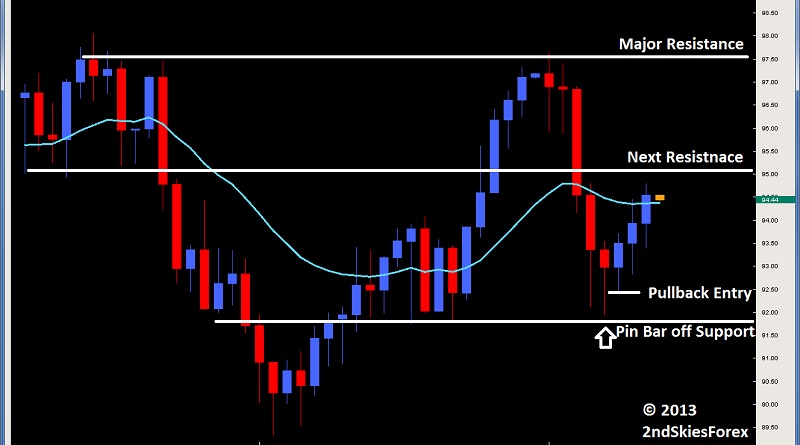

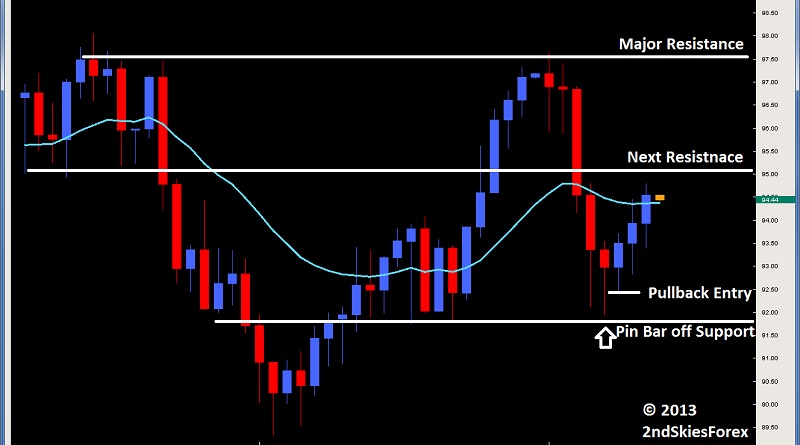

WTI Crude Oil

On Sunday in my weekly market commentary, I talked about the pin bar signal forming around the $92 level, and that a corrective pullback into the pin bar lows would offer a good setup to get long, targeting $94 and $95. Today the pair breached $94.50, offering a minimal 3:1 R:R reward to risk play, so hopefully you profited from that as did our course members.

The commodity is approaching the key $95 figure where it certainly could encounter sellers as the intra-day price action charts are showing this bullish move is still corrective (but is building upside momentum). Clearing out $95.50 would setup a test of $96.30 and $97.50, so bears can look to sell at these levels if any price action signals manifest there. Bulls meanwhile will wait for a pullback towards $92.50 before getting back long.

Original post

On Sunday in my weekly market commentary, I talked about the pin bar signal forming around the $92 level, and that a corrective pullback into the pin bar lows would offer a good setup to get long, targeting $94 and $95. Today the pair breached $94.50, offering a minimal 3:1 R:R reward to risk play, so hopefully you profited from that as did our course members.

The commodity is approaching the key $95 figure where it certainly could encounter sellers as the intra-day price action charts are showing this bullish move is still corrective (but is building upside momentum). Clearing out $95.50 would setup a test of $96.30 and $97.50, so bears can look to sell at these levels if any price action signals manifest there. Bulls meanwhile will wait for a pullback towards $92.50 before getting back long.

Original post