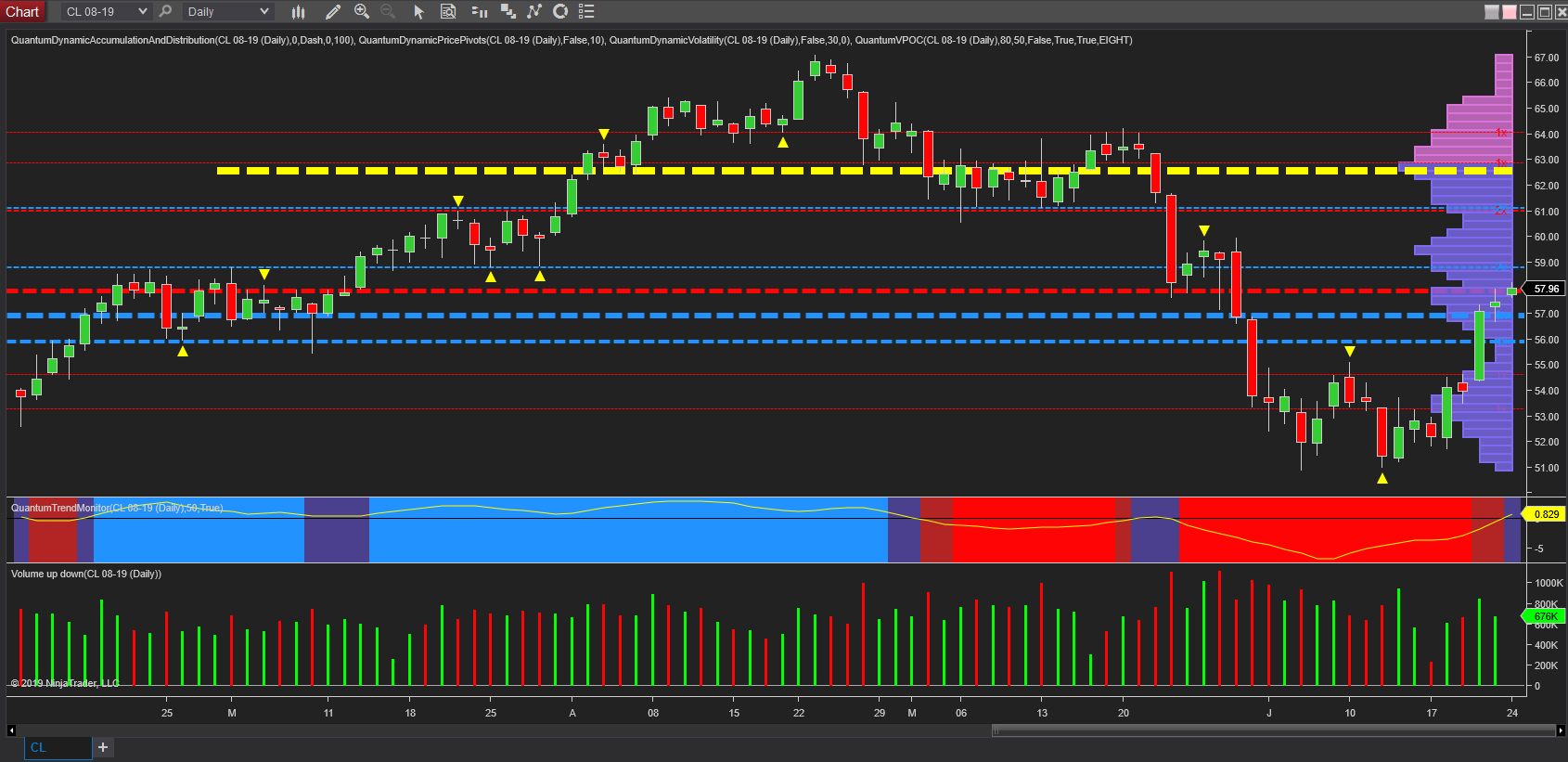

Oil is yet another commodity that has benefited from weakness in the U.S. dollar and which has certainly helped to reverse the strong bearish trend initiated when oil broke away from the volume point of control in late May, taking the commodity to a low of $50.88 per barrel early in June.

Since then we have seen an extended congestion phase develop in the $51 to $54.20 per barrel area, before last Thursday’s price action propelled prices through two strong areas of price resistance on good volume and a solid wide spread price candle. Both are denoted with the blue dashed lines of the accumulation and distribution indicator, the first at $56 per barrel and the second at $57 per barrel.

Friday followed through with a close above the second of these, and with the gapped up open in yesterday’s early trading, we are now testing a third level at $58 per barrel at the time of writing and denoted by the red dashed line of the accumulation and distribution indicator.

This is another strong level now acting as resistance, but should this be breached, these three levels will then provide a very solid platform of support for a further move higher. Volume on the volume point of control histogram are consistent with only one low volume node at $60.50 per barrel before the volume point of control at $62.50 per barrel is tested and comes in play once again. And here we can expect to see further congestion develop once attained. Note the trend monitor indicator which is now in a transitional phase on the daily chart and signalling this return to bullish sentiment for oil.

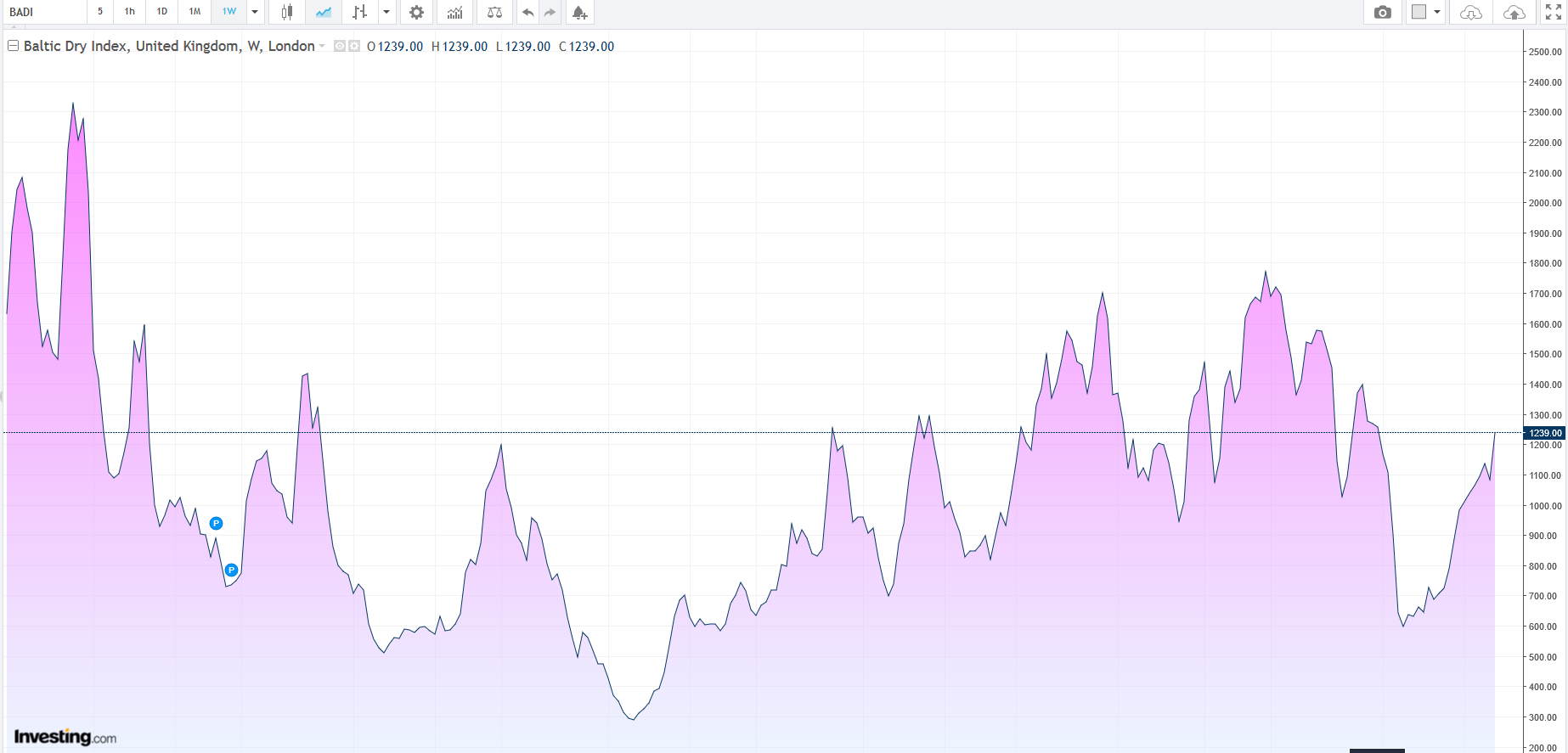

Finally always worth watching is the Baltic Dry Index which has seen a strong rally on the weekly chart rising strongly from the lows of early in the year at 600, to currently trade at 1239 at time of writing, and suggesting as it does the cost of shipping is rising as demand for commodities increases.