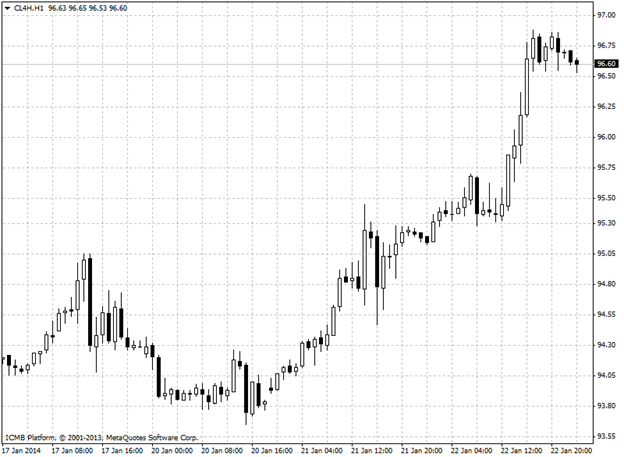

CL

Oil price carried Tuesday's gains into Wednesday as investors continued to applaud International Energy Agency data revealing that global demand is on the rise, while an International Monetary Fund decision to hike its 2014 global growth forecasts also supported the commodity. Crude extends gains on IEA report, hopes for bullish U.S. supply data In its monthly report released on Tuesday, the IEA said that global oil demand is forecast to rise by 1.3 million barrels a day this year to 92.5 million barrels, compared to a previous estimate of 91.2 million barrels a day. The IEA cited “stronger economic momentum as the year progresses,” as its reasoning behind the upward revision. The agency added that oil supplies from the Organization of the Petroleum Exporting Countries rose by 310,000 barrels a day to 29.82 million barrels in December, due to higher output in Saudi Arabia. The American Petroleum Institute will release its inventories report later in the day, while Thursday’s government report could show crude stockpiles rose by 1.6 million barrels in the week ended January 17, which pushed prices even higher.

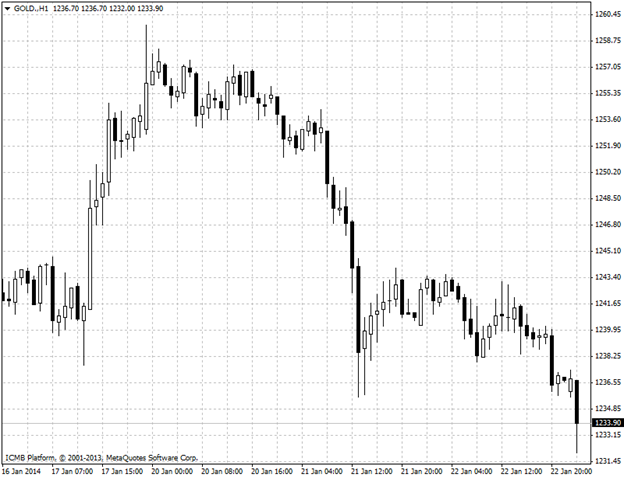

GOLD

Gold prices fluctuated between small gains and losses during Asian trading hours on Wednesday as the markets awaited the U.S. unemployment data to be released later today. Gold prices fluctuate in Asia ahead of U.S. job data The dollar continued to see support from the International Monetary Fund's decision this week to hike its global economic growth forecast to 3.7% from 2014 from an October forecast for 3.6% growth. The news fueled expectations for central banks to wind down stimulus programs such as bond purchases going forward, the Federal Reserve especially, as the multilateral lending institution predicted the U.S. economy to grow 2.8% this year, up from an October forecast of 2.6%. Many market participants held firm on their expectations for the Fed to trim its quantitative easing program to USD65 billion from the current USD75 billion at its next policy meeting that wraps up on Jan. 29. Fed bond purchases aim to prop up the economy by suppressing long-term interest rates, thus weakening the dollar as a side effect as investors flock to asset classes like stocks, with gold serving as an inflation hedge of choice.