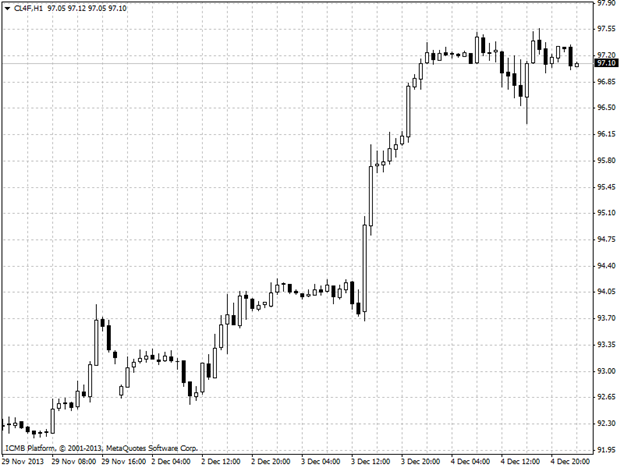

CL

Oil prices rose on Wednesday after data revealed that U.S. stockpiles made an unexpected drop last week, while an OPEC decision to leave output levels unchanged supported prices as well. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories fell by 5.6 million barrels in the week ended Nov. 29, well beyond expectations for a decline of 500,000 barrels. Total U.S. crude oil inventories stood at 385.8 million barrels. The report also showed that total motor gasoline inventories increased by 1.8 million barrels, compared to expectations for a gain of 1.5 million barrels. The numbers supported oil prices as did OPEC's decision to leave output unchanged through the first half of 2014 at 30 million barrels a day. Better-than-expected data out of the U.S. housing and labor market also pushed up crude prices by fanning hopes for a more sustained economic recovery down the road in the U.S., the world's largest consumer of crude.

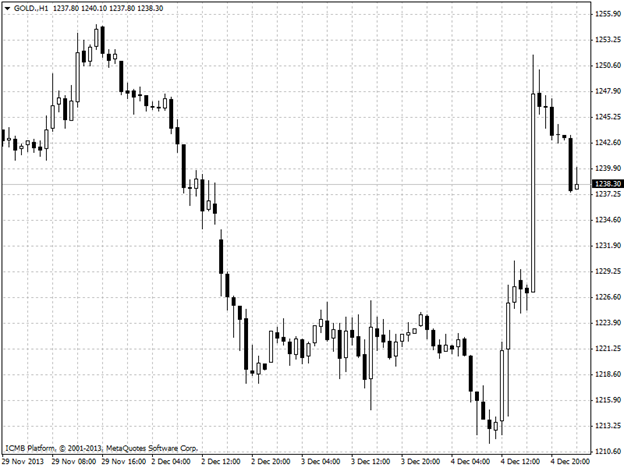

GOLD

Gold prices jumped up on Wednesday after a mixed bag of U.S. economic indicators gave bottom fishers reason to snap up nicely priced positions, though market sentiments remained firm that the Federal Reserve will begin scaling back stimulus programs within the coming months. Stimulus tools such as the Fed's USD85 billion in monthly bond purchases aim to drive recovery by pushing down long-term interest rates, weakening the dollar in the process, with talk of their dismantling strengthening the greenback. Gold prices dropped to five-month lows in recent sessions after a string of solid factory and other reports fanned expectations for the Federal Reserve to soon begin tapering its monthly bond purchases, which have elevated the yellow metal for over a year by keeping the greenback weak. On Wednesday, however, mixed data allowed for a short burst of bargain hunting.