It was give and take overnight with oil shrugging off a stronger dollar while gold wilted as U.S. bond yields rose.

OIL

Oil appeared to be correcting nicely overnight after the previous day’s impressive rally. That was until the American Petroleum Institute’s (API) Crude Inventory data hit the streets. The data showed a very surprising drawdown of 761,000 barrels against an expected rise of 3.422 million barrels.

Both crude contracts immediately bounced by over a dollar to make back most of their losses on the day. WTI finished unchanged at 51.75 a barrel and Brent, perhaps being the more overbought of the two, finished down 50 cents at 58.25. Overall this is an impressive result and tonight’s official crude inventory data will now be closely watched. We continue to believe that caution is warranted at these levels though, as both contracts’ relative strength indices continue to be very overbought.

WTI

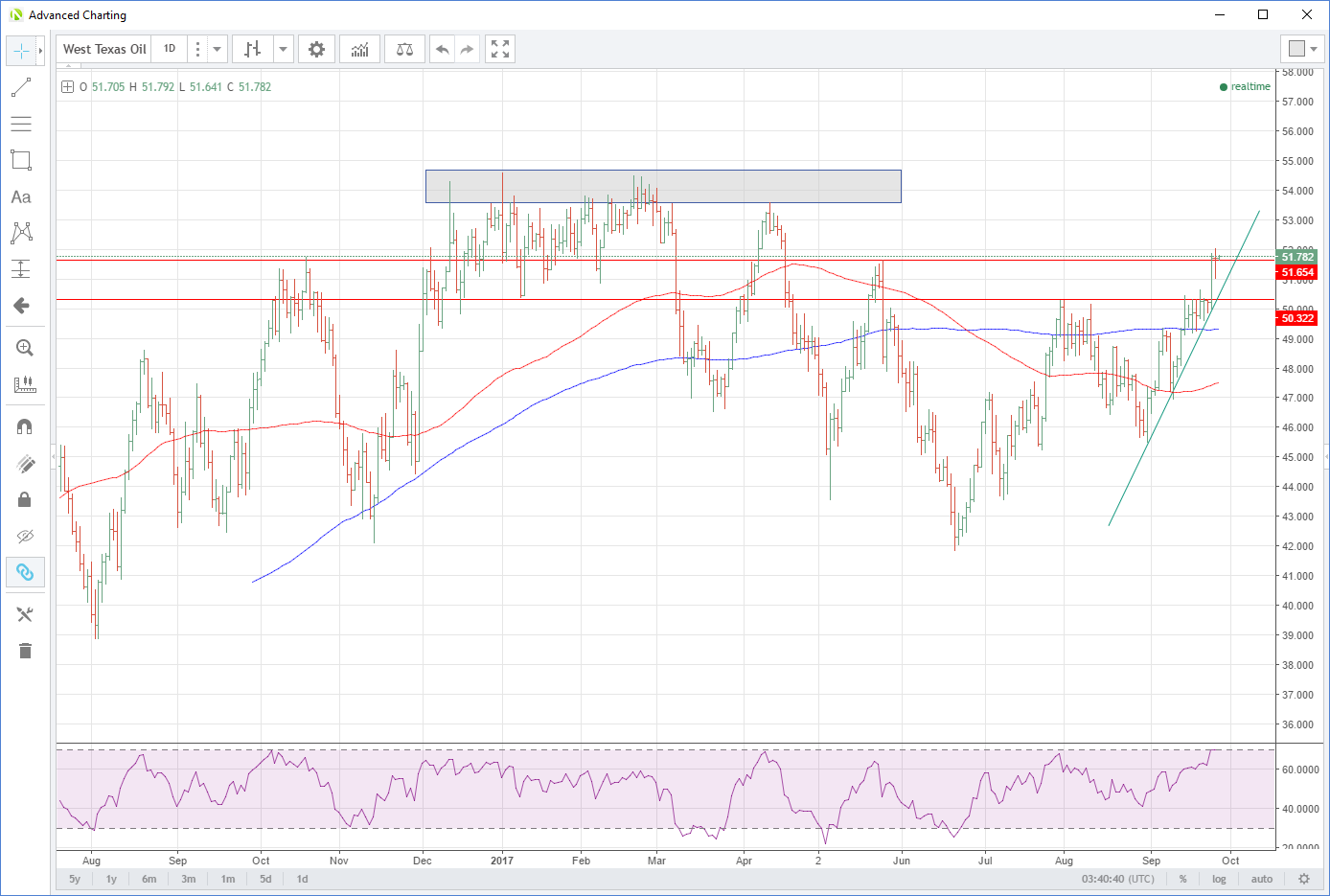

WTI is trading unchanged in early Asia with support at 51.00, the overnight low, followed by trend line support at 50.30. Resistance sits at 53.60 today, and this is the beginning of a massive resistance zone between 53.60 and 54.60 that has capped all rallies for the past year. WTI needs to close above this zone before longer-term bulls can start to believe the light at the end of the tunnel is not the train coming the other way.

Brent

Brent trades unchanged at 58.30 this morning with resistance at 59.00 and then the 60.00 which will be formidable given its short-term overbought technical picture. Support rests at 57.40, the overnight low, followed by the 56.50 to 57.00 breakout zone.

GOLD

Gold disappointed overnight, giving back almost all of the previous day’s gains to fall just over one percent or some 16 dollars to close in New York at 1295.35. Gold wilted as the U.S. dollar surged on rising bond yields across the curve out to the 10-year. The EUR/USD correction post the German election continued. A dialing down of the geopolitical rhetoric overnight also reduced gold’s safe haven premium.

Gold is now back in the Fibonacci retracement zone between 1281.00 and 1299.00 with a daily close below the former suggesting the bull run may have run its course for now.

Gold is trading quietly at 1295.50 this morning with short-term support at 1288.00 and intra-day resistance now quite distant at 1214.00.

All eyes will be on President Trump’s tax speech today which should dictate the near-term direction of the U.S dollar and thus gold.