Today’s price action in oil may look to be boring at first sight, but it is far from being so. There appears to be pressure building under the surface. Actually, this chart situation is such that it leads us to open a new position. The bulls have been strong lately but look to be taking a breather now. Or, is that a breather? Figuring out the right answer is what today’s Alert, and the new position, is all about...

Let’s take a closer look at the charts below (charts courtesy of www.stockcharts.com and www.stooq.com ).

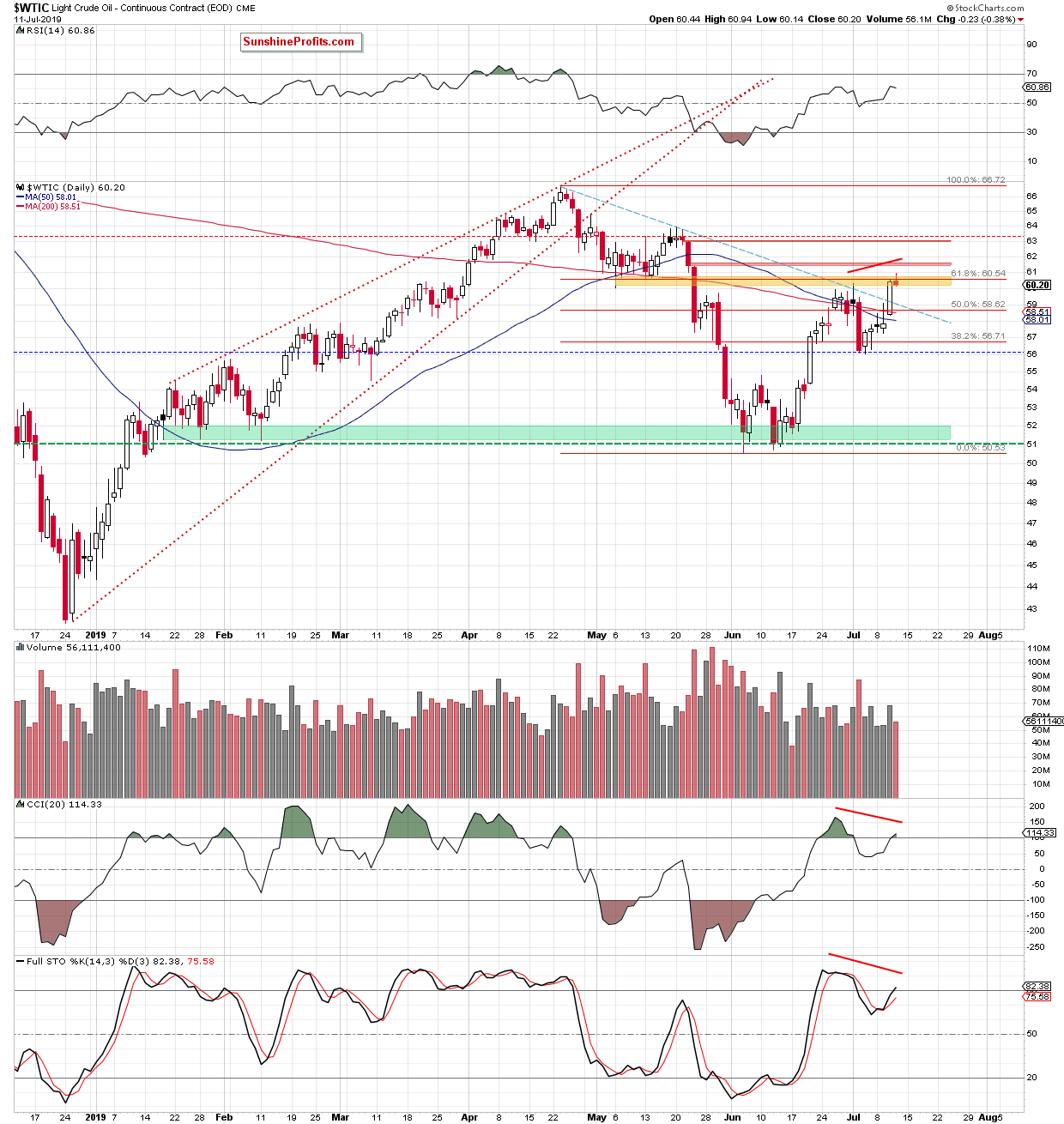

Crude oil opened Wednesday with another gap higher, and went on to extend gains in the following hours. Yesterday, it has moved slightly above its previous peaks, the yellow resistance zone and the 61.8% Fibonacci retracement, but the bulls have given up their gains before the day was over. This way, the earlier intraday breakouts have been invalidated.

The volume comparison also doesn’t attest to the bulls’ strength. Yesterday’s volume has been smaller than the day before, hinting at the buyers’ lack of conviction. Take a look at the relative position of the daily indicators relative to price throughout July – it’s a clear bearish divergence in both the CCI and Stochastic Oscillator, and the oil price. It increases the probability of reversal and another move to the downside in the very near future.

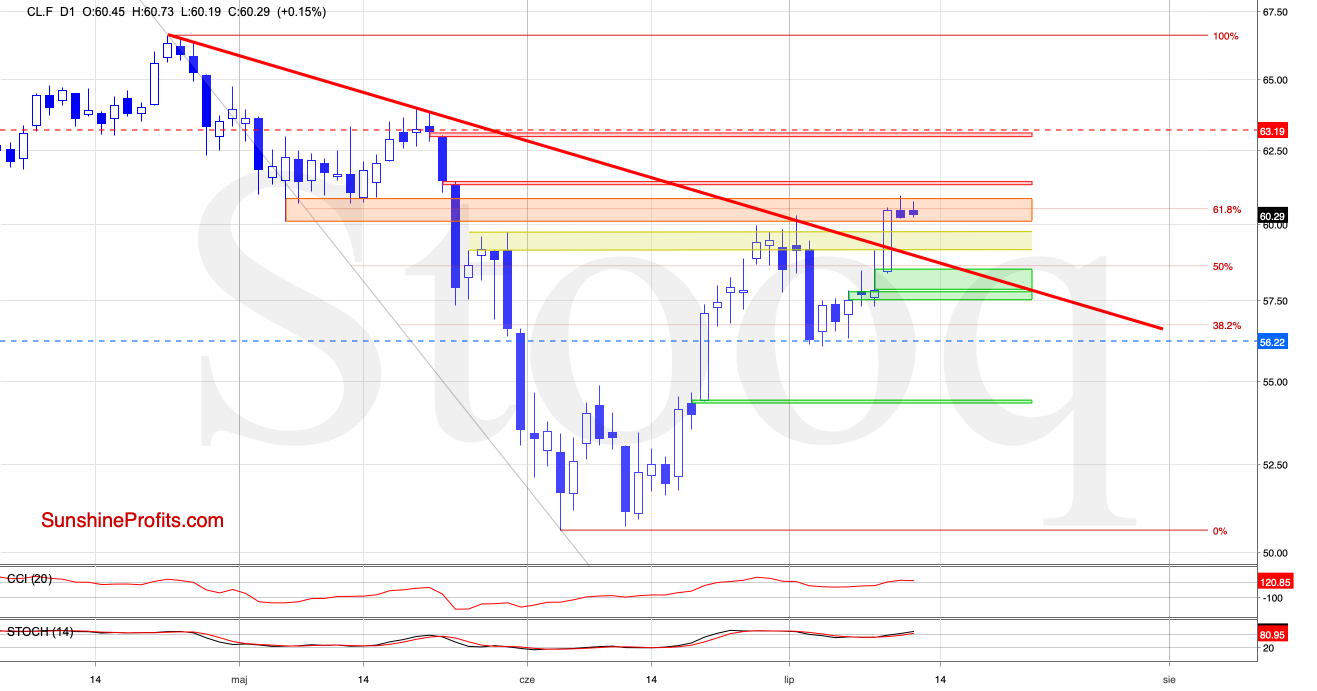

Let’s take a look at the situation in crude oil futures.

The bulls tried to push oil higher earlier today, but they failed for the second time in a row as the orange resistance zone and the 61.8% Fibonacci retracement continue to keep gains in check. Slightly above both of these obstacles, there is also the red gap serving as another block on the way to the north.

Connecting the dots, reopening short positions is justified from the risk/reward perspective.

How low could the commodity go if we see a reversal followed by declines from here? In our opinion, the first downside target will be around the support area created by the recent lows (around $56.13; $56.22 in the case of crude oil futures).

Summing up, despite the bullish upswing of recent days, the oil outlook remains bearish. Oil has reached a strong combination of resistances (the red resistance zone and the 61.8% Fibonacci retracement) and the bulls appear to have run out of steam. There’re bearish divergences between the CCI and oil prices, and between the Stochastic Oscillator and oil prices. The bulls appear to have run out of steam as also the volume comparison hints at, and reopening short positions is therefore justified