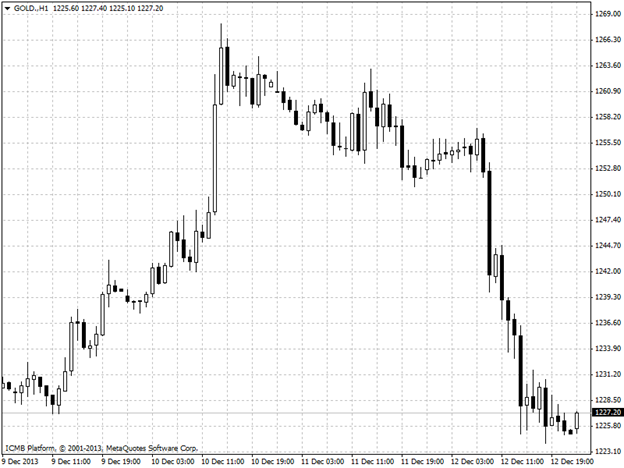

CL

Oil prices rose on Thursday after better-than-expected U.S. retail sales fueled hopes for a more robust U.S. economy, though concerns that a more pronounced recovery could prompt the Federal Reserve to taper stimulus tools very soon capped oil's gains. The Commerce Department reported earlier that U.S. retail sales rose 0.7% in November, beating market expectations for a 0.6% increase. Core retail sales, which are stripped of automobiles, rose 0.4%, above forecasts for a 0.2% increase. A stronger greenback makes oil a less attractive commodity on dollar-denominated exchanges. Bearish supply data released on Wednesday watered down oil's gains as well. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories fell by 10.59 million barrels in the week ended Dec. 6, well beyond expectations for a decline of 2.95 million barrels, due in part to a drop in imports. Total U.S. crude oil inventories stood at 375.2 million barrels as of last week. The report also showed that total motor gasoline inventories increased by 6.72 million barrels, compared to expectations for a gain of 1.79 million barrels, which sent crude futures falling.

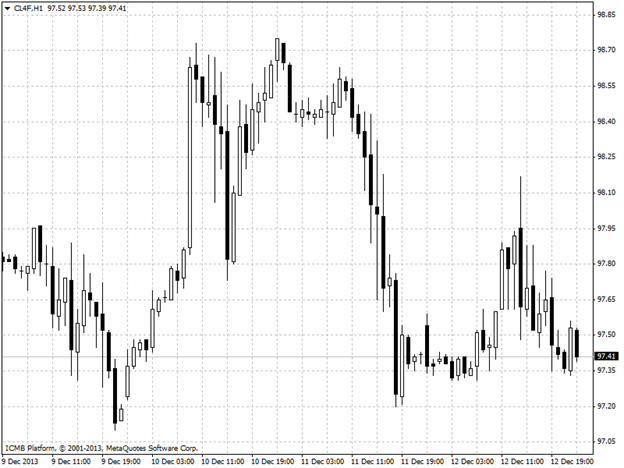

Gold

Gold prices plummeted on Thursday after better-than-expected U.S. retail sales figures sparked market expectations for the Federal Reserve to announce plans to taper its USD85 billion in monthly asset purchases, possibly as early as next week. Gold takes a dive as sales data point to imminent Fed stimulus tapering Bond purchases seek to boost recovery by pushing down interest rates, weakening the dollar in the process and making gold an attractive hedge. The Commerce Department reported earlier that U.S. retail sales rose 0.7% in November, beating market expectations for a 0.6% increase. Core retail sales, which are stripped of automobiles, rose 0.4%, above forecasts for a 0.2% increase. The data kept expectations alive that the Federal Reserve will soon decide to taper its USD85 billion in monthly bond purchases, possibly at Dec. 17-18 policy meeting. Monthly bond purchases have supported gold prices for over a year. Elsewhere, the U.S. Department of Labor said the number of individuals filing for initial jobless claims assistance last week rose to a two-month high of 368,000, far surpassing expectations for an increase to 320,000 from the previous week’s revised total of 300,000.