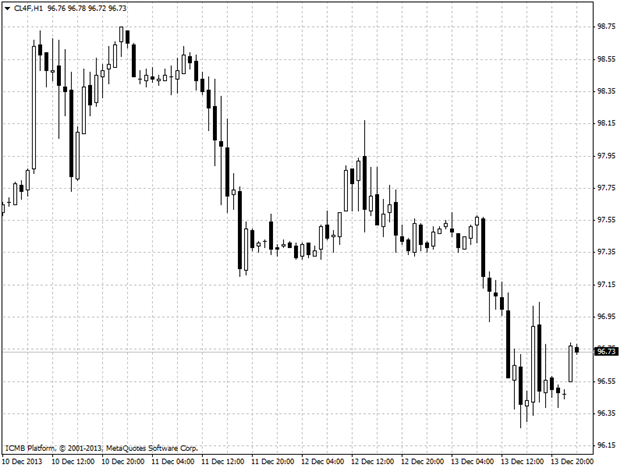

CL

New York-traded crude oil futures fell to a two-week low on Friday, amid concerns over rising U.S. fuel inventories and as caution set in ahead of next week's Federal Reserve policy meeting. The U.S. Energy Information Administration reported Wednesday that gasoline inventories increased by 6.7 million barrels last week to hit the highest level since October 4. Oil prices came under additional pressure amid expectations that the Federal Reserve could make a small cut to its asset purchase program at its upcoming policy meeting. The central bank is scheduled to meet December 17-18 to review the economy and assess monetary policy. The Fed’s stimulus program is viewed by many investors as a key driver in boosting the price of commodities as it tends to depress the value of the dollar.

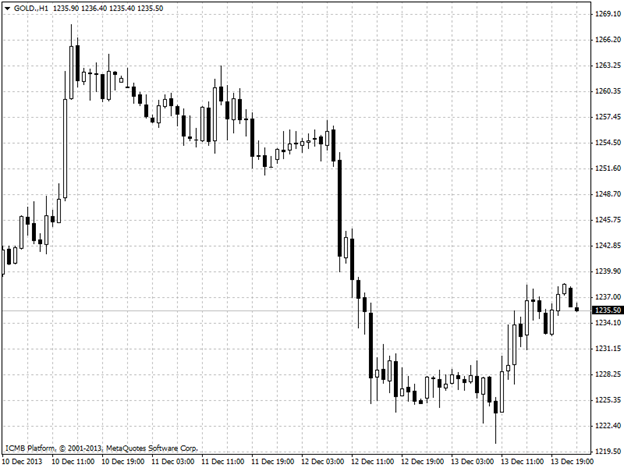

Gold

Gold futures rose for the first time in three days on Friday, as investors returned to the market to seek cheap valuations in wake of recent losses. The central bank is scheduled to meet December 17-18 to review the economy and assess monetary policy. Gold prices have largely tracked shifting expectations as to whether the Fed would start unwinding its USD85-billion-a-month asset-purchase program by the end of the year. Expectations for a small reduction in the pace of the Fed’s USD85 billion-a-month asset purchase program at its upcoming policy meeting were boosted after stronger-than-forecast U.S. retail sales data for November released on Thursday added to signs that the economic recovery is deepening. An agreement on a two-year U.S. budget deal was also seen as removing an obstacle to the winding back of monetary stimulus. Gold is down approximately 27% this year, heading for the first annual loss in 13 years, as solid U.S. economic data underlined expectations the Fed will begin curbing stimulus. In the week ahead, investors will be focusing on Wednesday’s outcome of the Fed’s monthly policy meeting, and a press conference with Chairman Ben Bernanke will be closely watched.