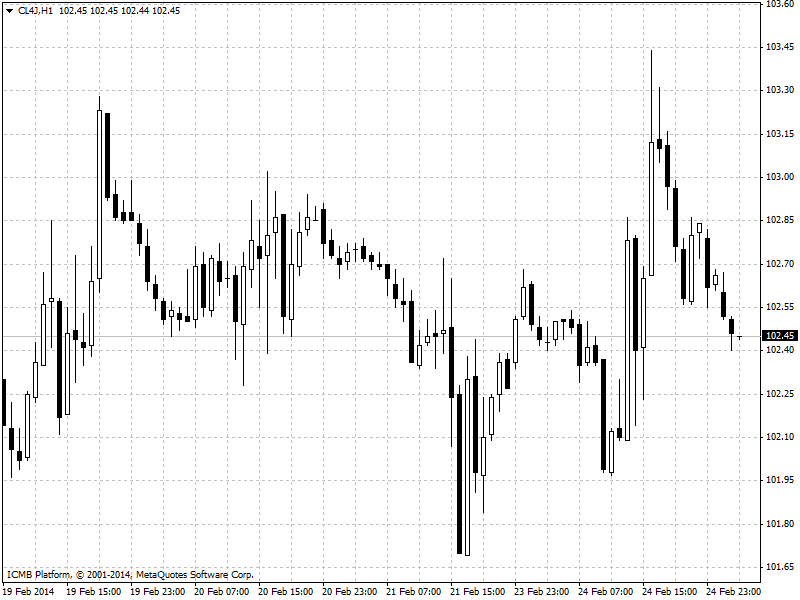

CL

West Texas Intermediate swung between gains and losses near $103 per barrel amid speculation crude stockpiles at Cushing, Oklahoma, fell as cold weather boosted fuel demand in the world’s biggest oil consumer. Futures fluctuated after rising for the first time in three days yesterday. Supplies at Cushing, the U.S. largest oil-storage hub, probably dropped for a fourth week, according to the estimates. WTI for April delivery was at $102.85 a barrel this morning, 59 cents below yesterdays high, in electronic trading. The contract rose 0.8% to $103.44 yesterday. The volume of all futures traded was about 75% below the 100-day average.

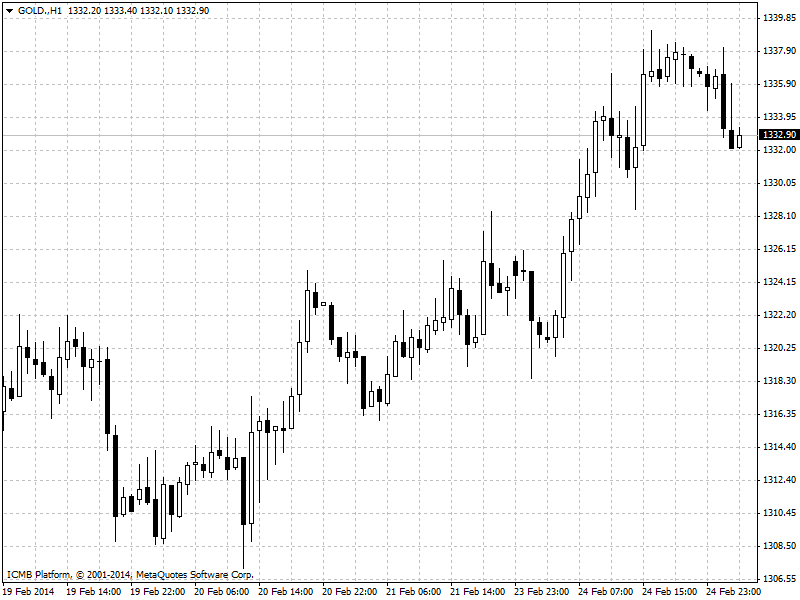

GOLD

Gold rose to 16-week highs on speculation that weakening U.S. growth and turmoil in Ukraine will boost demand for the precious metals as a haven. Economic activity in the U.S., as measured by the Federal Reserve Bank of Chicago’s national index, for January was at minus 0.39, compared with the estimates of minus 0.2. A below-zero reading indicates below-trend growth. Gold futures for April delivery climbed 1.1% to settle at $1,338 per ounce, the highest for a most-active contract since October 31, after slumping last year by the most since 1981. Gold rose by 11% since the end of December and is headed for a second monthly gain. Bullion prices rebounded this year even as the Federal Reserve continued slowing stimulus. Gold for spot electronic trading gained 1.5% yesterday to hit the four-months high at $1339.10. today the metal started with a little change from what it closed on yesterday at $1335.70 per ounce, fluctuating between $1340.15 and $1334.66.