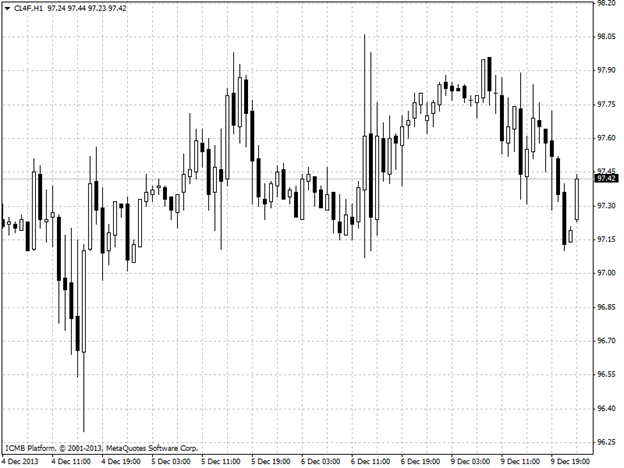

CL

Oil prices carried Friday's gains into Monday as investors continued to applaud a better-than-expected U.S. November jobs report, though gains were limited over the monetary implications that an improving economy may have on oil going forward. The data sent oil rising on sentiments that the U.S. economy is gaining momentum and will demand more fuel and energy going forward. However, monetary implications of a more robust U.S. economy capped the commodity's gains. The jobs report kept expectations firmly in place that the Federal Reserve will begin scaling back its USD85 billion in monthly bond purchases in 2014. Fed bond purchases aim to drive recovery by driving down interest rates, weakening the dollar while they remain in place, though talk of their dismantling strengthens the greenback. A stronger greenback makes oil a less attractive commodity on dollar-denominated exchanges.

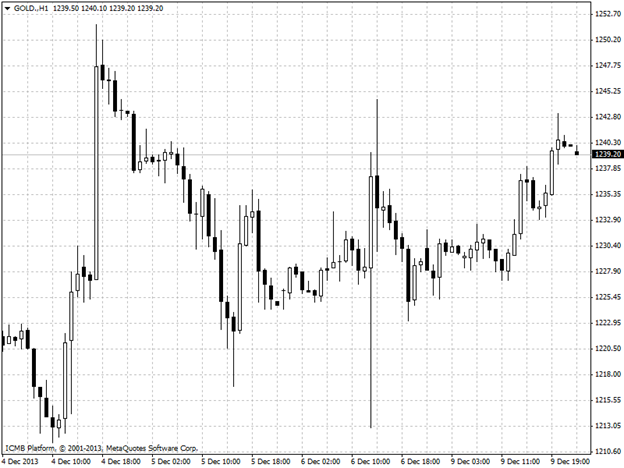

GOLD

Gold prices rebounded on Monday after bottom fishers snapped up nicely-priced positions in the metal and took back losses stemming from Friday's better-than-expected U.S. employment and consumer sentiment reports. Bargain hunters sent prices back into positive territory on Monday, especially after Federal Reserve Bank of St. Louis President James Bullard said tapering will become increasingly likely as long as the labor market continues to improve. “A small taper might recognize labor market improvement while still providing the Committee the opportunity to carefully monitor inflation during the first half of 2014,” Bullard said in prepared remarks of his speech. “Should inflation not return toward target, the Committee could pause tapering at subsequent meetings.” Gold's gains were modest, however, as the market has largely priced in Fed tapering sometime in early 2014.