Very quietly, in the past few weeks, Oil is going down. Decline of almost 10 USD/bbl is not in the spotlight because we do not have any major shifts in the global geopolitics (just Turkey, which is an importer). What is more, situation in the middle east is pretty stable, even with Iran, where we got used to the recent rhetoric from Persians.

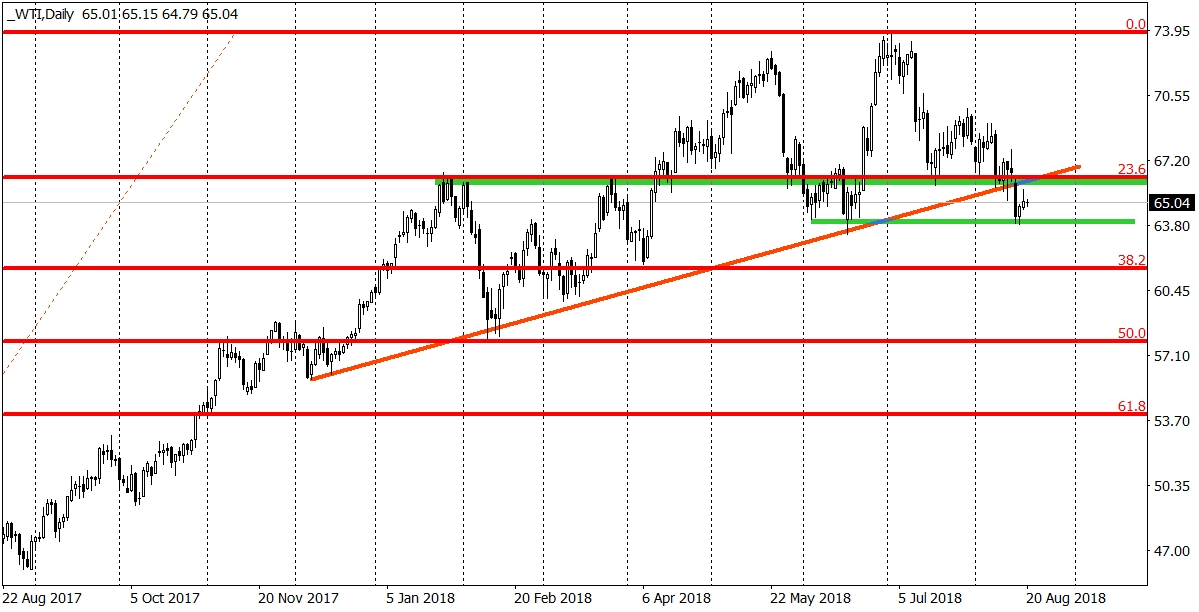

Situation here, since the beginning of July, is very bearish. The price is falling down sharply and on the last Wednesday, we received a major sell signal, which can be a leading negative factor for the mid-term situation on the WTI. After a nice decline and a creation of the triple top formation, the price broke the neckline of this pattern (red) and the horizontal support on the 66 USD (upper green). Currently, we have an attempt to test those two as a closest resistances. We tried that on Friday and we try that today. So far, without a success, which can be considered as an additional bearish factor.

All traders need to know that as long as we stay below the 23,6% Fibonacci, the sentiment remains negative and we should see a further decline. Price closing a day above that line will cancel the sell signal and will open us a way towards new highs.