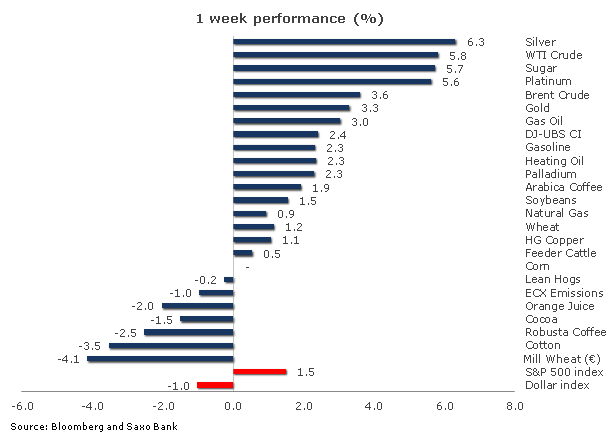

Middle East tensions, a weaker dollar, easy money at zero rates and stronger stock markets all helped commodities to good gains this week with the DJ-UBS commodity index rising by 2.4 percent. All sectors saw gains with energy and precious metals not surprisingly continuing to be the main contributors while agriculture and industrial metals were more subdued. The dollar was weaker, especially against the euro following Greece receiving its bailout.

Silver rose 6.3 percent following a generally strong technical move across precious metals, WTI crude outperformed Brent crude which rose to a nine-month high above 120 dollars. US farmers will boost planted acreage of corn to the most since 1944 in order to take advantage of continued high prices. Escalating sense of panic in oil markets

Escalating sense of panic in oil markets

The war of words between Iran and western nations continues with investors and consumers beginning to fear a messy conclusion to the stand-off. Brent crude has made a definite move back above 120 dollars, rallying to the highest level in nine months as supply worries offset concerns that a subsequent slowdown in the global economy could curb demand, just like it did during and after the Libyan conflict last year. In the process, the price of crude oil measured in both Euro and Sterling rose above its 2008 peak and is now posing a fresh problem for European economies already struggling with the debt crisis.

Strong Libyan output helping but not enough

While most of the focus and tension continues to centre around Iran and its intentions it is the real supply outages in smaller OPEC countries like Yemen, South Sudan and Syria that are doing the damage right now. Despite news that Libya plans to export 1.2 million barrels in February, up from around 970k in January, these events combined have still triggered a sizeable drop in output.

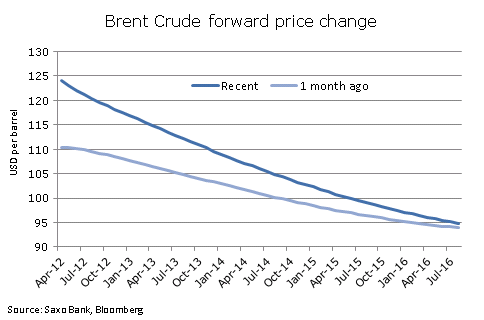

These geopolitical events have increased the competition for spot deliveries of Brent crude and as a consequence have moved the forward curve steeper into backwardation. The chart below shows how the upside price pressure on Brent crude has been concentrated at the front of the curve with the April 2012 shifting 13.7 dollars higher during the past month while deferred prices have rallied much less. WTI crude oil catching up

WTI crude oil catching up

The technical outlook for WTI crude has also improved and once resistance at 103.50 gave way the rally picked up in speed and in process it managed to outperform Brent crude with the discount to Brent narrowing to USD 15 from a recent peak of USD 18. Goldman Sachs closed a long position in Brent crude and instead moved to WTI crude on the assumption that the June opening of a pipeline from Cushing to the US Gulf Coast will slowly begin to bring the price of WTI crude in line with the global market price represented by Brent crude.

Gold lifted by platinum

The price of gold continued its ascent as it rallied to a three-month high after having cleared a technical hurdle just above 1,760. Silver followed suit and in the process moved back above its 200-day moving average. The move was very much driven by technical buying with hedge funds and others jumping on the technical buy wagon. So what caused the move higher in gold? Was it on the back of increased worries about the developing situation in oil markets? Probably not, as the crisis surrounding Iran has been known and slowly escalated since December with no apparent demand for extra gold as a result. Physical demand out of China and India is in fact reported to have been weak during the last couple of weeks so no support there either.

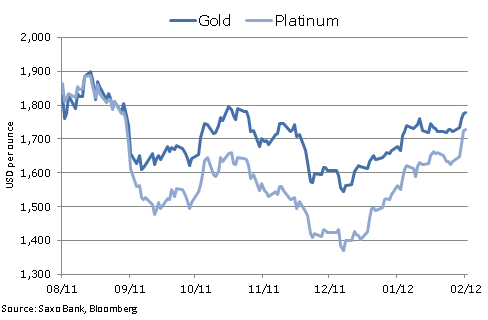

The below chart probably tells us the story as this move was one of those rare cases where the tail actually wagged the dog. The much smaller platinum market helped drive gold higher as the price spread between the two approached parity for the first time in five months. A four-week long illegal labour dispute at mines in South Africa, the world’s largest producer of platinum, has increased the prospect of a shortage of platinum, especially after the mining company announced that it was facing a 50 percent shortfall in its April deliveries. The longer term outlook for platinum supplies however still points towards a surplus according to analysts. On that basis there seems to be some reluctance in driving the platinum price back above gold which in turn helped gold break through resistance. Having cleared USD 1,763 a troy ounce traders will now look towards the November high at 1,803 as a possible top in this current move while support can be found at 1,750.

The longer term outlook for platinum supplies however still points towards a surplus according to analysts. On that basis there seems to be some reluctance in driving the platinum price back above gold which in turn helped gold break through resistance. Having cleared USD 1,763 a troy ounce traders will now look towards the November high at 1,803 as a possible top in this current move while support can be found at 1,750.

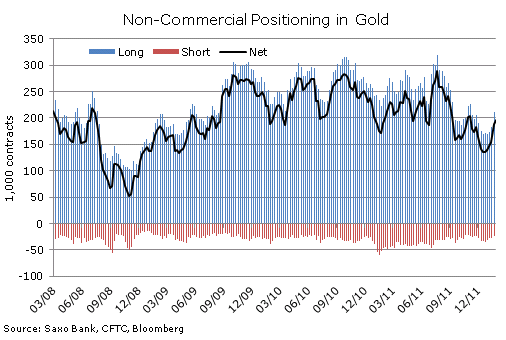

Hedge funds still not engaging fully

Large professional investors such as hedge funds seem to be looking for better opportunities in stocks and other products, and are still not engaging fully in this rally as recent US data shows. Speculative investments in futures on the New York COMEX exchange are still some 10.5 million ounces below the August peak and actually dropped a bit last week after five consecutive weeks of increased long positions. Exchange traded funds which are primarily used by retail investors and those holding a longer term view are back to recent peaks with some 2,392 metric tonnes currently being held by the largest exchange traded fund (ETF) providers. Near-term support for gold will be provided by a weaker dollar, oil related inflation worries combined with the tensions in the Middle East. Corn acreage rises the most since 1944

Corn acreage rises the most since 1944

US farmers will be busy this spring with the United States Department of Agriculture estimating the largest crop since 1944 which will help propel U.S. farm income to the second highest on record. Higher production combined with a reduced South American crop should bode well for exports in the coming marketing year which will overall help keep prices under control as the sector continues to grow inventories. The uncertainty of South American production has lifted soybean prices to a new five-month high and has outperformed corn by more than 10 percent since the beginning of the year. This could potentially sway some farmers towards planting soybeans instead of corn. This “battle of acreage” will increase the focus on price relations as we approach spring.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil and Gold Drive Commodities Higher

Published 02/25/2012, 12:31 AM

Updated 03/19/2019, 04:00 AM

Oil and Gold Drive Commodities Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.