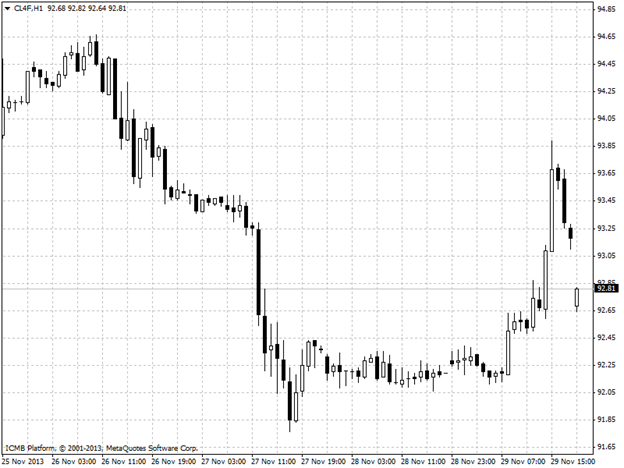

CL

New York-traded crude oil futures edged higher in thin trade on Friday, as investors returned to the market to seek cheap valuations after prices fell to a six-month low in the previous session. U.S. oil futures lost 2.23%. For November, Nymex crude oil saw a 3.2% monthly loss, as ongoing concerns over rising U.S. inventories and increased production levels weighed. The U.S. Energy Information Administration reported Wednesday that crude oil inventories last week raised by 3 million barrels to 391.4 million barrels, the most since June. Domestic output rose to 8.02 million barrels a day, the highest level in almost 25 years. Concerns that the Federal Reserve will start to taper its bond-buying program at one of its next few meetings also weighed. The Fed’s stimulus program is viewed by many investors as a key driver in boosting the price of commodities as it tends to depress the value of the dollar.

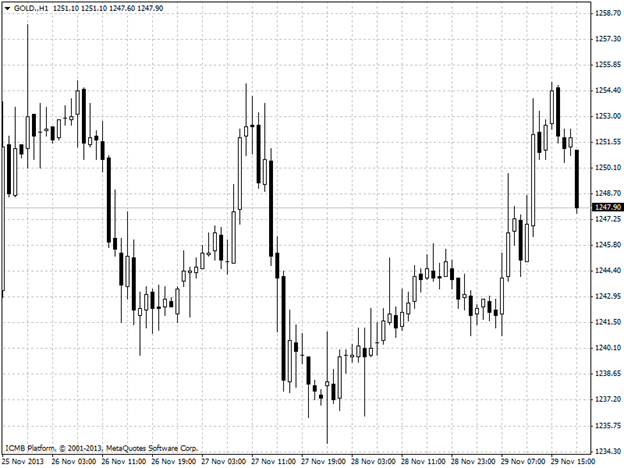

GOLD

Gold futures advanced in thin trade on Friday, but prices were still set to record the worst monthly loss in five months amid growing concerns the Federal Reserve will start to taper its bond-buying program at one of its next few meetings. Prices of the precious metal lost 5.4% in November, the biggest monthly decline since June, as solid U.S. economic data underlined expectations the Fed will begin curbing stimulus. Gold prices have largely tracked shifting expectations as to whether the Fed would start unwinding its USD85-billion-a-month asset-purchase program by the end of the year. Comex gold prices added 0.5%, amid indications of increased demand from China and as investors returned to the market to seek cheap valuations after prices tumbled to a four-and-a-half-month low earlier in the week. Bearish sentiment on the precious metal remained intact after minutes of the Fed’s October meeting said the central bank could start scaling back its USD85 billion-a-month asset purchase program in the “coming months” if the economy continues to improve as expected.