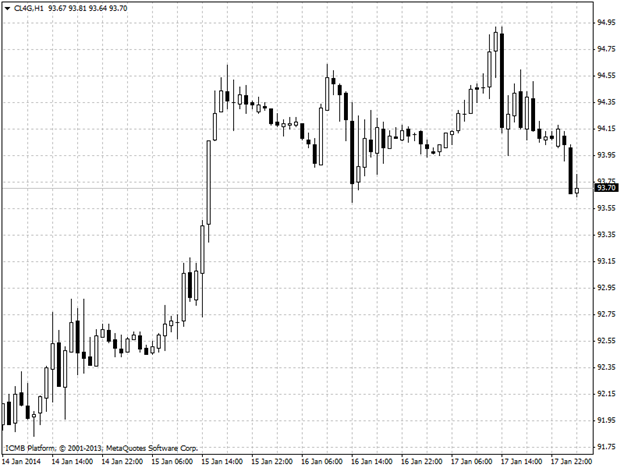

CL

New York-traded crude oil futures hit a two-week high on Friday, amid expectations the U.S. economic recovery will continue to deepen going into this year. Crude oil futures - weekly outlook: January 20 - 24 Nymex oil prices settle at 2-week high on Friday Nymex oil prices rallied sharply on Wednesday after government data showed that U.S. oil supplies fell significantly more-than-expected last week, easing concerns over a slowdown in demand from the world’s largest oil consumer. The U.S. Energy Information Administration said in its weekly report that U.S. crude oil inventories fell by 7.7 million barrels in the week ended January 10, compared to expectations for a decline of 0.6 million barrels. Total U.S. crude oil inventories stood at 350.2 million barrels as of last week, the lowest since March 2012. The CFTC Commitments of Traders report for the week ending January 14 showed that gross long oil positions fell by 7,066 contracts to 284,307, while gross short positions increased by 10,389 lots to 54,585. Net longs totaled 229,722 contracts, compared to 247,177 in the preceding week.

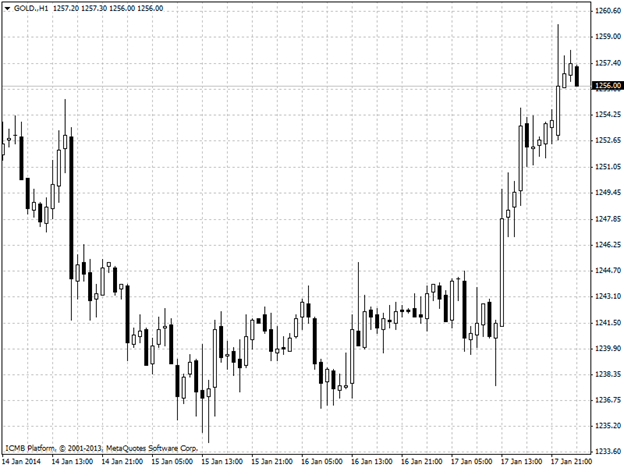

GOLD

Gold futures ended the week higher on Friday, as traders continued to speculate over for how quickly the Federal Reserve will roll back its stimulus program. Investors continued to watch U.S. data points for clues on the future course of monetary policy and to help assess the timing for a further reduction in the Fed’s bond purchasing program. U.S. housing starts fell 9.8% last month, more than the 8.3% decline forecast by analysts. U.S. building permits rose less-than-expected in December, but remained close to November’s five year highs. Separate reports showed that U.S. industrial production rose 0.3% in December, increasing for the fifth consecutive month, while consumer sentiment declined in January. The Fed is scheduled to meet January 28-29 to review the economy and assess policy. Expectations of monetary stimulus tend to benefit gold, as the precious metal is seen as a safe store of value and inflation hedge.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil And Gold Analysis: Oil Futures Hit Two-Week High

Published 01/20/2014, 02:44 AM

Updated 04/25/2018, 04:40 AM

Oil And Gold Analysis: Oil Futures Hit Two-Week High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.