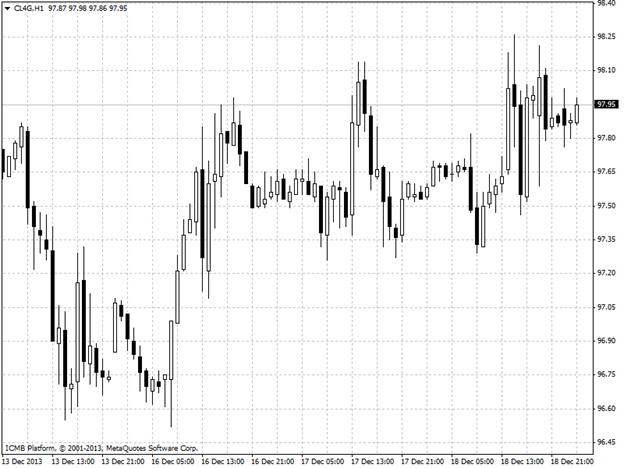

CL

Oil prices rose in early afternoon trading on Wednesday, buoyed by news that U.S. supplies fell more than expected last week, though uncertainty over the Federal Reserve's looming policy announcement due out later in the session capped gains. The U.S. Energy Information Administration reported in its weekly report earlier that U.S. crude oil inventories fell by 2.9 million barrels in the week ended Dec. 13, beating expectations for a decline of 2.3 million barrels. Total U.S. crude oil inventories stood at 372.3 million barrels as of last week, and the data sent prices gaining by stoking sentiments that demand for fuel and energy in the U.S. may be heavier than once anticipated The report also showed that total motor gasoline inventories increased by 1.3 million barrels, short of expectations for a gain of 1.9 million barrels. Solid data out of the U.S. housing sector boosted oil prices as well. The Census Bureau reported earlier U.S. housing starts rose to 1.09 million units last month, from 890,000 in October, beating consensus forecasts for an increase to 950,000 units. Building permits in the U.S. fell 3.1% to 1.01 million units in November, from 1.04 million units the previous month. Still, analysts were expecting building permits to drop 4.7% last month.

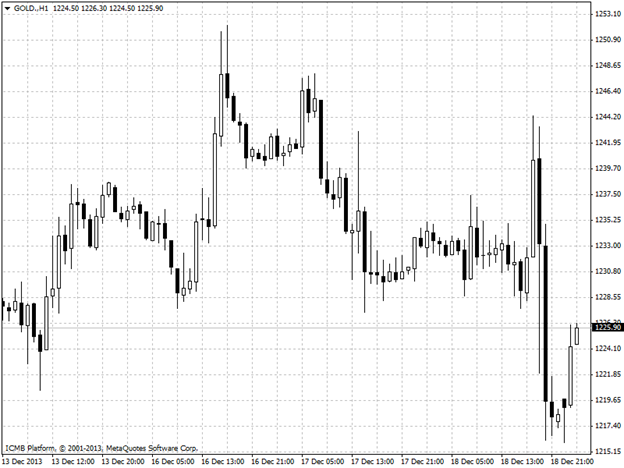

GOLD

Gold prices held steady in afternoon trading on Wednesday as investors remained on the sidelines ahead of the Federal Reserve's statement on monetary policy and the fate of its USD85 billion monthly bond-buying program due out later in the day. Gold holds steady as market awaits Federal Reserve policy statement Bond purchases seek to boost recovery by pushing down interest rates, weakening the dollar in the process and making gold an attractive hedge. The Federal Reserve is due to release its December statement on interest rates and whether or not it will make changes to its USD85 billion in monthly bond purchases. Investors avoided gold ahead of time, as a decision to taper the pace of its asset purchases could lead to price swings, while a decision to punt scaling back the stimulus program could send prices gaining. Gold prices have fallen in recent sessions as investors priced in less monetary support from the U.S. central bank, though uncertainty as to how the precious metal will react to an actual announcement allowed for quiet but edgy trading.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Oil Prices Up, Gold Holds Steady

Published 12/18/2013, 08:19 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Oil Prices Up, Gold Holds Steady

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.