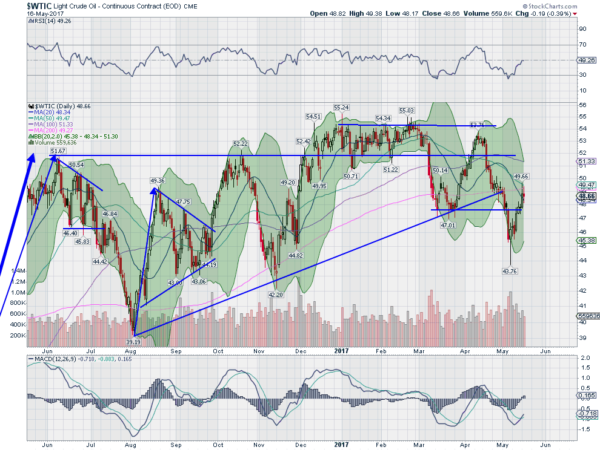

Crude oil went through a volatile run higher from August through to December. There strong moves higher mixed with 2 strong pullbacks. If you were a crude oil trader it was a time to pounce. If you were a crude oil producer it was a time of less sleep. Then the price moved sideways for 3 months through March and the roles were reversed.

A sharp drop in March was then followed by a strong trend higher through to early April. Back to the volatility? The next leg down made a lower low a couple weeks ago before reversing higher. It seems the volatility is back. But from afar the entire last 12 months has had crude oil trade in a range between $40 and $55, most of the time between 42 and 52. Range bound.

You can beat yourself up if you do not pullback from the day to day and see the broader view. For a day trader it is prime time to trade in crude oil. But for the long term investor it is not. Know which one you are before you start to research a market.

As for crude oil there are signs that a change from this malaise may be brewing. The topping candles the last few days at the 20 day SMA support the view of a reversal. Should that happen a lower high would be in place following a lower low. A nascent downtrend. This would create opportunity for both the short term trader and investor should it persist.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.