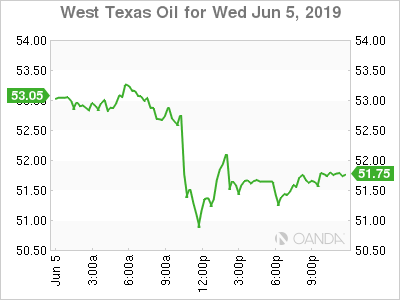

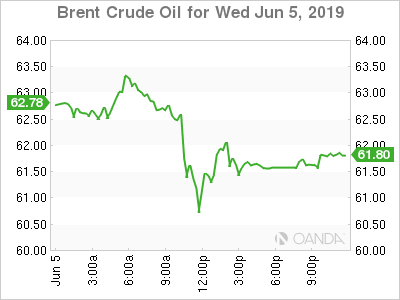

Oil prices fell on Wednesday after the Energy Information Administration (EIA) published the weekly U.S. crude inventories. The surprise buildup of 6.8 million barrels of crude and 3.2 million barrels of gasoline put downward pressure on energy prices. Brent fell 2.28 percentage and WTI recorded a loss of 3.31 percentage as the U.S. dollar also found its footing and rose against major pairs.

A rate cut by the U.S. Federal Reserve is rising in probability and with it the greenback has lost its appeal as investors are seeking yield elsewhere. Trade wars have kept the U.S. dollar bid and were in a factor in the rebound seen on Wednesday.

Rising U.S. production is more than offsetting the efforts from the OPEC+ and if we add the negative effect a trade war could have on energy demand the result is lower prices. Russia has not been totally on board with rejoining the agreement to cut output after it ends in June, without a major producer the weight of the cuts would be even more on Saudi Arabia.