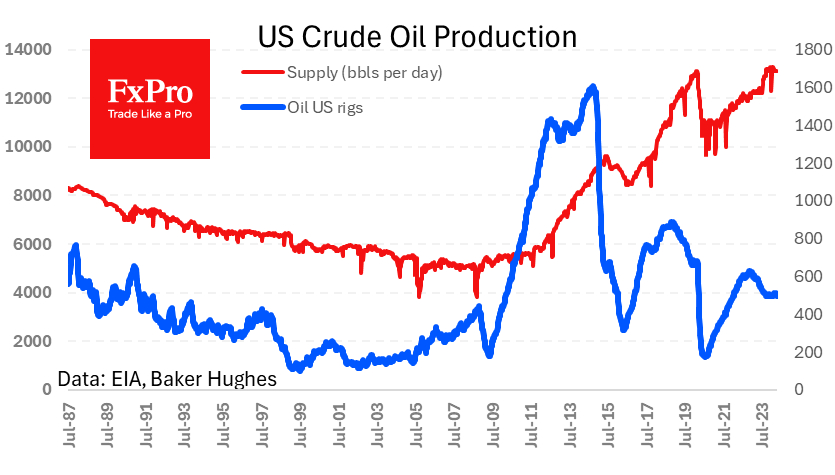

The number of operating oil rigs in the US fell by 7 to 499. This is the lowest in 12 weeks and further confirmation that even with relatively favourable oil prices, producers are in no hurry to ramp up production but are looking to keep it flat for the foreseeable future.

This news, published late on Friday, has a small positive impact on quotations, reducing fears of oil overproduction. However, they are hardly decisive.

Production has been at 13.1 million bpd for the past eight weeks, compared to 12.3 million a year earlier and an average of 12.9 million over the past 12 months. And that’s enough to rebuild inventories. According to the latest EIA report, commercial stocks are over 460 million barrels (highest since June 2023), with over 366 million barrels in the strategic reserve (highest since April 2023).

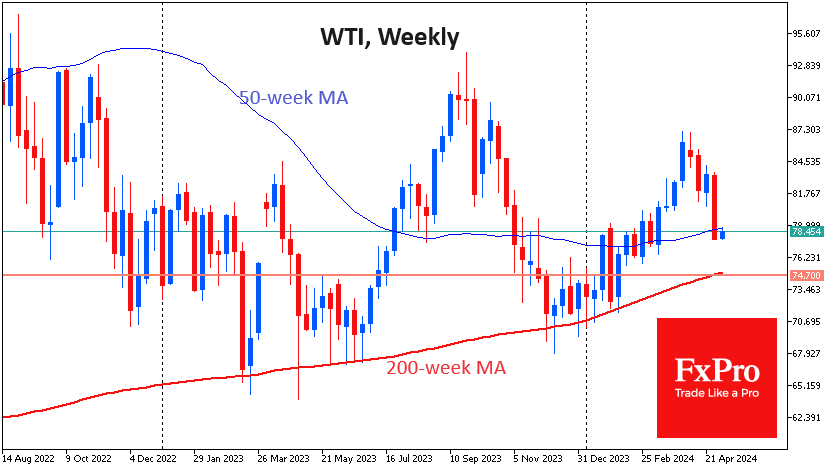

One could be much more successful in attributing the 1% bounce in oil prices on Monday to a rebound from oversold conditions. In the week of the active oil sell-off since 26th April, the WTI price has fallen 7.6% from peak to bottom.

Early last week, the price fell under the 50-day and then the 200-day moving averages. The bulls didn’t even fight back, although since November, touching the 200-day has been accompanied by a rather prolonged tug-of-war.

It may well be that the bulls are only now joining the game in full force, defending the lower boundary of the upward channel formed in December.

We also believe that despite the price pullback, the time for heavy artillery in the form of OPEC+ has not come. All last year and at the start of this one, they interfered with the supply-demand balance when the barrel price fell below the 200-week moving average, which is now at $74.7 for WTI and $78 for Brent, which is about 5% below spot prices.

Thus, if WTI crude oil prices fall below $77, the uptrend will be broken, forcing bulls to focus on supporting the $75 area, a crucial area for the past few years.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil Bounces Locally, Global Support 5% Below Spot Price

Published 05/06/2024, 10:32 AM

Oil Bounces Locally, Global Support 5% Below Spot Price

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.