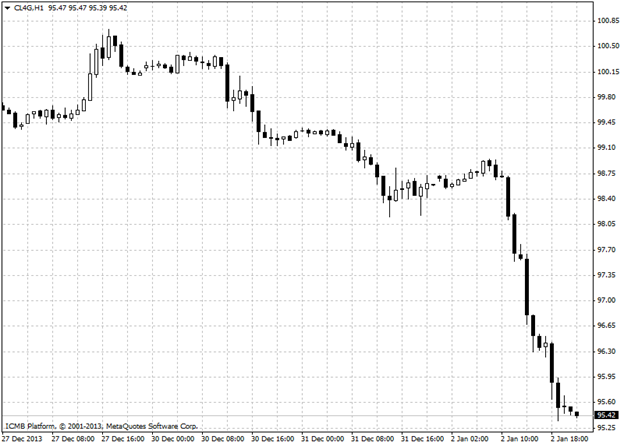

CL

U.S. oil prices started off the new year with heavy losses on Thursday, falling to a three-week low, after data showed that the number of people who filed for unemployment assistance in the U.S. last week fell less-than-expected. Oil’s losses deepen after disappointing jobless claim soil prices fall sharply after disappointing jobless claims report Trading volumes are expected to remain light due to the holiday period, reducing liquidity in the market and increasing volatility, which can help exaggerate market moves. The U.S. Department of Labor said in a report earlier that the number of individuals filing for initial jobless benefits declined by 2,000 to a seasonally adjusted 339,000 last week. Analysts had expected U.S. jobless claims to fall by 7,000 to 334,000 from the previous week’s revised total of 341,000. Oil prices also weakened due to a broadly stronger U.S. dollar, as dollar-priced commodities become more expensive to investors holding other currencies when the greenback gains. The dollar index, which tracks the performance of the greenback against a basket of six other major currencies, was up 0.6% to trade at 89.78. Oil traders now looked ahead to key U.S. weekly supply data, which was forecast to show a fifth consecutive weekly drop in crude stockpiles.

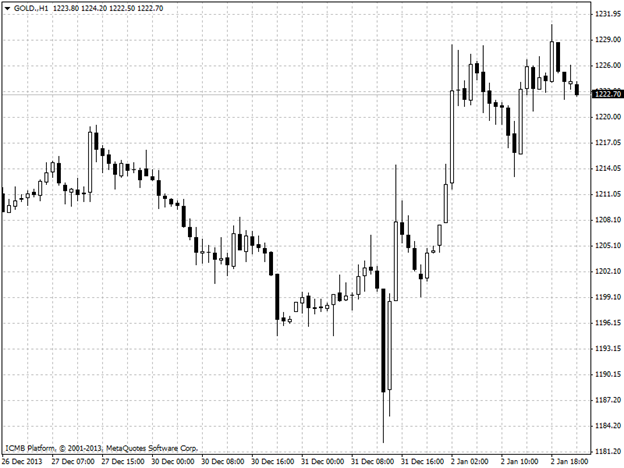

GOLD

Gold prices shot up on Thursday on the coattails of increased physical demand in Asia, though concerns the Federal Reserve will continue winding down stimulus measures in 2014 capped gains. Reports of rising demand for gold bars and jewelry in Asia sent prices spiking on Wednesday. Investors expected gains to be short lived, as data released earlier kept expectations strong the Federal Reserve will continue to taper its USD75 billion in monthly asset purchases as the year progresses. The U.S. Department of Labor said earlier that the number of individuals filing for initial jobless benefits in the week ending Dec. 28 declined by 2,000 to a seasonally adjusted 339,000. Analysts had expected U.S. jobless claims to fall by 7,000 to 334,000 last week from the previous week’s revised total of 341,000, though investors still applauded the decrease. Past and present rounds of asset purchases rolled out since the 2008 financial crisis of bolstered gold ever since. Gold prices fell about 29% in 2013 amid growing expectations that the Federal Reserve will taper its bond purchases in 2014 and possibly end the program later this year.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Oil Prices Start Off Year With Heavy Losses

Published 01/03/2014, 04:29 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Oil Prices Start Off Year With Heavy Losses

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.