Crude oil futures moved sharply higher during U.S. afternoon trade Wednesday, after a U.S. government report showed oil supplies fell less than expected last week. The U.S. EIA reported in its weekly report that U.S. crude oil inventories fell by a modest 0.1 million barrels in the week ended June 1, below expectations for a 0.5 million barrel decline. U.S. crude supplies rose by 2.2 million barrels in the preceding week. Total U.S. crude oil inventories stood at 384.6 million barrels as of last week, just below the highest level since 1990. Total motor gasoline inventories increased by 3.3 million barrels, above expectations for a gain of 0.7 million barrels, after falling by 0.8 million barrels in the preceding week. The U.S. is the world’s biggest oil-consuming country, responsible for almost 22% of global oil demand. Oil prices were sharply higher before the supply data as investors hung on to hopes for action by global central banks and other authorities to stimulate growth and boost the world economy.

Gold

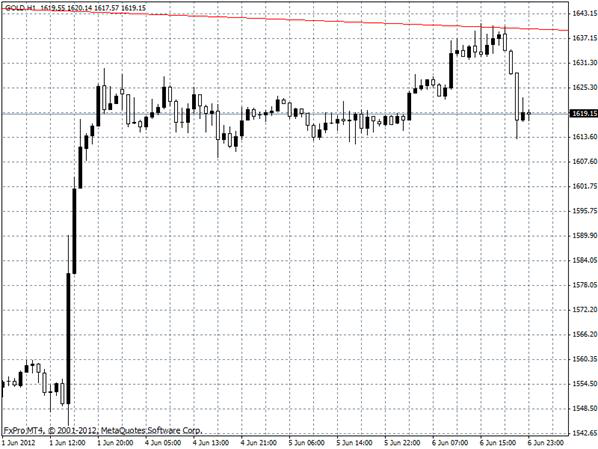

Gold futures traded sharply higher during U.S. afternoon hours Wednesday, surging to a four-week high after the European Central Bank kept rates unchanged and pledged to extend some of its liquidity providing operations. Market participants noted that gold’s gains accelerated after breaking above key resistance close to USD1, 630, triggering fresh buy orders amid bullish chart signals. Investors hung on to hopes for action by global central banks and other authorities to stimulate growth and boost the world economy, boosting the appeal of the precious metal. Gold prices have rallied on past monetary stimulus measures. Investors tend to pile in to the yellow metal on fears that excess liquidity would put a damper on the value of paper currencies and spark inflation. The precious metal is widely considered a hedge against inflation and a store of value. Gold traders will be looking for clues as to the likelihood of a fresh round of monetary easing, which could potentially hurt the U.S. dollar and support gold.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Trade Higher Wednesday

Published 06/07/2012, 07:33 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Trade Higher Wednesday

CL2N

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.