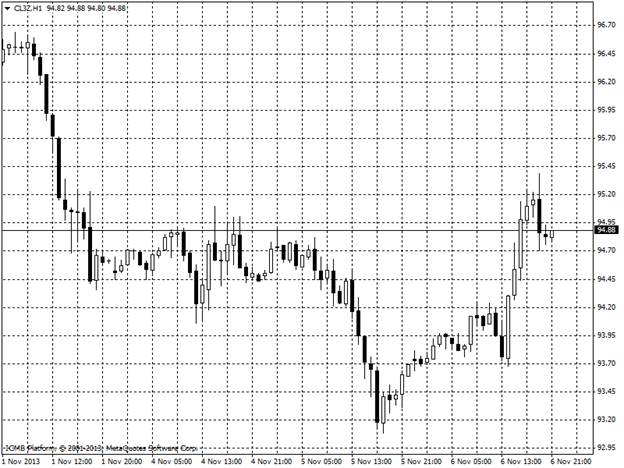

CL

Crude rebounded from the lowest level in five months before a report that may show U.S. fuel supplies shrank. Price declines the past week are probably excessive, according to a technical indicator. WTI has lost 5.4 percent in the past seven days. Its 14-day relative strength index yesterday fell to 25.9, the lowest reading since June 2012. Futures rebounded in April from about $86 a barrel when the chart indicator was most recently below 30.

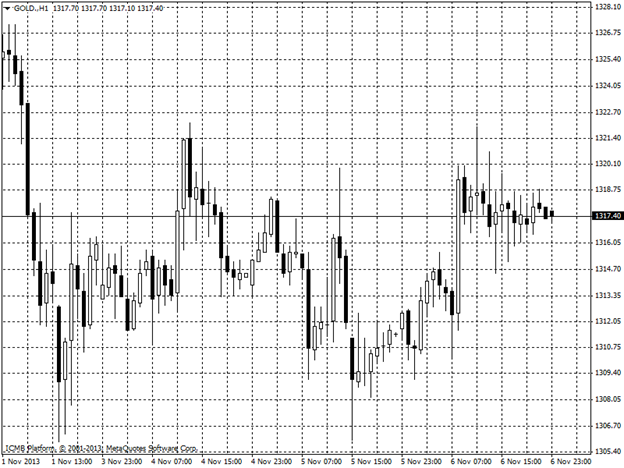

GOLD

Gold sales from Australia’s Perth Mint, which refines most of the bullion from the second-largest producer, rose in October as a drop in prices to a three-month low spurred demand and the mint filled a backlog of orders. Sales of coins and minted bars climbed 13 percent to 77,255 ounces last month from 68,488 ounces in September, according to data from the mint. While demand in October more than doubled from 30,430 ounces in August, sales were 31 percent lower than this year’s peak in April, when gold tumbled into a bear market.