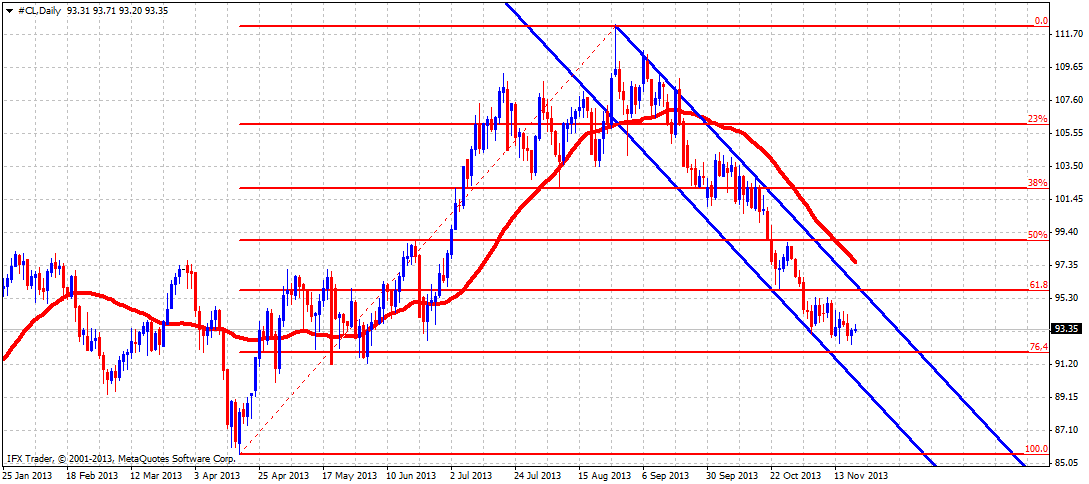

Both Gold and Oil are now on a downward trend. Oil continues to trade inside the downward sloping trend channel that started from $109 which continues to put pressure on Oil prices. The decline has reached the 76,4% Fibonacci retracement and previous consolidation price level at $92-94:

The trend remains down and there is still no sign of a trend reversal for Oil prices. We believe that we are near the end of this downward move and soon we will see an upward reversal. But for now we remain neutral and wait for a bullish sign.

The first bullish sign of a possible upward reversal in Oil prices will be given once prices break out of the downward sloping channel and stop the lower lows and lower highs pattern. An important resistance area is found at $95-96. Breaking above that level will increase the chances that an important low is in.

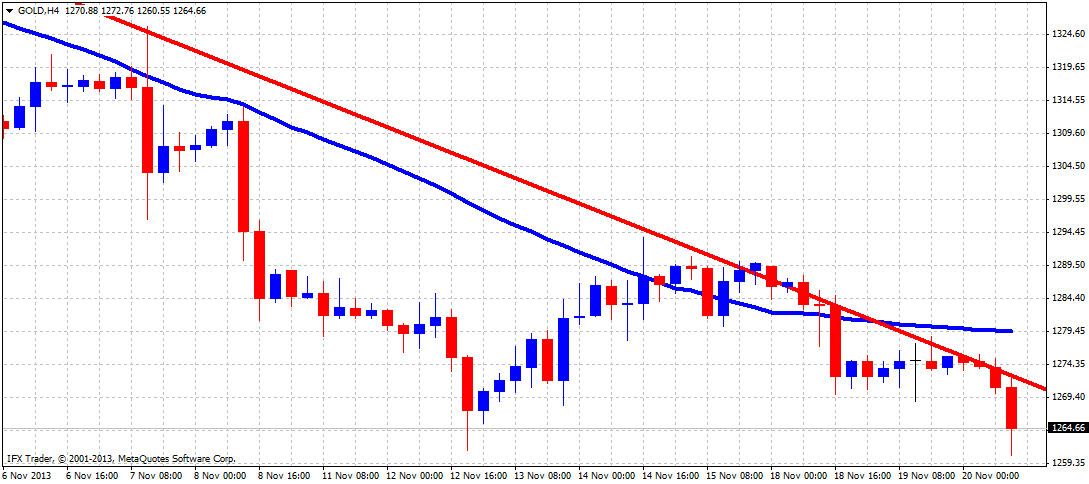

Gold on the other hand bounced from $1260 to 1293 but did not manage to renew its upward strength. Prices reached the downward sloping, short-term trend line resistance where it got rejected. Although we were at first bullish, we turned bearish once prices moved back below our support area at $1278-79.

Prices have now broken the short term support at $1270 and the decline I believe is not over yet. The move from $1260 to 1293 was corrective and I expect prices to test the important support level at $1250 where the Head and shoulders neckline support is.

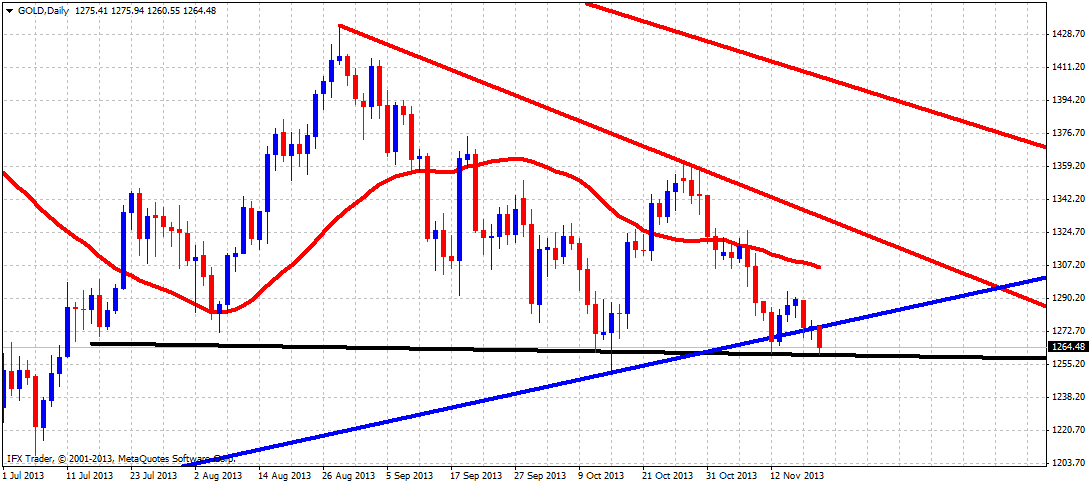

The daily chart shows how prices have broken below the blue support line, but are now very close to our next and more important support neckline at $1250-60. Breaking below that neckline we believe will push prices towards $1140-1090. We remain short term bearish with $1294 as stop. Take profit could be made above the support levels. Prices can very well make a new low towards $1250 and then make a bigger bounce upwards towards $1300…but we will have more time analysing such a scenario as we see the price behaviour over the next sessions.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.