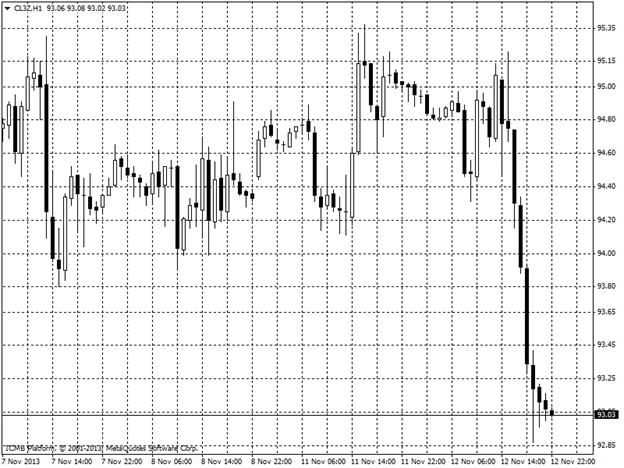

CL

Crude oil fell to a five-month low, on estimates that U.S. inventories rose last week to the most since June. U.S. crude stockpiles probably climbed by 800,000 to 386.2 million in the week ended Nov. 8, The EIA, the Energy Department’s statistical arm, is scheduled to release its weekly report a day later than usual this week because of Veterans Day holiday. Cushing inventories rose for a fourth week to a two-month high of 36.5 million barrels in the seven days ended Nov. 1. crude dropped $2.10, or 2.2 percent, to $93.00 a barrel on the New York Mercantile Exchange, the lowest since May 31.

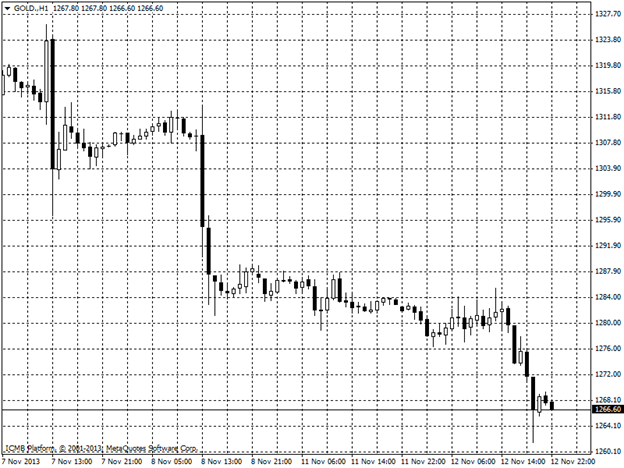

GOLD

Gold declined for a fourth day to a three-week low in London on speculation a strengthening U.S. economy will spur the Federal Reserve to slow stimulus. Gold is set for the first annual drop in 13 years as some investors lost faith in the metal as a store of value and on speculation a strengthening economy will spur the Fed to slow debt purchases. Dallas Fed President Richard Fisher, who said he wouldn’t rule out backing a reduction in bond buying by March, said in a speech in Melbourne today that monetary accommodation “becomes riskier by the day. Gold drop to 1261.