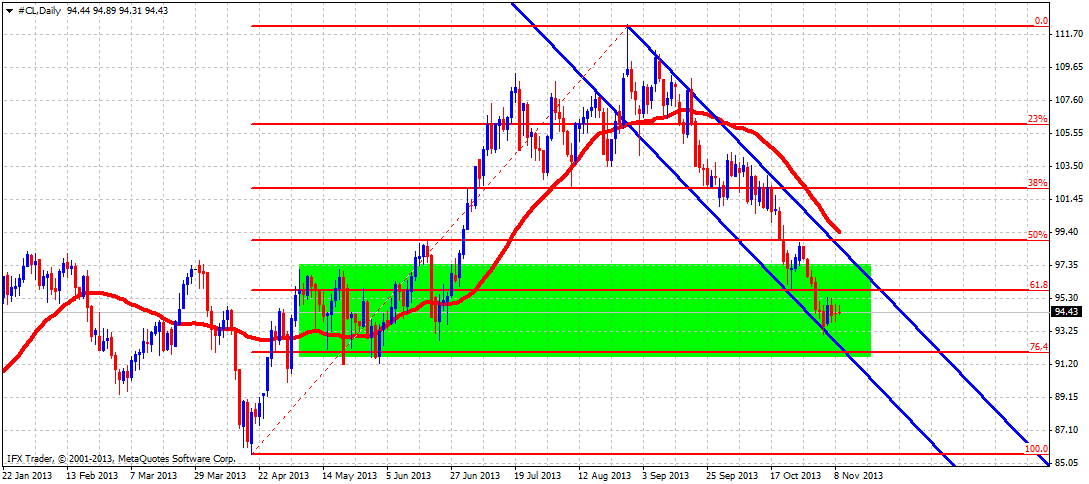

Oil prices have been falling for some time now, inside the downward sloping channel as shown in the first chart below. The trend remains down as prices continue to make lower lows and lower highs. Prices have reached the 76.4% Fibonacci retracement and the area of the previous wave 2 consolidation.

Oil prices are expected to find support as the decline has pushed prices near 76.4% retracement. Prices have touched the lower boundaries of the downward sloping channel and the previous wave 2 consolidation area. Support is strong between 91 and 95. Oil has made a low at 93 and unless prices break above 95, there is no good chance for a trend reversal.

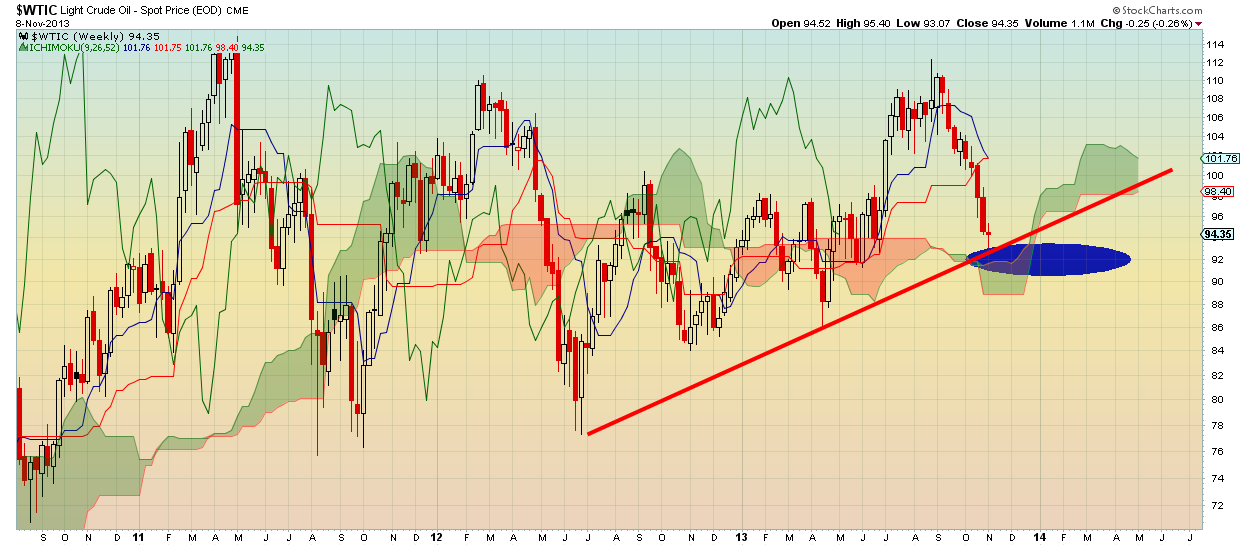

Both Ichimoku cloud support and the upward sloping trend line in the weekly chart provide support for the longer term pattern of higher highs and higher lows, supporting our view that a trend reversal could be near.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.