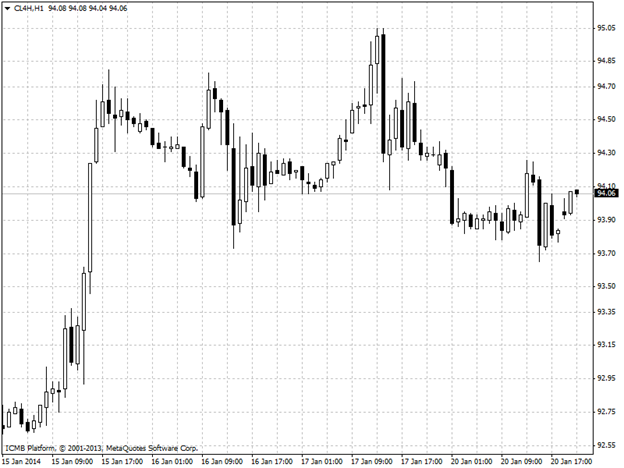

CL

Crude oil futures fell on Tuesday on comfortable global oil supplies as the threats of tensions receded from Iran. NYMEX crude oil fall after lower supply concerns On the New York Mercantile Exchange, West Texas Intermediate crude for delivery in March traded at USD93.95 a barrel during Asian morning trade, down 0.68%. On Monday the New York-traded oil futures held in a range between USD93.93 a barrel and USD94.04 a barrel and closed at USD94.01 a barrel. Nymex oil futures were likely to find support at USD92.63 a barrel, the low from January 15 and resistance at USD95.07 a barrel, the high from January 17. Gross long oil positions fell by 7,066 contracts to 284,307, while gross short positions increased by 10,389 lots to 54,585. Net longs totaled 229,722 contracts, compared to 247,177 in the preceding week.

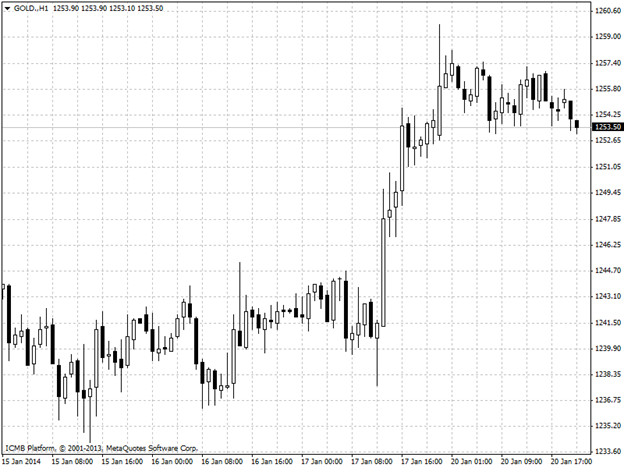

GOLD

Sentiment towards gold has picked up modestly in January, as the precious yellow metal closed just above $1,250 per ounce on Friday, a psychologically key threshold, amid other encouraging signals. Gold Sentiment Sees Modest Positive Signals Gold Sentiment Sees Modest Positive Signals Modest positive signals for gold in early 2014 could also be driven by index rebalancing and hedge fund buying. Many investors and analysts still believe that gold won’t do well in 2014, as a U.S. economic recovery appears on steady legs and as Indian import rules depress global demand. That follows gold’s steep price decline in 2013, its worst percentage fall since 1981.