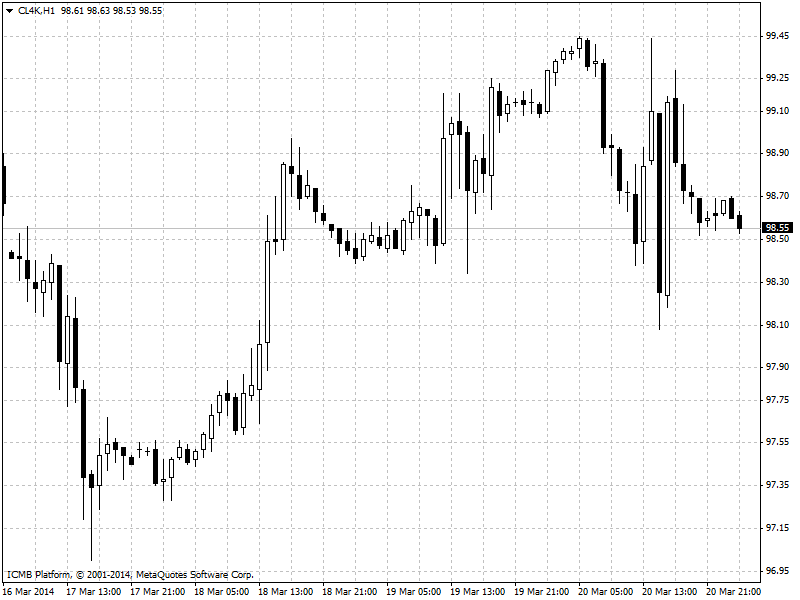

CL

Crude prices edged lower in choppy trading on Thursday as the dollar advanced after Federal Reserve Chair Janet Yellen suggested rate hikes could come around the first half of 2015. Crude falls as Yellen comments sends investors to dollar A rising greenback often softens oil prices by making the commodity less attractive on dollar-denominated exchanges. The dollar shot up after Yellen suggested at a Wednesday press conference that interest rates could rise six months after the Fed's bond-buying program ends. The Fed is currently buying $55 billion in Treasury and mortgage debt a month, and expectations for the monetary authority to taper that figure gradually and close the program by fall followed by rate hikes in 2015 strengthened the dollar against most major currencies.

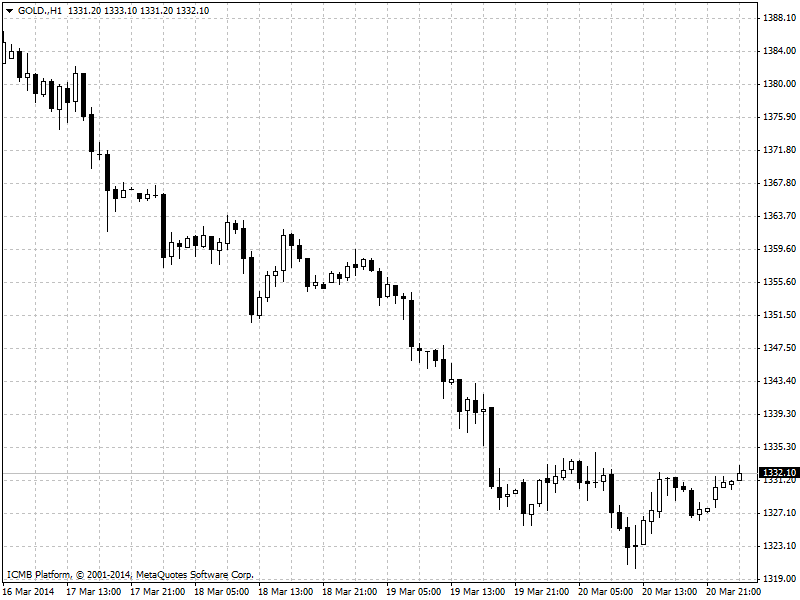

GOLD

Gold prices dropped as the dollar rose on Thursday as investors bet that rate hikes will take place around the first half of 2015 based on comments Federal Reserve Chair Janet Yellen made on Wednesday. Gold drops on Yellen rate hike comments. Gold and the dollar tend to trade inversely with one another. The Fed is currently buying $55 billion in Treasury and mortgage debt a month, and expectations for the monetary authority to taper that figure gradually and close the program by fall followed by rate hikes in 2015 strengthened the dollar against gold. Fed asset purchases aim to stimulate the economy by suppressing interest rates, weakening the dollar as long as they remain in effect, thus making gold an attractive hedge. The survey's indicators of future activity reflected optimism about continued growth over the next six months. Soft housing data failed to seriously dent the greenback's advance and offset gold's decline, as markets dismissed the disappointing numbers as the product of rough winter weather.