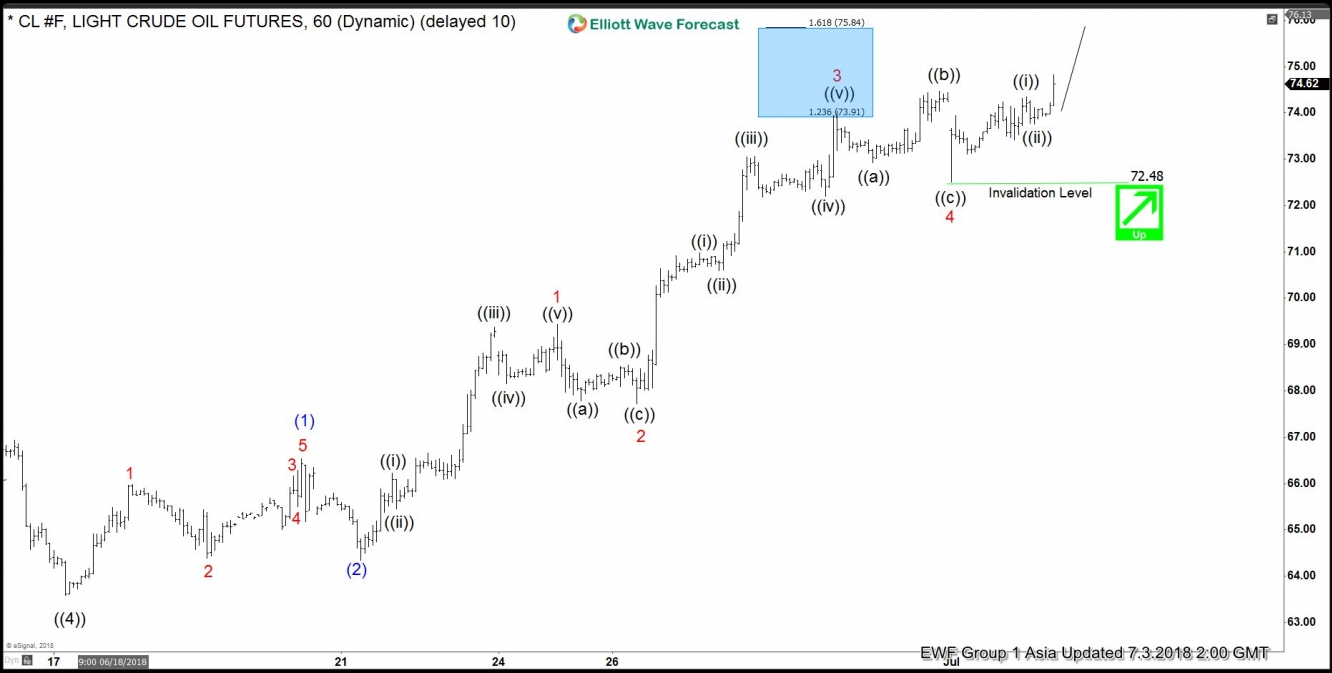

Crude Oil short-term Elliott Wave view suggests that the pullback to $63.59 on 6/18/2018 low ended primary wave ((4)). Up from there, the instrument reacting strongly to the upside and internals of that rally higher suggests that it’s taking place in an Impulse Elliott wave structure with extension with lesser degree oscillation showing the sub-division of 5 waves structure in it’s each leg higher.

Above from $63.59 low, intermediate wave (1) ended in 5 waves structure at $66.53 high. Down from there, intermediate wave (2) pullback ended at $64.34 low. Up from there, intermediate wave (3) higher remains in progress with lesser degree cycles also showing the advance of 5 waves structure in Minor wave 1 and Minor wave 3 thus favoring more upside.

The internals of that advance ended Minor wave 1 of (3) at $69.44, Minor wave 2 of (3) ended at 67.72 low. The Minor wave 3 of (3) ended at $73.99 & Minor wave 4 of (3) ended at $72.48. Then above from there Minor wave 5 of (3) remains in progress. And as far as it stays above $72.48 instrument can reach as high as Minor wave 5=Minor wave 1 target area at $77.60-$78.84. Afterwards, the instrument is expected to do an intermediate wave (4) pullback in 3, 7 or 11 swings before further upside is seen. We don’t like selling it into a proposed pullback.

OIL 1 Hour Elliott Wave Chart