- Crude oil rally goes into overdrive after OPEC offers no relief

- Euro under pressure, could get worse when ECB meets next week

- Powell doesn’t say much but stocks like that, peace talks resume

Commodity markets panic

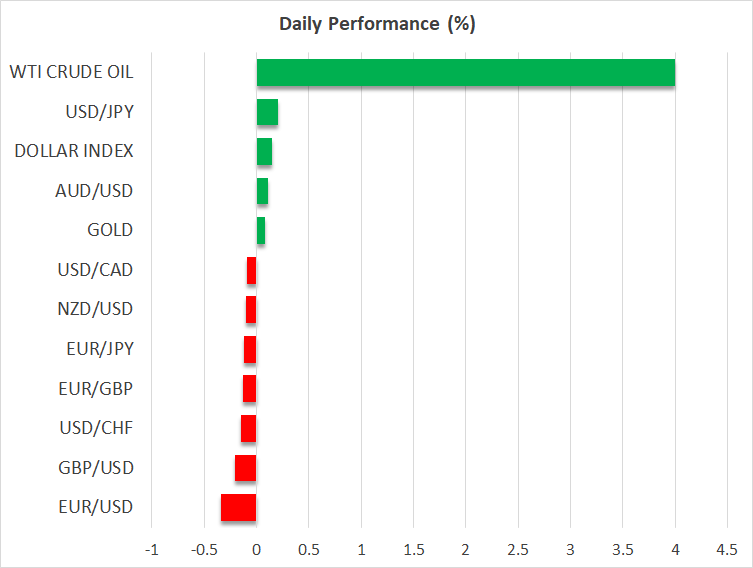

The storm in commodity markets is turning into a hurricane. What started out as an energy shock because of the suffocating sanctions on Russia has started to broaden out, lighting a fire under food prices and metals.

Oil prices have been at the tip of the spear throughout this commodity rally, charging higher to reach levels last seen in 2008. There are widespread reports that traders and companies around the world are refusing to touch Russian oil even though there haven’t been any explicit sanctions imposed on it, which is creating a sense of scarcity.

Futures markets tell the whole story as most commodities have reached record levels of ‘backwardation’, which essentially means investors are willing to pay a rich premium for securing supply immediately. OPEC did not help alleviate this shortage at all yesterday, sticking to its plan to add supply very gradually despite the mayhem in the markets.

Really bad news for the euro

With food prices now joining energy prices in their march higher, traders are betting inflationary pressures won’t go away anytime soon. Market-based inflation expectations metrics have skyrocketed lately, creating a headache for central banks, especially the European one.

The ECB will meet next week and it faces an impossible dilemma. European growth will probably take a serious hit as consumers get squeezed by soaring food and energy costs. The banking sector could even exacerbate any slowdown given its exposure to Russian assets. On the other hand, inflation is likely to heat up even further.

Therefore, the ECB will have to choose - prioritize growth and accept a period of higher inflation, or forge ahead with higher rates and risk crashing the economy? For the euro, both choices are negative. Either the central bank will pause its normalization plans or it will risk another policy mistake.

In contrast, the US economy faces only an inflationary shock. America is energy independent and its banks have almost no exposure to Russian money, so this is unlikely to hamstring economic growth. In short, recent developments argue for more pain in euro/dollar and the technical picture tells a similar story.

Equities cheer Powell testimony

The mood in stock markets improved yesterday after the Fed chief played down the prospect of a 50 basis points rate increase during his Congressional testimony. Treasury yields moved higher as well, although that seemed to be driven by the leap in energy prices, not anything Powell said.

It is quite striking that inflation expectations have risen much more than nominal yields lately, keeping real yields suppressed. That’s another way of saying inflation will spike but central banks won’t take a sledgehammer to strike it down, which paints a favorable picture for gold prices.

Elsewhere, the Bank of Canada raised interest rates as expected. The decision didn't have an immediate impact on the loonie, but with the central bank uncertainty out of the way, the currency managed to realign itself with oil prices in the aftermath.

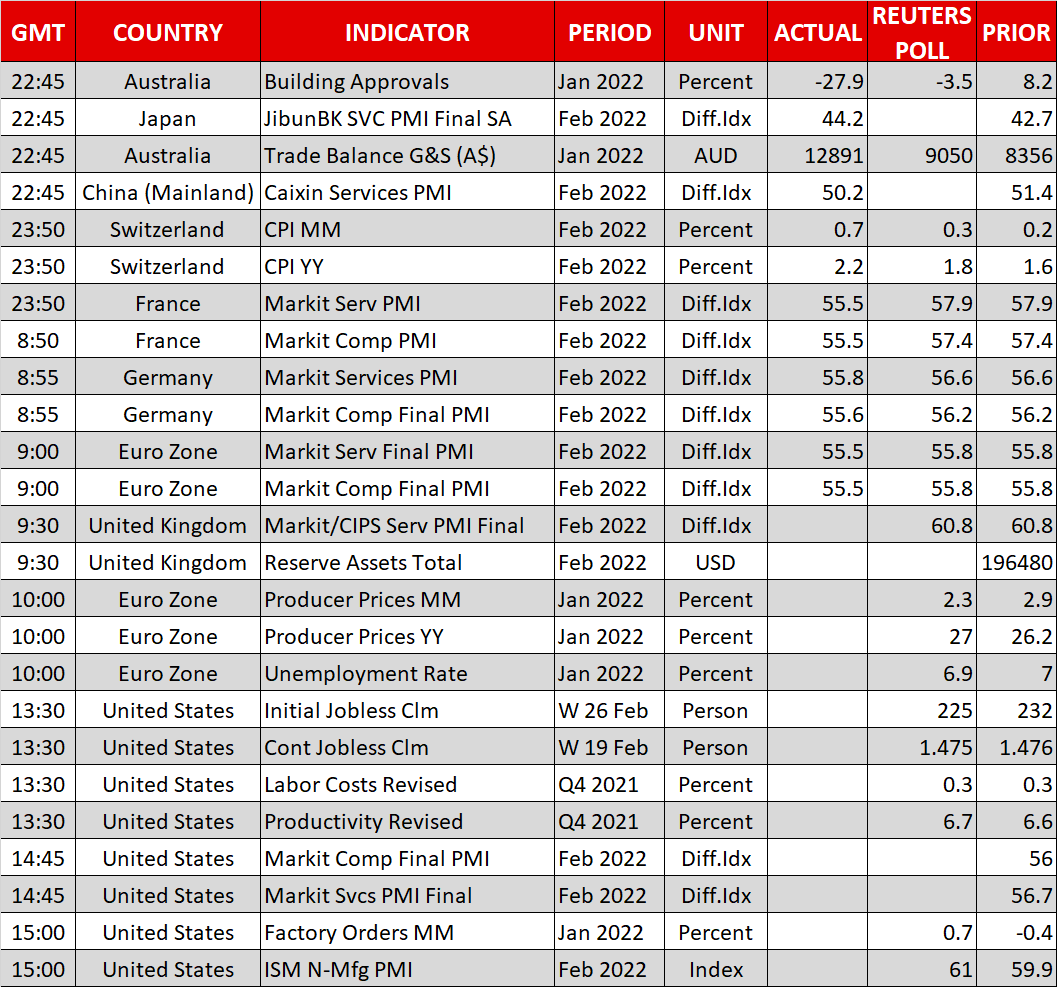

As for today, Powell will testify again, this time before the Senate. On the data front, the ISM services PMI could be crucial ahead of tomorrow’s US employment report. The minutes of the latest ECB meeting will also be released but are probably outdated given recent events.

Perhaps most importantly, the second round of peace talks between Ukraine and Russia is expected to kick off. Traders will be hanging on every word. Any signs of de-escalation could spark huge reversals in financial markets, especially because that seems unlikely with the fighting intensifying lately.