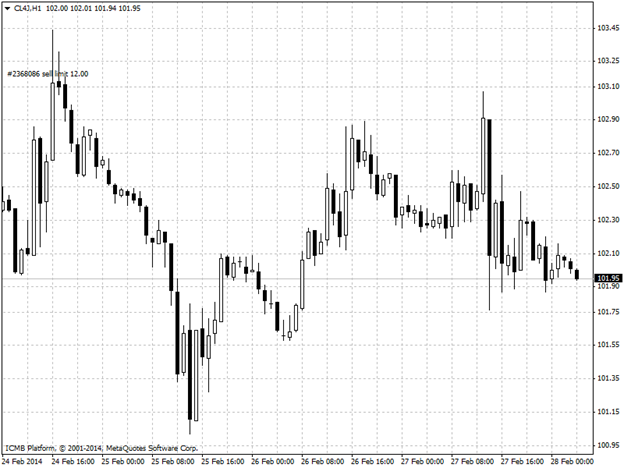

CL

West Texas Intermediate crude fell for a second day, trimming a monthly gain. Futures decreased as much as 0.5%. WTI’s discount to the European benchmark crude has narrowed this month to the smallest since October as winter storms bolstered U.S. heating-fuel use and stockpiles at Cushing, Oklahoma, fell with the opening of a new pipeline. WTI for April delivery fell as much as 53 cents to $101.87 a barrel, and was at $102.40 as morning trades highest price. The volume of all futures traded was about 67% below the 100-day average. Prices are up 4.7% this month.

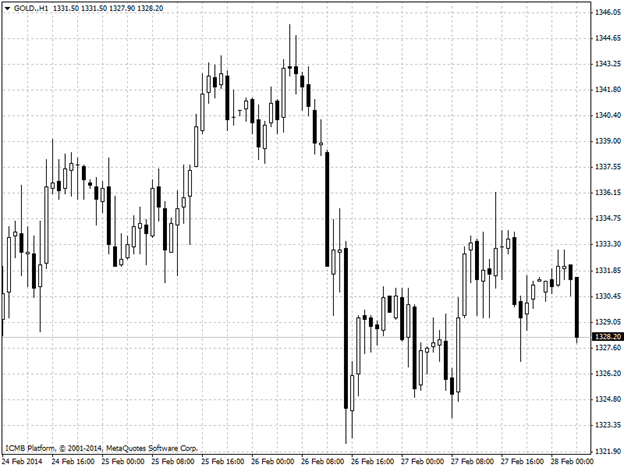

GOLD

Gold headed for the first back-to-back monthly gain since August as concern that the U.S. recovery may be losing momentum and turmoil in emerging markets boosted haven demand. Assets in bullion-backed exchange-traded products were set for the first monthly increase in 14 months. Bullion for immediate delivery was at $1,333.42 per ounce this morning from $1,331.33 yesterday. Prices are up 7% this month and reached a 17-week high of $1,345.46 on February 26.