A hit of 2014 nostalgia washed over in me in an awesome wave yesterday as all anyone could talk about was falling oil prices. WTI crude, the main US crude futures contract, fell to below $50 a barrel yesterday afternoon with Brent crude retreating below the $55 level as well. The most important and pertinent question as to the demise of the global energy complex used to be ‘why?’ it is now when will it stop?

These falls in oil prices are as a direct result of both demand and supply side issues. Slowing industrial demand in emerging markets has combined with a glut of supply that OPEC continues to let run. It does not look like there is much to stop these falls from continuing. Saudi Oil Minister Ali al-Naimi said over the weekend that Saudi Arabia doesn’t care if oil falls to $20 a barrel. The Saudis are in the driving seat of this move and until they let up the pressure then we are all looking at lower energy prices.

Of course, for consumers in non-oil exporting nations that is a massive plus and will lead to continued increases in disposable income and discretionary spending in the coming months. Of course, for policymakers at the world’s central banks, it provides an interesting dichotomy – promoted spending but increased deflationary pressures.

We saw this in yesterday’s German CPI announcement which fell to 0.1% on a year-on-year comparison, the lowest since October 2009. Of course back in 2009 we saw a very slight dip back into deflation followed by a fairly sharp rebound in price increases. Little damage was done then, but we cannot see a similar performance in the current situation. ECB members are split on the pros of the economic stimulus of lower oil prices versus the con of outright deflation in the eurozone. The latest reading of inflation in the single currency area takes place tomorrow and is expected to fall to -0.1%.

While we wait on the ECB’s latest measures – the next meeting takes place on Jan 22nd – there are other central banks to focus on. The Norges Bank – the Norwegian central bank – cut rates in December to deal with a lower Brent crude price and yesterday’s movements will have taken prices below policymakers’ expectations. Their next rate setting meeting is not until March but there is no reason to not be looking for an extraordinary move in the coming weeks.

The other side of the deflationary coin is a pick-up in services sector activity, something that we expect to see from the global economy through the session in the form of the latest run of PMI announcements. As always Italy’s number is due at 08.45, France at 08.50, Germany at 08.55, and the eurozone wide measure at 09.00 with the UK number due at 09.30 and the US at 15.00.

Overnight the Chinese services PMI rose to 53.4 from 53.0 the month previous, the fifth consecutive month of expansion there. The most important news out of the country today however has been that China is said to be accelerating around $1.1trn of infrastructure spending through 2015 in a bid to iron out the kinks in its move towards domestic demand driven growth.

The key metric for the rest of the world will be Friday morning’s PPI and CPI announcements, however, as we look to see just what kind of disinflationary impetus is coming from the world’s manufacturing base.

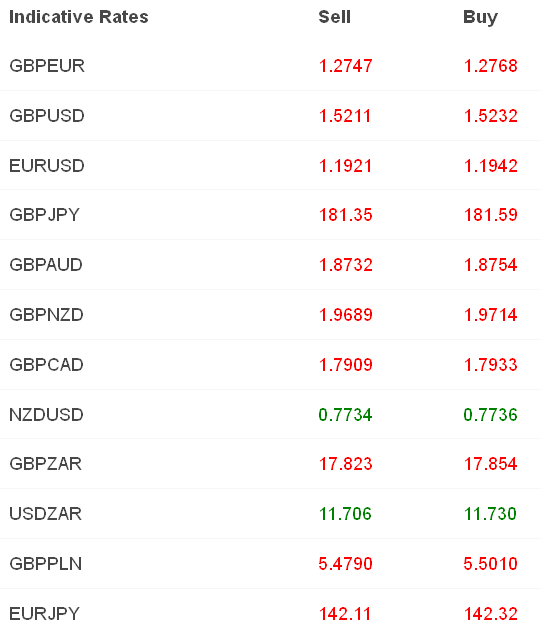

As for sterling, as we opened up yesterday’s session, the first real one of the year, the picture was quite clear. Sterling opened up lower against the majority of its G10 counterparts, with it only able to gain against the European single currency, the Swiss Franc – which is being sold heavily to hold the EUR/CHF floor – and the Norwegian krone that remains impaled on the poor oil price outlook.

I am by no means a GBP bear through 2015; quite the opposite. In the short term, however, sterling sellers must be aware of the risks, especially against the USD, through the first part of 2015.